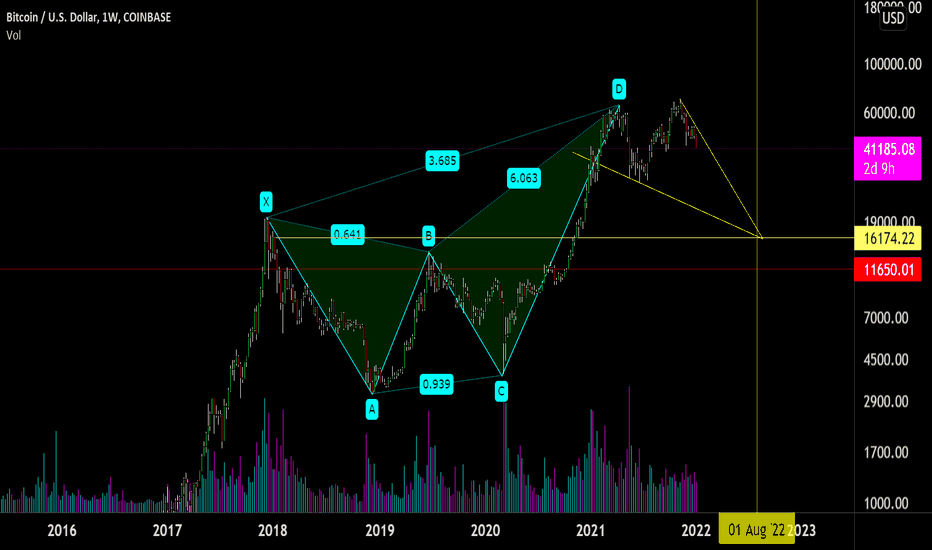

Ethereum in all-time rising wedge, now borderline falling out and breakdown to a disastrous level...

Note

The 30-Day Hull Moving Average has now flipped bearish on the Monthly Chart with the most recent price action having pierced the lower trend line...

A bullish case, and the saving grace for ETH here, is that it is also moving within an Ascending Triangle with the lower line also being pierced here...

Back to the bearish scenario, price has been forming an Ascending Broadening Wedge over the last 2 years with price breaking down out of the formation with the recent move...

Note

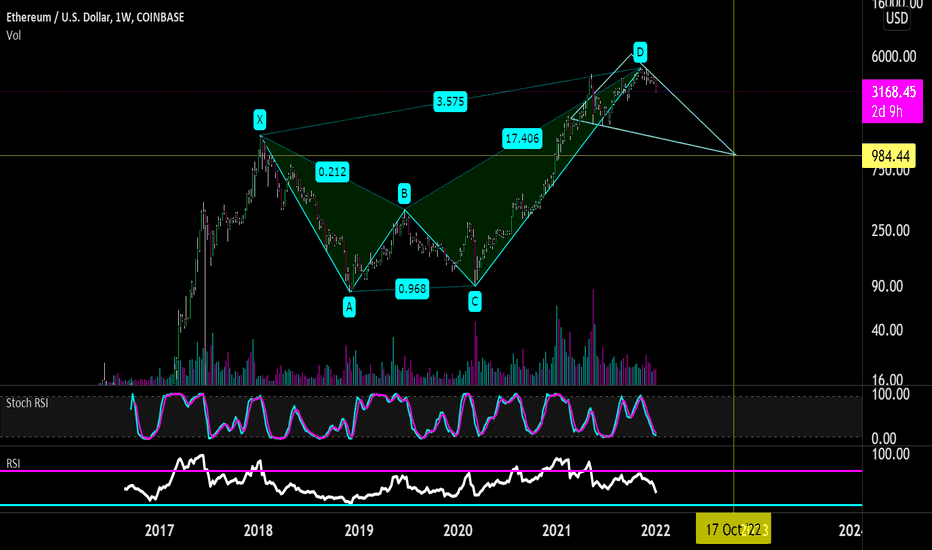

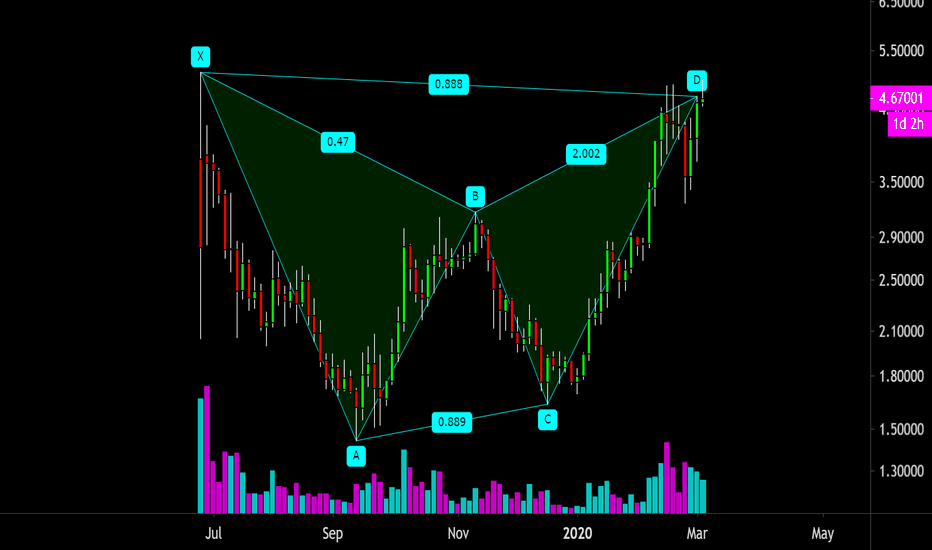

Mustering some bullish hopium, I could see a recovery attempt leading to the completion of a Harmonic pattern in the hope to retest the ATH, after which--if the harmonic is completed--ETH will see a price decline after its formation with a retest of the support of the lower trendline of the Ascending Broadening Wedge, if the ATH is not definitively broken and support is created and held above $4900.

Note

Why would I even think a Harmonic Pattern would play out here?Note

Slight Bullish Divergence forming on the Daily. Best possible hope here is for today's candle to form a Green Hammer...

With Price gaining at least 15% over the next 3 days to close the week with a strong wick...

This will allow for the 30-Day HullMA to catch up and the Stochastic to build bullish momentum at the bottom which is currently at the bottom at 5.80...

Note

Currently watching this potential Diamond Bottom forming. It does have the corresponding volume profile for the pattern...

Would be looking for high-er volume on the breakout. This pattern has a 13% failure rate with a typical rise of 15%-35%, with a 43& chance of Throwbacks...

This pattern does not invalidate the Ascending Broadening Wedge until a clear break of the Wedge's lower trendline is held

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.