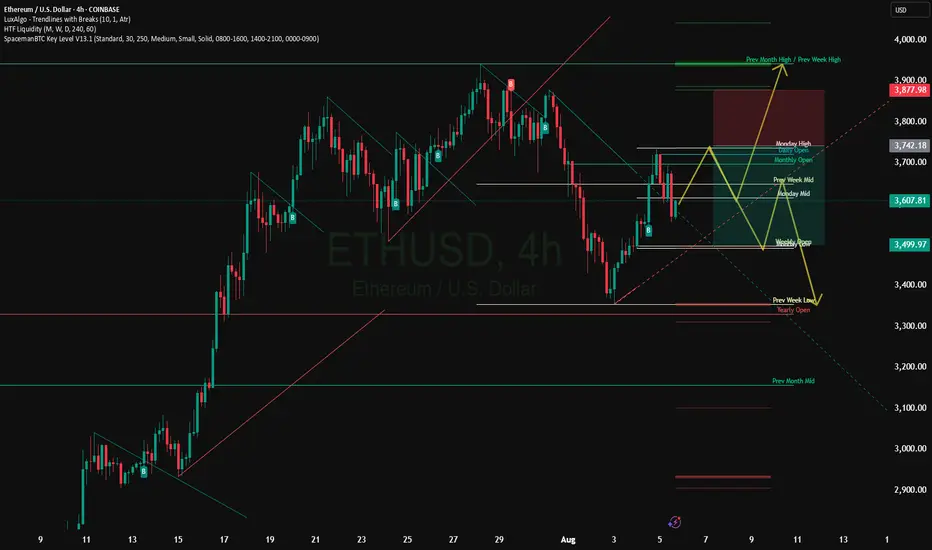

Market Structure and Trend

ETH has risen from around $2900 to around $3800 in July, breaking the important $4000 resistance level that has previously failed to be broken three times in 2024

ETH is trading in a tight price range of $3650–$3704, with the price above the EMA(25) ($3460), confirming the medium-term bullish trend

Indicators and Signals

EMA(7): $3739 — price below → short-term weakness signal; but above EMA(25) and EMA(99) (~$2832) → trend remains bullish

Stochastic RSI (6): ~1.6 — oversold level, signaling a possible rebound

RSI (according to TipRanks): around 76.7 — overbought, partially limits growth

ADX (14-day) on Barchart: around 17–23 — weak trend and consolidation

Support and resistance levels

Support:

$3616 — 3650 zone (lower boundary of the range and EMA(25)),

then $3460 (EMA25) and then $3460–$3300 if broken below

Resistance:

$3739 (EMA7),

above $3800,

key level $4000 — psychological and technical barrier,

further — historical maximum around $4800

Possible scenarios

Bulls

If the price holds above $3650 and stochastic RSI bounces up — growth to $3739 → $3780–$3800 is expected.

Breakthrough and holding above $3800 will open the way to $4000–$4100, and potentially higher, up to $4800+ if the market turns in favor of ETH

Bears

Consolidation below $3616 → possible movement to $3460 and lower to $3300+ with increased selling and weak volume

RSI above 70 may foreshadow a correction in the absence of further momentum.

ETH has risen from around $2900 to around $3800 in July, breaking the important $4000 resistance level that has previously failed to be broken three times in 2024

ETH is trading in a tight price range of $3650–$3704, with the price above the EMA(25) ($3460), confirming the medium-term bullish trend

Indicators and Signals

EMA(7): $3739 — price below → short-term weakness signal; but above EMA(25) and EMA(99) (~$2832) → trend remains bullish

Stochastic RSI (6): ~1.6 — oversold level, signaling a possible rebound

RSI (according to TipRanks): around 76.7 — overbought, partially limits growth

ADX (14-day) on Barchart: around 17–23 — weak trend and consolidation

Support and resistance levels

Support:

$3616 — 3650 zone (lower boundary of the range and EMA(25)),

then $3460 (EMA25) and then $3460–$3300 if broken below

Resistance:

$3739 (EMA7),

above $3800,

key level $4000 — psychological and technical barrier,

further — historical maximum around $4800

Possible scenarios

Bulls

If the price holds above $3650 and stochastic RSI bounces up — growth to $3739 → $3780–$3800 is expected.

Breakthrough and holding above $3800 will open the way to $4000–$4100, and potentially higher, up to $4800+ if the market turns in favor of ETH

Bears

Consolidation below $3616 → possible movement to $3460 and lower to $3300+ with increased selling and weak volume

RSI above 70 may foreshadow a correction in the absence of further momentum.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.