New data and discoveries have come in, so my prediction for ETH has changed.

Back in March 2025, I saw this ETH pattern forming:

So far, everything is playing out as expected, but I believe the timeline has shifted to sometime at the end of December 2025.

We have one major liquidation event to play out before this happens in September, and I would not be surprised if we get a pullback to $3,500 before liftoff.

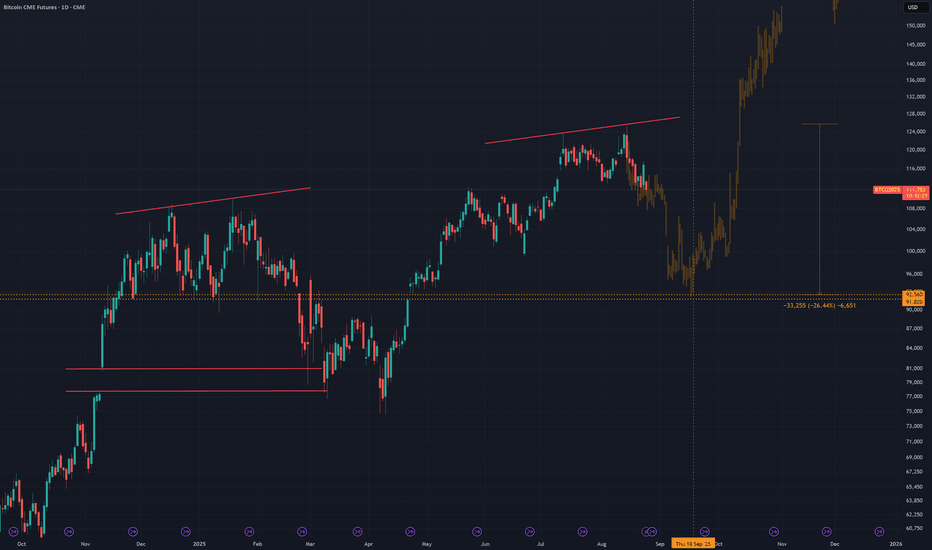

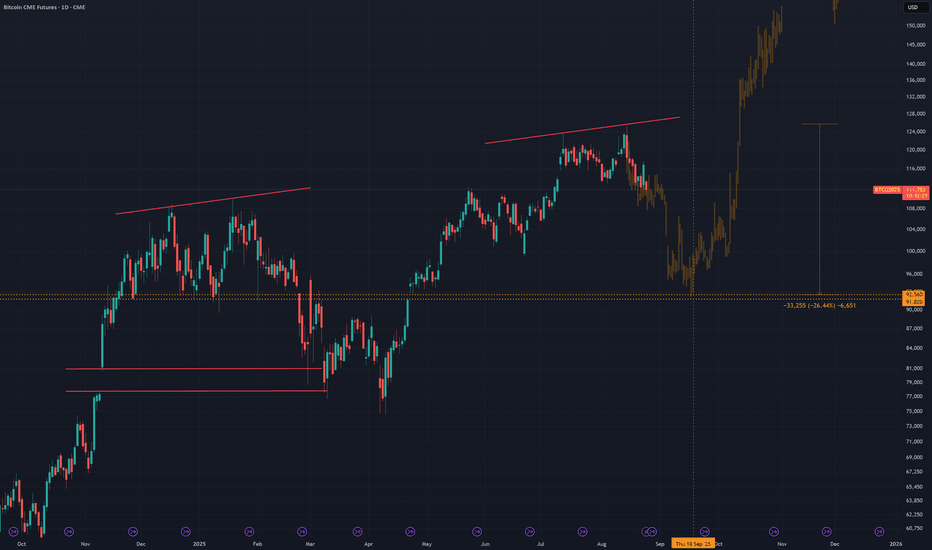

Bitcoin will most likely go down to $92,000 to close the CME gap:

You can check that out above, and when that happens, ETH should bottom out somewhere around $3,500.

The next major time Fibonacci will be on October 10th, 2025; this is most likely when we get the breakout. Until then, a massive trap is forming.

Ascending triangles are the name of the game in a bull market, especially with ETH:

As long as we keep putting in lower highs into ascending triangles, we are good to go higher; anything else is noise.

Invalidation for this thesis is simple: we close a weekly candle under the orange support, and chances are very high that we are done.

All I think is happening here is preparation for a massive bear trap, flushing out all the late leverage, as they always do. This is just a rite of passage before a major rally ensues.

Back in March 2025, I saw this ETH pattern forming:

So far, everything is playing out as expected, but I believe the timeline has shifted to sometime at the end of December 2025.

We have one major liquidation event to play out before this happens in September, and I would not be surprised if we get a pullback to $3,500 before liftoff.

Bitcoin will most likely go down to $92,000 to close the CME gap:

You can check that out above, and when that happens, ETH should bottom out somewhere around $3,500.

The next major time Fibonacci will be on October 10th, 2025; this is most likely when we get the breakout. Until then, a massive trap is forming.

Ascending triangles are the name of the game in a bull market, especially with ETH:

As long as we keep putting in lower highs into ascending triangles, we are good to go higher; anything else is noise.

Invalidation for this thesis is simple: we close a weekly candle under the orange support, and chances are very high that we are done.

All I think is happening here is preparation for a massive bear trap, flushing out all the late leverage, as they always do. This is just a rite of passage before a major rally ensues.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.