📊 Technical Summary

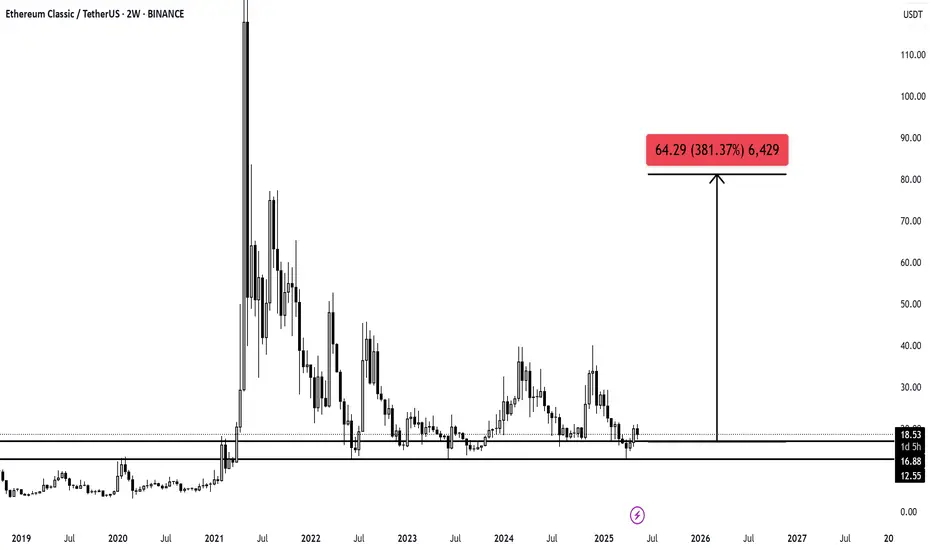

Support Levels: $12.55 and $16.88 – both have historically acted as accumulation zones.

Current Price: ~$18.55

Resistance/Target Zone: $64.29 — this aligns with a historical resistance area and implies a +381% potential upside.

Pattern Context: Price has been consolidating for nearly two years within a wide range after the 2021 peak. This long base often precedes explosive moves.

🔍 Key Observations

Long-term Base Formation: ETC is forming a strong multi-year base — a common precursor to major bullish breakouts.

Historical Breakout Zone: The $12–$18 range acted as launchpad in 2021 and is now holding again.

Massive Upside Potential: If the breakout is confirmed, a move toward $64.29 is realistic based on prior price action.

🎯 Outlook

Bullish Bias while price holds above $16.88.

Confirmation of breakout above ~$22–$25 range could trigger parabolic rally.

Target: $64.29

Risk: Breakdown below $12.55 would invalidate the setup.

✅ Conclusion

Ethereum Classic is showing classic signs of a macro reversal. As long as it maintains the current accumulation zone, it remains a strong candidate for long-term upside.

Subscribe to my Telegram Channel 👉 :

t.me/addlist/y5mi70s3c0Y3MDQ0

Subscribe to my X 👉 : x.com/VIPROSETR

t.me/addlist/y5mi70s3c0Y3MDQ0

Subscribe to my X 👉 : x.com/VIPROSETR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Subscribe to my Telegram Channel 👉 :

t.me/addlist/y5mi70s3c0Y3MDQ0

Subscribe to my X 👉 : x.com/VIPROSETR

t.me/addlist/y5mi70s3c0Y3MDQ0

Subscribe to my X 👉 : x.com/VIPROSETR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.