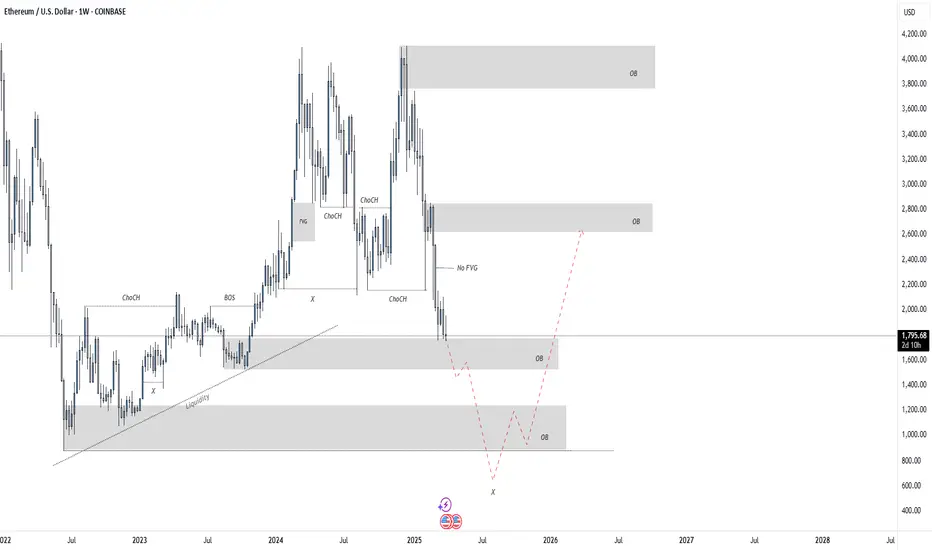

The broader market structure remains bearish, with price continuously making lower highs and lower lows. While many traders may see the 1,800 order block as a support level, the absence of a fair value gap indicates that this area lacks real institutional interest. Instead, it serves as a liquidity pool where market makers can absorb buy orders before driving price lower. The true liquidity targets lie below, particularly around the 600$ levels, where a significant number of stop losses and liquidation points are resting. These levels act as magnets, and until they are taken, the probability of a sustained bullish move remains low.

Additionally, the inefficiencies left in the previous sharp upward move suggest that price still has unfinished business to the downside. Smart money thrives on liquidity, and the clean lows below 600$ offer an attractive area for a deeper sweep before any meaningful bullish expansion can take place. This is a classic case of market manipulation, where early longs are baited into the market just before a significant downside move clears out weaker hands.

Once liquidity has been swept from the 600$ regions, the probability of a true reversal increases. At that point, institutional players will have accumulated enough liquidity to justify a move higher. The most logical upside target following this sweep is the 2,700 order block, which aligns with a previous imbalance and a major area of institutional interest. However, until the sell-side liquidity is fully taken out, any attempt at longs is premature and likely to result in being used as exit liquidity for smart money.

In conclusion, the current price action is a textbook example of liquidity engineering. The move down into 1,800$ was a carefully orchestrated inducement to trap buyers before a deeper price correction. The most probable scenario is a continued decline to sweep liquidity below 600$, at which point smart money will begin repositioning for a true bullish move toward 2,700. Until then, every attempt to push higher is likely just part of a larger manipulation cycle designed to fuel the next major market move.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.