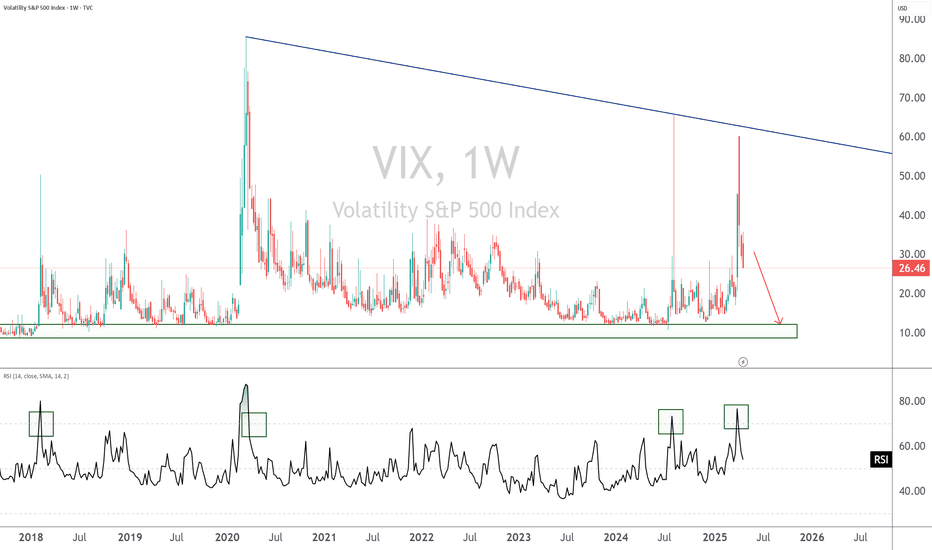

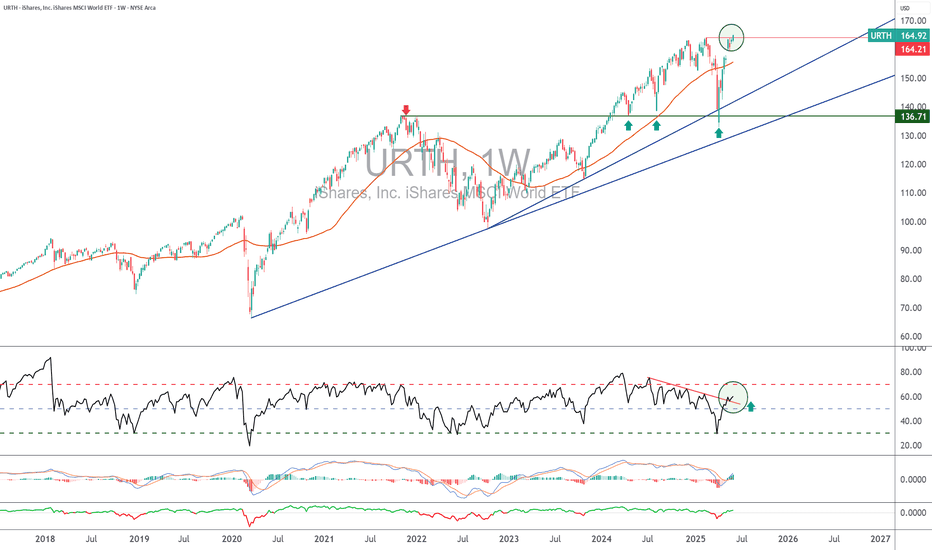

In our April 15 analysis, we questioned the likelihood of a low point for the S&P 500 index based on technical analysis considerations. The VIX (the implied volatility of the S&P 500) also showed bearish technical characteristics (inverted correlation with the S&P 500), and indeed, the equity market offered a solid rebound against a backdrop of trade diplomacy.

With elements of technical overheating appearing in the short term, let's review the technical analysis signals to establish a diagnosis of the current situation in the US equity market.

