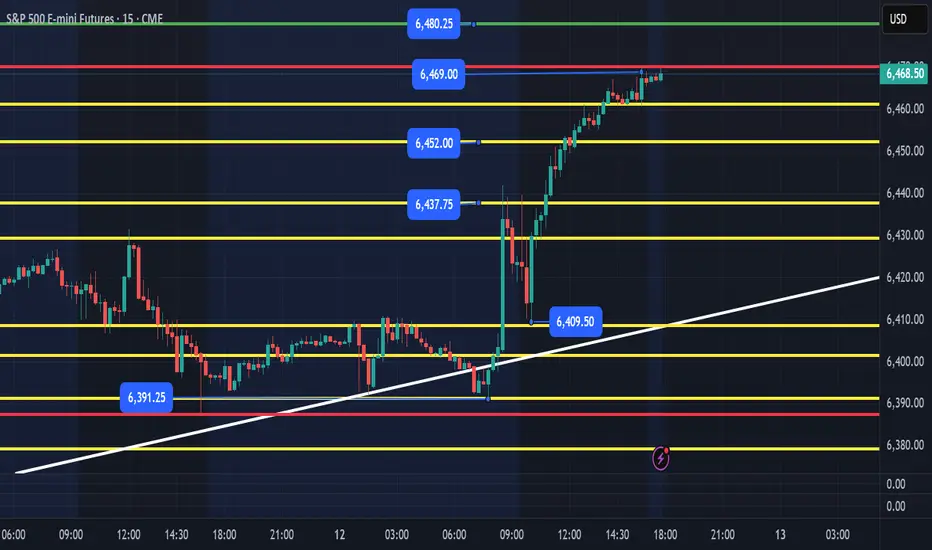

Today's CPI was not as complex as I have seen in other releases. While price tried to shake out longs by ripping 40pts at the 8:30am CPI release, sold off and held structure support at 6410 and continued higher and have met 2 out of 3 targets I had planned for the week.

I posted the following this morning.

"IF, price can hold the 6411-14 area, we should be able to put in a nice bull flag and continue up after the 9:30am NYSE open. IF, price losses the 6410 level, we might need to try and dip below yesterdays low at 6387 and then rally up. We are still targeting the levels above at 6452, 6468, 6480 to hit this week."

We hit 6409.75 and took off and hit our 6452 & 6468 targets!

What is next for ES with PPI coming out tomorrow and OPEX on Friday. I expect to see more complex trading the next couple of days. ES closed at the highs and are only 12pts from our last target of 6480 this week. ES can continue higher with price putting in structure between 6430-6468. The yellow support levels I have outlined are areas we could see price test, recover, reclaim and move us higher. Ideally, we can set a low overnight that we flush and recover to get us to the 6480, 6493+ targets.

IF, price needs to cool off, we would want to see it go no lower than 6430 area with a reclaim of the 6437 support level. That would be a healthy pullback and keep structure moving higher.

There is nothing short term bearish until we lose the 6391 level. IF, price does go that low, we should see an initial bounce, but would be a warning sign. The RSI on the 8hr chart is currently at 80, which alone isn't a signal that price will reverse, it is something to keep an eye on. We could get a rug pull tomorrow after the PPI release all the way back down to the 6390 level, IF, we do and ES is selling fast, wait for price to build structure around 6380-85 level and enter once it clears the 6390-92 level.

I will post an update and Daily Trade plan by 8am EST based on overnight price action.

You can reference my trade plan from today by looking at the related publication section to the right and also see my weekly overview I posted on Monday am. Follow to get my daily trade plan.

I posted the following this morning.

"IF, price can hold the 6411-14 area, we should be able to put in a nice bull flag and continue up after the 9:30am NYSE open. IF, price losses the 6410 level, we might need to try and dip below yesterdays low at 6387 and then rally up. We are still targeting the levels above at 6452, 6468, 6480 to hit this week."

We hit 6409.75 and took off and hit our 6452 & 6468 targets!

What is next for ES with PPI coming out tomorrow and OPEX on Friday. I expect to see more complex trading the next couple of days. ES closed at the highs and are only 12pts from our last target of 6480 this week. ES can continue higher with price putting in structure between 6430-6468. The yellow support levels I have outlined are areas we could see price test, recover, reclaim and move us higher. Ideally, we can set a low overnight that we flush and recover to get us to the 6480, 6493+ targets.

IF, price needs to cool off, we would want to see it go no lower than 6430 area with a reclaim of the 6437 support level. That would be a healthy pullback and keep structure moving higher.

There is nothing short term bearish until we lose the 6391 level. IF, price does go that low, we should see an initial bounce, but would be a warning sign. The RSI on the 8hr chart is currently at 80, which alone isn't a signal that price will reverse, it is something to keep an eye on. We could get a rug pull tomorrow after the PPI release all the way back down to the 6390 level, IF, we do and ES is selling fast, wait for price to build structure around 6380-85 level and enter once it clears the 6390-92 level.

I will post an update and Daily Trade plan by 8am EST based on overnight price action.

You can reference my trade plan from today by looking at the related publication section to the right and also see my weekly overview I posted on Monday am. Follow to get my daily trade plan.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.