ETH | Swing Long Idea

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increased risk appetite across global markets are creating favorable conditions for further upside in crypto assets.

📈 Technical Analysis

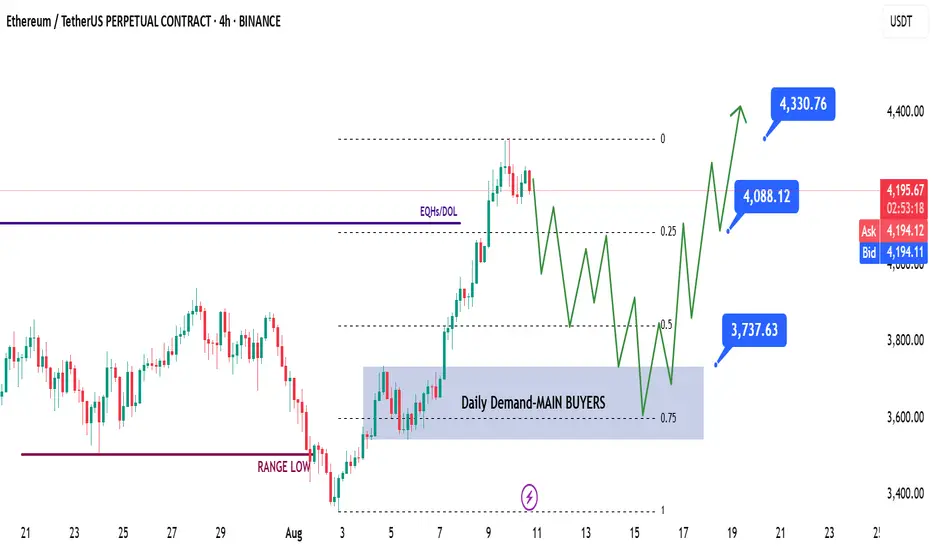

Price has run the HTF liquidity level at $4100.

While the breakout above $4100 was aggressive, it appears price may require additional liquidity before pushing higher.

This idea focuses on a possible ETH retracement and continuation pattern over the coming days to weeks.

📌 Game Plan

If a deep retracement occurs, I’ll be watching the 0.5 Fibonacci discount zone and the 0.75 retracement level for optimal entries.

Key focus: daily demand zone at $3750 — ideally aligned with the 0.75 retracement.

I won’t wait for an exact touch of the 0.75 level; instead, I’ll watch for strength and a clear break of structure to trigger entries.

🎯 Setup Trigger

Look for a 12H–4H break of structure shift after the daily demand zone at $3750 is hit.

📋 Trade Management

Stoploss: 12H–4H swing low that caused the break of structure

Targets:

TP1: $4088

TP2: $4330

TP3: $5000 (possible swing point)

Will trail stops aggressively to secure profits as price moves in my favor.

💬 Like & follow if you found this breakdown helpful — more setups coming soon!

📊 Market Sentiment

Overall sentiment remains bullish, supported by expectations of a 0.25% rate cut in the upcoming FOMC meeting. A weakening USD and increased risk appetite across global markets are creating favorable conditions for further upside in crypto assets.

📈 Technical Analysis

Price has run the HTF liquidity level at $4100.

While the breakout above $4100 was aggressive, it appears price may require additional liquidity before pushing higher.

This idea focuses on a possible ETH retracement and continuation pattern over the coming days to weeks.

📌 Game Plan

If a deep retracement occurs, I’ll be watching the 0.5 Fibonacci discount zone and the 0.75 retracement level for optimal entries.

Key focus: daily demand zone at $3750 — ideally aligned with the 0.75 retracement.

I won’t wait for an exact touch of the 0.75 level; instead, I’ll watch for strength and a clear break of structure to trigger entries.

🎯 Setup Trigger

Look for a 12H–4H break of structure shift after the daily demand zone at $3750 is hit.

📋 Trade Management

Stoploss: 12H–4H swing low that caused the break of structure

Targets:

TP1: $4088

TP2: $4330

TP3: $5000 (possible swing point)

Will trail stops aggressively to secure profits as price moves in my favor.

💬 Like & follow if you found this breakdown helpful — more setups coming soon!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.