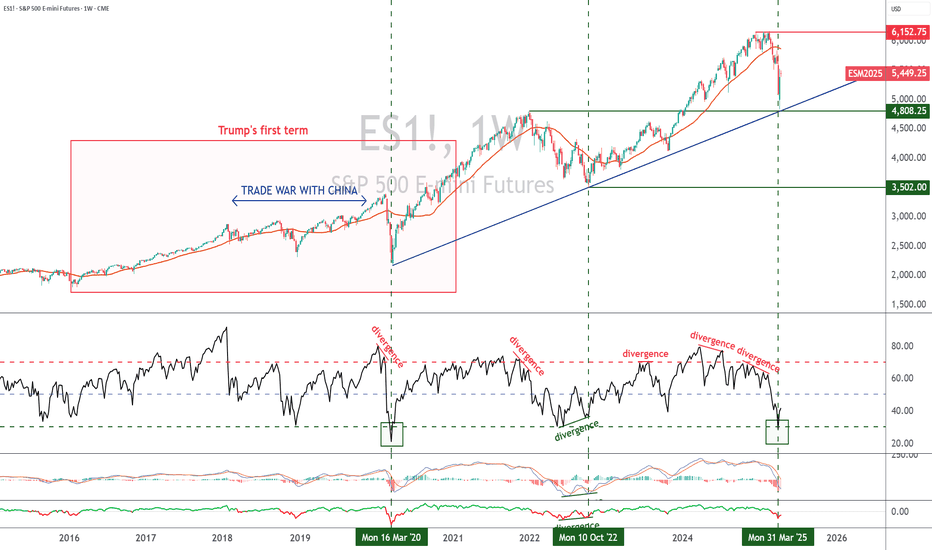

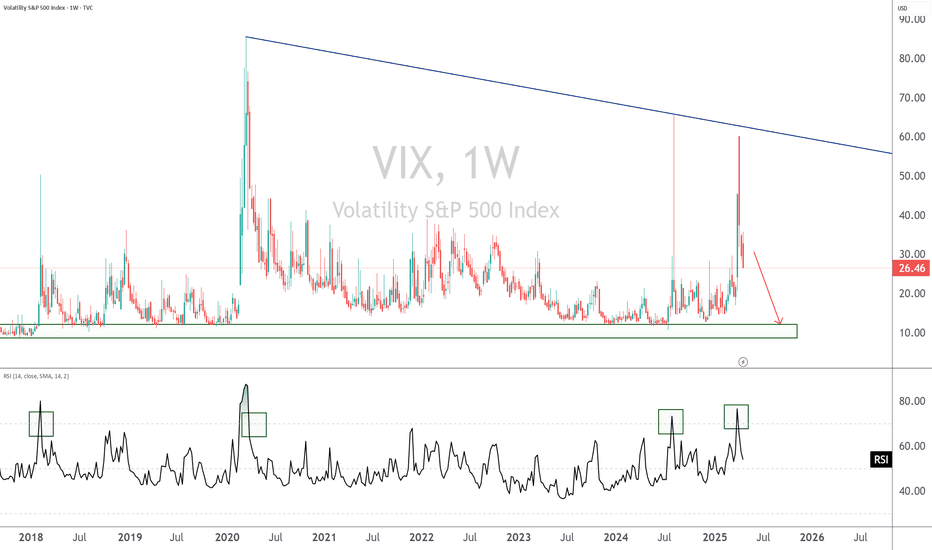

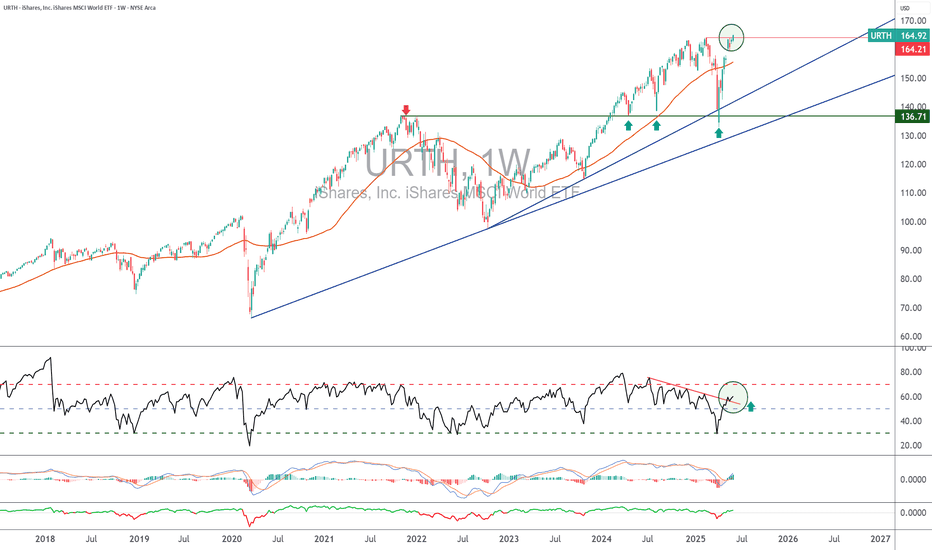

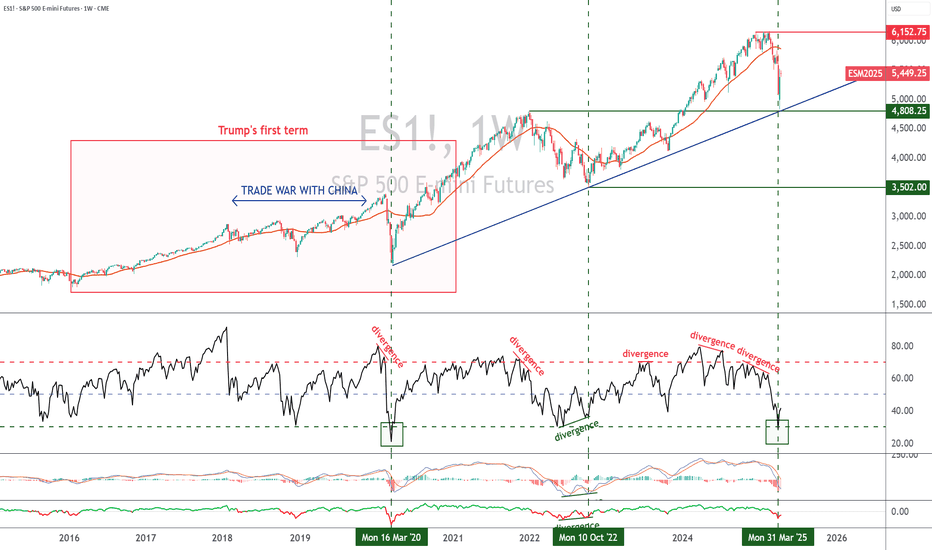

To start with, you can reread our April analyses of the S&P 500 and VIX by clicking on the two images below.

1) Short-term technical overheating, but fundamental uptrend preserved above technical support at 5750/5800 points

The S&P 500 index has developed a bullish V-bottom rally since the beginning of April, and the global equity market even made a new all-time high last week.

The upward movement of the S&P 500 sees an alternation between bullish impulses and short-term consolidations/corrections, and this chart pattern is likely to repeat itself as long as trade diplomacy takes its course and as the market awaits the FED's next monetary policy decision next week. The daily chart suggests short-term technical overheating (small bearish price/momentum divergence, with momentum represented here by the RSI technical indicator). In any case, even if the market needs a breather in the short term, the underlying trend remains bullish above major support at 5700/5800 points, i.e. the bullish gap opened in mid-May and the 200-day moving average.

The chart below shows daily Japanese candlesticks for the S&P 500 future contract

2) In terms of retail investor sentiment, the reservoir of sellers has diminished, but remains well filled

The study of retail investor sentiment is part of contrarian analysis of financial markets, one of the disciplines of technical analysis of financial markets. Although the pool of sellers has shrunk, a significant proportion of retail investors are still doubtful about the recovery. This pessimistic sentiment among retail traders is an indicator that the recovery still has medium-term potential, as market peaks have always taken place amid retail investor euphoria.

3) On the quantitative side, watch out for a technical overbought situation in the short term

On the other hand, caution is called for in the short term, as the percentage of S&P 500 shares above the 50-day moving average (this tool here represents the quantitative side of the market) is approaching its overbought zone, a situation soon to be reversed from that of early April.

4) Institutional investors remain cautious ahead of the FED meeting on Wednesday June 18, while trade agreements are still pending

In conclusion, it is important to bear in mind that next week's fundamental highlight will be the FED's monetary policy decision. The market needs to know whether or not the FED will confirm two rate cuts between now and the end of the year. The FED will also be updating its macro-economic projections, and institutional investors are being cautious in the meantime, as shown by the CFTC's latest Commitment Of Traders report.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

