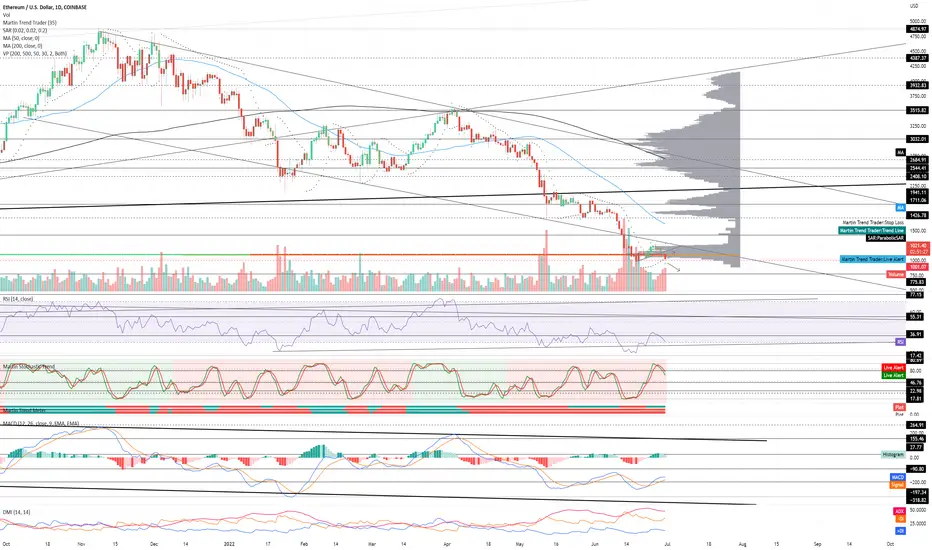

ETHUSD Daily cautiously bearish. Recommended ratio: 25% ETH, 75% Cash. *The Federal Reserve Bank of Atlanta released a real-time GDP estimate that currently projects -1% GDP growth for Q2, when the BEA releases their first Q2 GDP estimate on July 28th it will give more clarity but the general consensus is that we are heading for an "official" recession (I have previously stated we are arguably already in a recession). How much of a recession has been priced in is yet to be determined but the NYSE and NASDAQ combined have already lost $7 trillion in market cap in 2022 (data from World Federation of Exchanges) and it is estimated that more than $11 trillion (in market cap) has left global equity markets (US represents 41.6% of global equity markets). Cryptos and equities are once again bearing the brunt of a risk-off investment thesis that is being propagated by fears of a recession. With regards to Ethereum, The Merge hasn't been scheduled yet but some core developers think it will be launched in September.* Price is currently trending down at $1005 as it attempts to defend $1k support; if it is able to defend $1k support it would also likely form a local Double-Bottom which would be bullish, but it's still premature to say at this time. Volume is Moderate (high) and currently on track to favor sellers for a fifth consecutive session if it can close today's session in the red; it has also been ascending for five consecutive sessions. Parabolic SAR flips bullish at $1275, this margin is neutral at the moment. RSI is currently trending down at 30 as it approaches a retest of the uptrend line from 01/22/22 at ~28. Stochastic remains bearish and is currently trending down at 67, it is still technically testing 80 but it risks losing it if it is unable to bounce here; the next support is at 47. MACD remains bullish and is currently forming a soft peak as it trends down slightly at -168, it is still technically testing -197 support. ADX is currently forming a trough at 48 after Price was rejected by the lower trendline of the descending channel from October 2021 at ~$1300 and continues to see selling pressure, this is mildly bearish. If Price is able to bounce here at $1k then it will likely retest the lower trendline of the descending channel from October 2021 at $1200-$1300 as resistance. However, if Price continues to break down here, it will likely test $775 support for the first time since breaking above it in January 2021. Mental Stop Loss: (two consecutive closes above) $1250.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.