If you’re a parent, you’ll certainly understand that children do things despite being told not to. Is it out of curiosity? A rebellious nature? An issue with authority? Or my favorite, they know more?

Yes, yes, and yes.

It could be those answers or a variety of other reasons. Nonetheless, we don’t expect market participants to act like children. Maybe as adults, some of us never grew up and continue to do things for the same reasons we did as children.

Impulse control. Patience.

Some of the hardest lessons to learn, and undoubtedly can also be the costliest.

I recently read an interesting article trying to make sense of why the market has been up since March. In this article an individual, Michael Darda, with Roth MKM is quoted as saying…

“The equity markets are ignoring the bond markets and that is a mistake”, says Michael Darda, chief economist and market strategist at Roth MKM.

“I (Darda) examined seven-decades of the yield curve and how it relates to the business cycle and equity market performance. I found there have been 12 inversions since the 1950’s. Importantly, during these occasions the inversion was shown to have preceded the eventual recession by a wide range of between seven to 25 months, with an average lag of 14 months. What is more important is my research shows based on news articles for each of the 12 previous inversion cycles, the narrative of a soft or no landing thesis was prevalent. Upon conclusion of the cycle these narratives were proven incorrect.”

In my trading room I constantly rail against CNBC. Nowadays they only serve as a mouthpiece for money managers talking up their books or interview anyone with an incorrect, albeit intelligent sounding narrative. Very little push back from the hosts...(ahem, I mean entertainers).

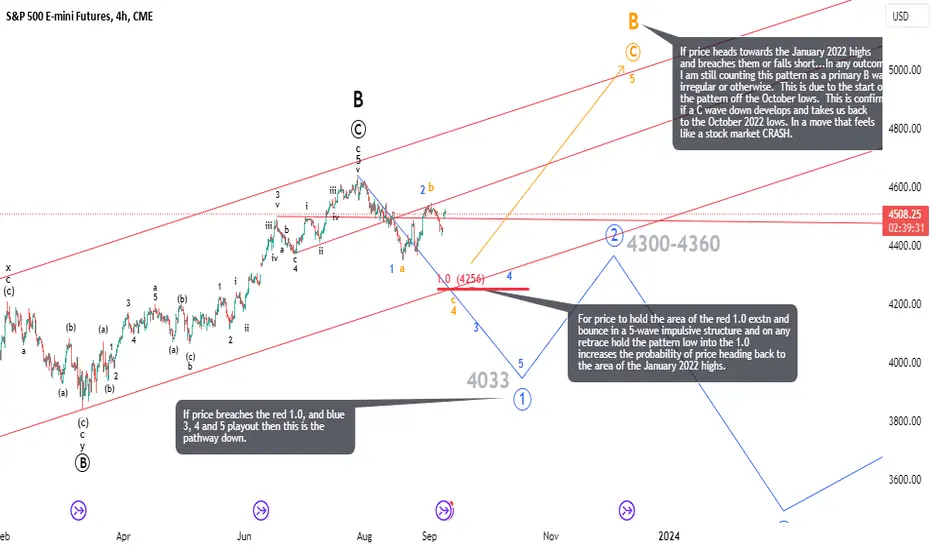

As I have mentioned many times to my members, I’ll never know what the catalysts are that tend to fulfill on my analysis…however, they tend to show up on time. But as an Elliottition, I’m fascinated by the behavior of large crowds, and when they act in a manner that the EWT analysis forecasts…it never gets old. To this day, I’m still blown away on how price can go directly to a particular Fibonacci level and reverse, or bounce.

On Friday we hit a dozy of a Fibonacci level in the indices, and this upcoming week, we should have a front row seat to witness just how bad it is.

But in a broader context I find myself asking the question. If the market has told its participants in 12 of the past 12 cycles that a particular outcome has happened, why would market participants choose to ignore this one?

Equally baffling, why would the same narratives be resurrected to validate the flawed perspective? I simply do not have answer. However, I must offer my most gracious thanks to those crowds of traders who continue to act in a manner that defies rational thought…. Nonetheless, is highly forecastable.

I thank you irrational traders. My family thanks you…and on behalf of many of my members…keep doing what you’re doing.

Rock on.

Best to all,

Chris

Yes, yes, and yes.

It could be those answers or a variety of other reasons. Nonetheless, we don’t expect market participants to act like children. Maybe as adults, some of us never grew up and continue to do things for the same reasons we did as children.

Impulse control. Patience.

Some of the hardest lessons to learn, and undoubtedly can also be the costliest.

I recently read an interesting article trying to make sense of why the market has been up since March. In this article an individual, Michael Darda, with Roth MKM is quoted as saying…

“The equity markets are ignoring the bond markets and that is a mistake”, says Michael Darda, chief economist and market strategist at Roth MKM.

“I (Darda) examined seven-decades of the yield curve and how it relates to the business cycle and equity market performance. I found there have been 12 inversions since the 1950’s. Importantly, during these occasions the inversion was shown to have preceded the eventual recession by a wide range of between seven to 25 months, with an average lag of 14 months. What is more important is my research shows based on news articles for each of the 12 previous inversion cycles, the narrative of a soft or no landing thesis was prevalent. Upon conclusion of the cycle these narratives were proven incorrect.”

In my trading room I constantly rail against CNBC. Nowadays they only serve as a mouthpiece for money managers talking up their books or interview anyone with an incorrect, albeit intelligent sounding narrative. Very little push back from the hosts...(ahem, I mean entertainers).

As I have mentioned many times to my members, I’ll never know what the catalysts are that tend to fulfill on my analysis…however, they tend to show up on time. But as an Elliottition, I’m fascinated by the behavior of large crowds, and when they act in a manner that the EWT analysis forecasts…it never gets old. To this day, I’m still blown away on how price can go directly to a particular Fibonacci level and reverse, or bounce.

On Friday we hit a dozy of a Fibonacci level in the indices, and this upcoming week, we should have a front row seat to witness just how bad it is.

But in a broader context I find myself asking the question. If the market has told its participants in 12 of the past 12 cycles that a particular outcome has happened, why would market participants choose to ignore this one?

Equally baffling, why would the same narratives be resurrected to validate the flawed perspective? I simply do not have answer. However, I must offer my most gracious thanks to those crowds of traders who continue to act in a manner that defies rational thought…. Nonetheless, is highly forecastable.

I thank you irrational traders. My family thanks you…and on behalf of many of my members…keep doing what you’re doing.

Rock on.

Best to all,

Chris

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.