With elements of technical overheating appearing in the short term, let's review the technical analysis signals to establish a diagnosis of the current situation in the US equity market.

To start with, you can reread our April analyses of the S&P 500 and VIX by clicking on the two images below.

1) Short-term technical overheating, but fundamental uptrend preserved above technical support at 5750/5800 points

The S&P 500 index has developed a bullish V-bottom rally since the beginning of April, and the global equity market even made a new all-time high last week.

The upward movement of the S&P 500 sees an alternation between bullish impulses and short-term consolidations/corrections, and this chart pattern is likely to repeat itself as long as trade diplomacy takes its course and as the market awaits the FED's next monetary policy decision next week. The daily chart suggests short-term technical overheating (small bearish price/momentum divergence, with momentum represented here by the RSI technical indicator). In any case, even if the market needs a breather in the short term, the underlying trend remains bullish above major support at 5700/5800 points, i.e. the bullish gap opened in mid-May and the 200-day moving average.

The chart below shows daily Japanese candlesticks for the S&P 500 future contract

2) In terms of retail investor sentiment, the reservoir of sellers has diminished, but remains well filled

The study of retail investor sentiment is part of contrarian analysis of financial markets, one of the disciplines of technical analysis of financial markets. Although the pool of sellers has shrunk, a significant proportion of retail investors are still doubtful about the recovery. This pessimistic sentiment among retail traders is an indicator that the recovery still has medium-term potential, as market peaks have always taken place amid retail investor euphoria.

3) On the quantitative side, watch out for a technical overbought situation in the short term

On the other hand, caution is called for in the short term, as the percentage of S&P 500 shares above the 50-day moving average (this tool here represents the quantitative side of the market) is approaching its overbought zone, a situation soon to be reversed from that of early April.

4) Institutional investors remain cautious ahead of the FED meeting on Wednesday June 18, while trade agreements are still pending

In conclusion, it is important to bear in mind that next week's fundamental highlight will be the FED's monetary policy decision. The market needs to know whether or not the FED will confirm two rate cuts between now and the end of the year. The FED will also be updating its macro-economic projections, and institutional investors are being cautious in the meantime, as shown by the CFTC's latest Commitment Of Traders report.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.