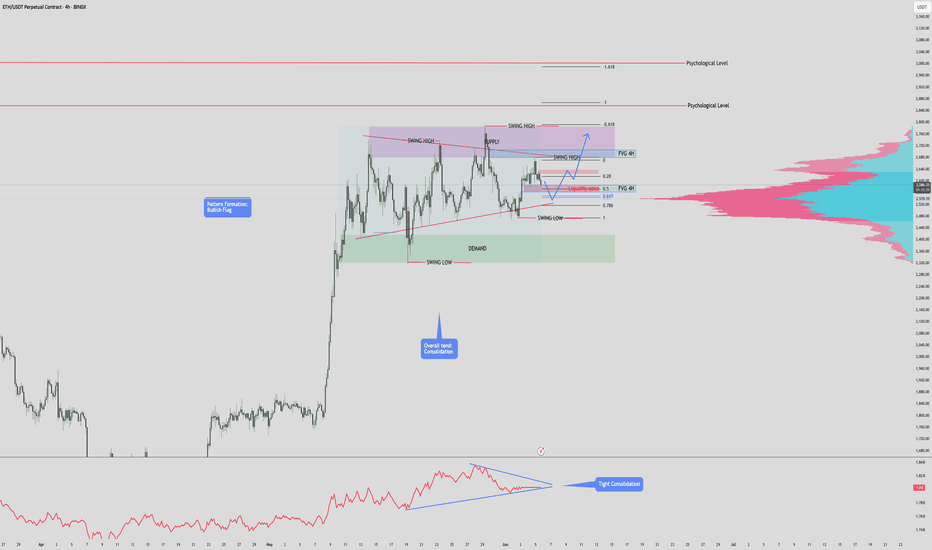

Structure: Bullish Flag | Outlook: Neutral-Bullish | Target: $3000?

🔹 Chart Overview

-Pattern: Bullish Flag (continuation structure)

Current Range:

- Supply Zone: $2,680.00 – $2,786.21

- Demand Zone: $2,319.79 – $2,417.61

Price Action:

- Tight consolidation between higher lows and lower highs, forming a symmetrical triangle within a flag structure.

Trend:

- Consolidation, but within a macro uptrend (prior strong rally).

Volume Profile:

- Anchored Volume shows high participation around $2,540–$2,600.

OBV:

- Flattening, signaling indecision and potential energy buildup.

Key Psychological Levels:

$2,860: Minor resistance from past S/R flips.

$3,000: Major round-number psychological resistance.

📐 Technical Confluences

Fibonacci Retracement:

- The 0.618 golden pocket aligns with the support trendline, reinforcing this as a critical zone.

Fair Value Gaps (FVG):

- Above Price: Acts as a magnet in bullish continuation.

- Below Price: Risk zone if price drops; aligns with liquidity and trendline support.

- Liquidity Zone: Aligned with 0.5–0.618 retracement; strong reaction expected.

📈 Bullish Scenario

Breakout of Pennant Resistance:

- A clean break above $2,786 (supply zone & swing high) with volume.

Close above Upper FVG and Liquidity Zone:

- Confirms bullish intent. Targets psychological level at $2,860, then $3,000.

Volume Confirmation:

- OBV uptick and high breakout volume would validate the move.

Bullish Target Zones:

TP1: $2,860 (psych level + previous resistance)

TP2: $3,000 (major psychological level)

TP3: $3,120–$3,180 (1.618 Fib extension)

📉 Bearish Scenario

Rejection from Current Supply or Liquidity Zone:

- Fails to break above supply; rolls over from the upper pennant line.

Break Below Support Trendline:

- Break below golden pocket and $2,417.61 demand zone.

Invalidation of Bullish Flag:

- A breakdown below $2,319.79 (swing low) invalidates the bullish flag and may signal a trend reversal.

Bearish Target Zones:

TP1: $2,200 (local volume gap + structure support)

TP2: $2,060–$2,120 (previous accumulation zone)

TP3: $1,950 (macro support & last strong demand)

✅ Summary

Structure:

- Price is compressing within a bullish continuation pattern, awaiting breakout confirmation.

Bias: Slightly bullish unless the swing low at $2,319 is broken.

Confirmation Needed:

- Break above or below pennant boundaries with volume.

Trade active

Price swept below the Liq zone as predicted but also took out the previous swing low.

Any longs that were taken last week are now invalidated.

We will still watch the chart - on the higher time frame this can be considered as a fake out ( IF ) it can cover the previous trend line.

A long would only be worth it if we entered above the previous High (AFTER) a confirmation such as 3 white soldiers.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.