Price is camped under a higher-timeframe supply/“weak-high” band. Trend remains constructive on the Weekly/Daily, but 4H/1H are coiling beneath resistance. I’m neutral into mid-week inflation data and will only engage on clean acceptance above the prior-high band or a rejection back into range.

Event stance: Two inflation releases hit 08:30 ET mid-week. I’ll be flat into the prints and wait for the first qualifying 15-minute close before arming anything

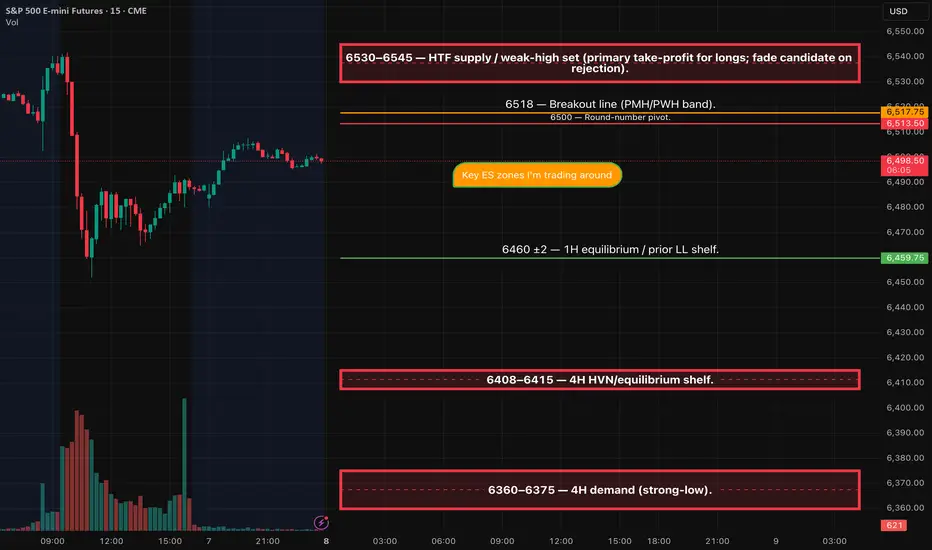

Key ES zones I’m trading around

6530–6545 — HTF supply / weak-high packet (primary take-profit for longs; fade candidate on rejection)

6518 — Breakout line (PMH/PWH band)

6500 — Round-number pivot

6460 ±2 — 1H equilibrium / prior LL shelf

6408–6415 — 4H HVN / equilibrium shelf

6360–6375 — 4H demand (strong-low)

Setup 1 — Breakout-Acceptance LONG

Trigger: 15m close > 6518, then two 5m bodies hold above.

Entry: 6520.5–6523.0 on the retest or break of bar-2 high.

Stop: tighter of (i) below the 15m trigger candle low, or (ii) below the last confirmed 5m swing; cap ≤ 6–8 pts.

• If neither option fits ≤ 8 pts from your fill, pass and wait for a cleaner micro HL.

TP1 (dynamic): first hard band (e.g., any workable print inside 6530–6545) that yields ≥ max(15, 2.5×SL) from your fill (front-run 0.25–0.5 pt if 2.5R is tight).

TP2/TP3: 6550, then 6570; trail by 15m/30m closes.

• Disqualifiers: any 5m body back ≤ 6518 before TP1; visible liquidity wall ≤ 5 pts beyond trigger; news window.

Setup 2 — SRR Rejection SHORT (Sweep → Recapture → Reversal)

Trigger: Sweep 6518–6530, fail, then 15m bearish close < 6518.

Entry: 6515.0–6518.0 on the retest from below.

Stop: tighter of (i) above the 15m trigger candle high, or (ii) above the last confirmed 5m LH; cap ≤ 6–8 pts.

• If the correct structural stop is > 8 pts from your fill, skip until a micro LH tightens risk.

TP1 (dynamic): first hard band below that gives ≥ max(15, 2.5×SL) from your fill—usually 6500; if 2.5R isn’t met to 6500, promote to 6482, then 6460.

TP2/TP3: 6482, then 6460 (extend toward 6410 if momentum).

• Disqualifiers: no 15m bearish confirmation; any 5m body ≥ 6518–6522 after entry (use your exact line); news window.

Event stance: Two inflation releases hit 08:30 ET mid-week. I’ll be flat into the prints and wait for the first qualifying 15-minute close before arming anything

Key ES zones I’m trading around

6530–6545 — HTF supply / weak-high packet (primary take-profit for longs; fade candidate on rejection)

6518 — Breakout line (PMH/PWH band)

6500 — Round-number pivot

6460 ±2 — 1H equilibrium / prior LL shelf

6408–6415 — 4H HVN / equilibrium shelf

6360–6375 — 4H demand (strong-low)

Setup 1 — Breakout-Acceptance LONG

Trigger: 15m close > 6518, then two 5m bodies hold above.

Entry: 6520.5–6523.0 on the retest or break of bar-2 high.

Stop: tighter of (i) below the 15m trigger candle low, or (ii) below the last confirmed 5m swing; cap ≤ 6–8 pts.

• If neither option fits ≤ 8 pts from your fill, pass and wait for a cleaner micro HL.

TP1 (dynamic): first hard band (e.g., any workable print inside 6530–6545) that yields ≥ max(15, 2.5×SL) from your fill (front-run 0.25–0.5 pt if 2.5R is tight).

TP2/TP3: 6550, then 6570; trail by 15m/30m closes.

• Disqualifiers: any 5m body back ≤ 6518 before TP1; visible liquidity wall ≤ 5 pts beyond trigger; news window.

Setup 2 — SRR Rejection SHORT (Sweep → Recapture → Reversal)

Trigger: Sweep 6518–6530, fail, then 15m bearish close < 6518.

Entry: 6515.0–6518.0 on the retest from below.

Stop: tighter of (i) above the 15m trigger candle high, or (ii) above the last confirmed 5m LH; cap ≤ 6–8 pts.

• If the correct structural stop is > 8 pts from your fill, skip until a micro LH tightens risk.

TP1 (dynamic): first hard band below that gives ≥ max(15, 2.5×SL) from your fill—usually 6500; if 2.5R isn’t met to 6500, promote to 6482, then 6460.

TP2/TP3: 6482, then 6460 (extend toward 6410 if momentum).

• Disqualifiers: no 15m bearish confirmation; any 5m body ≥ 6518–6522 after entry (use your exact line); news window.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.