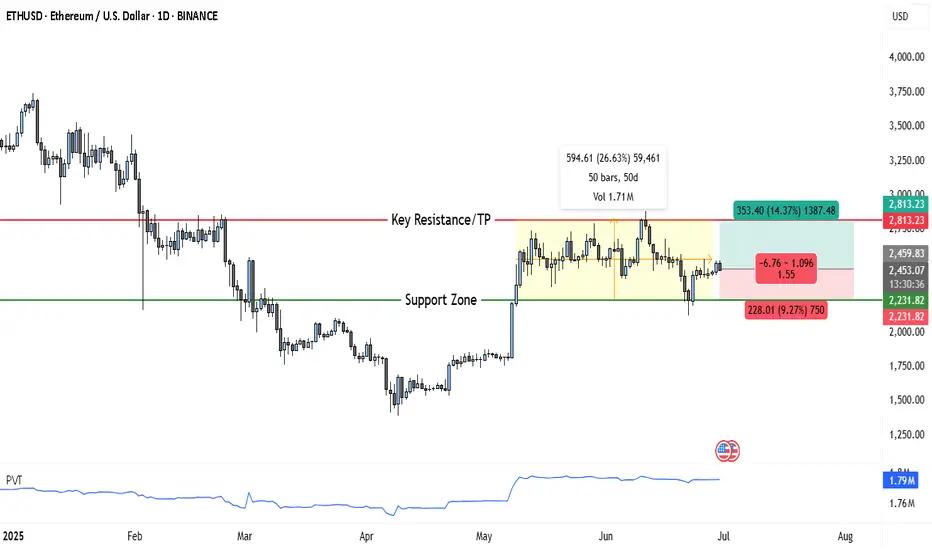

Ethereum has been consolidating in a large sideways range after recovering from a steep decline earlier this year. The chart clearly shows a defined support zone and key resistance area, with price currently trading just above mid-range and attempting to reclaim bullish momentum.

Chart Structure Highlights

• Support Zone: Around $2,231 – $2,232, which has been tested multiple times and held firmly, confirming strong demand here.

• Key Resistance / Take Profit Area: Near $2,813, a major level where price was repeatedly rejected in the past.

• Consolidation Box: A ~50-day range between support and resistance, suggesting accumulation.

• Recent Price Action: ETH is attempting to break out of the upper side of this consolidation, with buyers gradually stepping in.

Trade Setup

✅ Entry Zone: $2,450–$2,460

ETH is currently near this area, which represents a conservative breakout attempt from the range. Traders may look for confirmation candles closing above $2,460 for added conviction.

✅ Stop Loss: $2,231

Placed just below the lower edge of the support zone to protect against a failed breakout and renewed selling.

✅ Take Profit Target: $2,813

This is the key resistance level marked on the chart, offering approximately +14% upside from the entry.

Reward-to-Risk Profile

• Potential Reward: ~$353 (+14.3%)

• Potential Risk: ~$228 (-9.2%)

• Reward:Risk Ratio: ~1.55:1

Summary of the Setup

Ethereum has spent nearly 50 days consolidating between $2,230 and $2,813, and is now threatening a breakout to the upside. This creates a favorable swing trade scenario with a clear invalidation level below the strong support zone. A sustained move above the consolidation could target the $2,813 resistance in the coming weeks.

Chart Structure Highlights

• Support Zone: Around $2,231 – $2,232, which has been tested multiple times and held firmly, confirming strong demand here.

• Key Resistance / Take Profit Area: Near $2,813, a major level where price was repeatedly rejected in the past.

• Consolidation Box: A ~50-day range between support and resistance, suggesting accumulation.

• Recent Price Action: ETH is attempting to break out of the upper side of this consolidation, with buyers gradually stepping in.

Trade Setup

✅ Entry Zone: $2,450–$2,460

ETH is currently near this area, which represents a conservative breakout attempt from the range. Traders may look for confirmation candles closing above $2,460 for added conviction.

✅ Stop Loss: $2,231

Placed just below the lower edge of the support zone to protect against a failed breakout and renewed selling.

✅ Take Profit Target: $2,813

This is the key resistance level marked on the chart, offering approximately +14% upside from the entry.

Reward-to-Risk Profile

• Potential Reward: ~$353 (+14.3%)

• Potential Risk: ~$228 (-9.2%)

• Reward:Risk Ratio: ~1.55:1

Summary of the Setup

Ethereum has spent nearly 50 days consolidating between $2,230 and $2,813, and is now threatening a breakout to the upside. This creates a favorable swing trade scenario with a clear invalidation level below the strong support zone. A sustained move above the consolidation could target the $2,813 resistance in the coming weeks.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.