ETH Daily Recap & Game Plan – 15.08.2025

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increasing global risk appetite are creating favorable conditions for further upside in crypto assets.

Ethereum is approaching all-time highs, fueled by a $1B single-day ETF inflow. Additionally, rumors of potential SEC approval for Ethereum staking policy could directly boost ETH’s utility — strengthening the long bias.

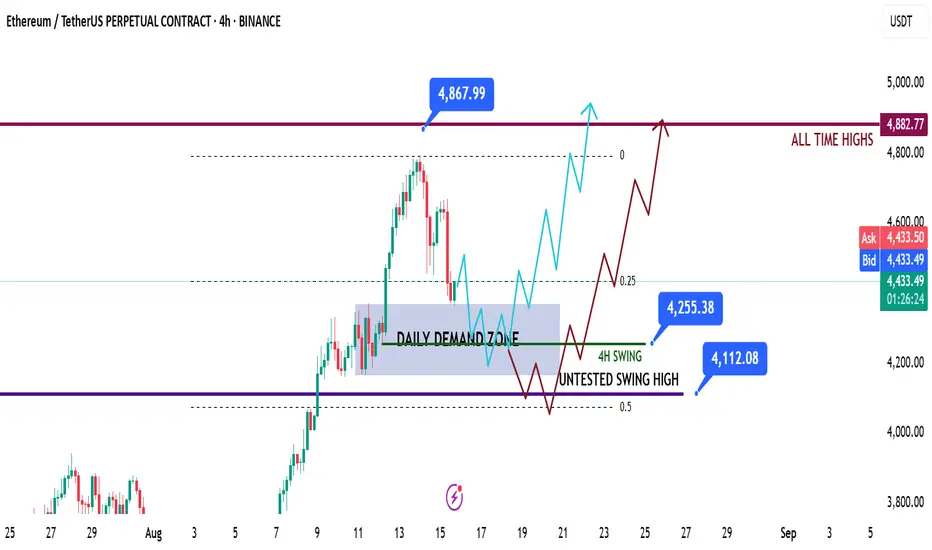

📈 Technical Analysis

Price has started a retracement move after Bitcoin reached new all-time highs.

Currently, ETH is testing the daily demand zone (blue box) — a level where we may see a reaction. For confirmation, I want to see a 4H break of structure before initiating any trades.

Since it’s the weekend, I expect some choppy price action and possibly a deeper retracement. I’m watching two potential scenarios (Blue vs. Red).

📌 Game Plan

Scenario 1 (Blue)

→ Price sweeps 4H swing liquidity at 4255$, then rejects.

Scenario 2 (Red)

→ Price dips deeper, tapping the untested swing high at 4112$ and possibly into the equilibrium discount zone (0.5 Fibonacci), before rejecting.

🎯 Setup Trigger

Waiting for a 4H break of structure before entering any position.

📋 Trade Management

Stoploss: 4H swing low confirming the BOS

Target: Run directly toward all-time highs at 4867$

💬 Like, follow, and comment if you find this setup valuable!

Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always do your own research before making any financial decisions.

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increasing global risk appetite are creating favorable conditions for further upside in crypto assets.

Ethereum is approaching all-time highs, fueled by a $1B single-day ETF inflow. Additionally, rumors of potential SEC approval for Ethereum staking policy could directly boost ETH’s utility — strengthening the long bias.

📈 Technical Analysis

Price has started a retracement move after Bitcoin reached new all-time highs.

Currently, ETH is testing the daily demand zone (blue box) — a level where we may see a reaction. For confirmation, I want to see a 4H break of structure before initiating any trades.

Since it’s the weekend, I expect some choppy price action and possibly a deeper retracement. I’m watching two potential scenarios (Blue vs. Red).

📌 Game Plan

Scenario 1 (Blue)

→ Price sweeps 4H swing liquidity at 4255$, then rejects.

Scenario 2 (Red)

→ Price dips deeper, tapping the untested swing high at 4112$ and possibly into the equilibrium discount zone (0.5 Fibonacci), before rejecting.

🎯 Setup Trigger

Waiting for a 4H break of structure before entering any position.

📋 Trade Management

Stoploss: 4H swing low confirming the BOS

Target: Run directly toward all-time highs at 4867$

💬 Like, follow, and comment if you find this setup valuable!

Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always do your own research before making any financial decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.