Predicting cryptocurrency prices, including Ethereum (ETH), for the short term like "next week" is highly speculative and subject to rapid change due to market volatility, global economic factors, and news events. However, I can provide a summary of recent analysis and upcoming factors that might influence Ethereum's price in the coming week.

Current Landscape & Recent Trends:

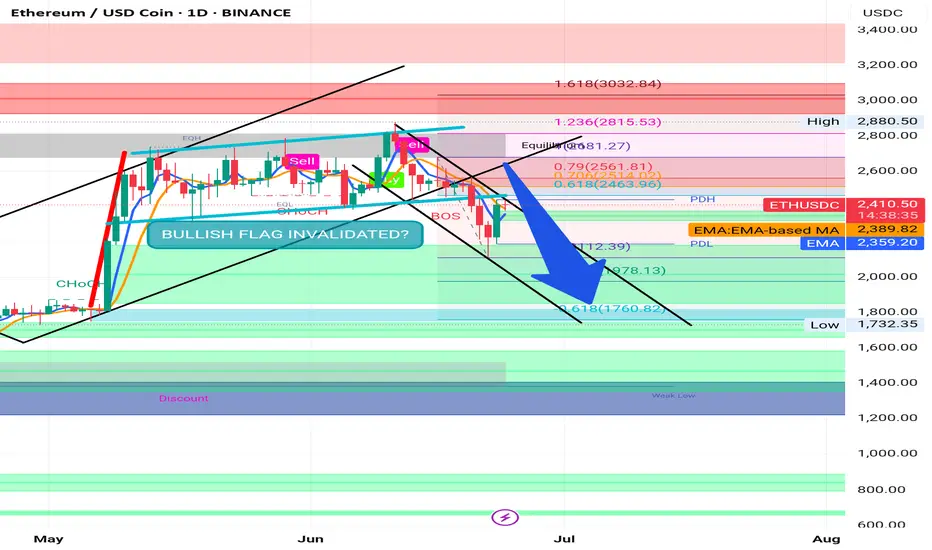

* Price Fluctuations: Ethereum has experienced significant volatility recently. As of June 24, 2025, ETH is trading around $2,260 - $2,400. There have been declines over the past week and month.

* Geopolitical Tensions: Geopolitical events, particularly in the Middle East, have been cited as a factor influencing recent crypto market dips, including Ethereum.

* Whale Activity: Despite recent price drops, some reports indicate that Ethereum whales (large holders) are not showing signs of significant selling, which could be a positive long-term signal.

* Technical Indicators:

* Some analyses suggest ETH found support around $2,110 and could eye a recovery.

* Resistance levels are noted around $2,500 and potentially higher towards $2,850.

* Other analyses point to bearish momentum with indicators like the MACD and RSI in certain timeframes.

* Long-Term Bullish Sentiment: Despite short-term fluctuations, some analysts maintain a long-term bullish outlook for Ethereum, citing its fundamental utility and potential for further growth.

Potential Influencing Factors for Next Week:

* EIP-7782: This Ethereum Improvement Proposal aims to significantly reduce block proposal, attestation, and aggregation times, potentially making the network faster and more efficient. Positive developments or news around this could be bullish.

* ETF Inflows: The ongoing interest and inflows into Ethereum ETFs could provide a sustained demand for ETH.

* Broader Market Sentiment: The performance of Bitcoin and the overall cryptocurrency market will heavily influence Ethereum's price. If Bitcoin sees a strong recovery, Ethereum is likely to follow.

* Macroeconomic News: Any major global economic news, inflation reports, or central bank decisions could impact investor sentiment towards riskier assets like cryptocurrencies.

* Geopolitical Developments: Continued or escalating geopolitical tensions could lead to further risk-off sentiment in the market.

General Outlook:

Some predictions indicate that Ethereum could see a slight increase next week, with some forecasts suggesting it could reach around $2,426.44 based on a 5% predicted growth rate. However, there are also warnings of potential further declines if key support levels are not held, with some analysts even suggesting a possible drop towards $1,800.

Important Disclaimer:

These are just predictions and observations based on available information. The cryptocurrency market is extremely unpredictable, and actual prices can deviate significantly. Do not consider this financial advice. Always conduct your own research and consider consulting with a financial professional before making any investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.