Cryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a pretty interesting case for those, who are eyeing the backbone of Web3.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

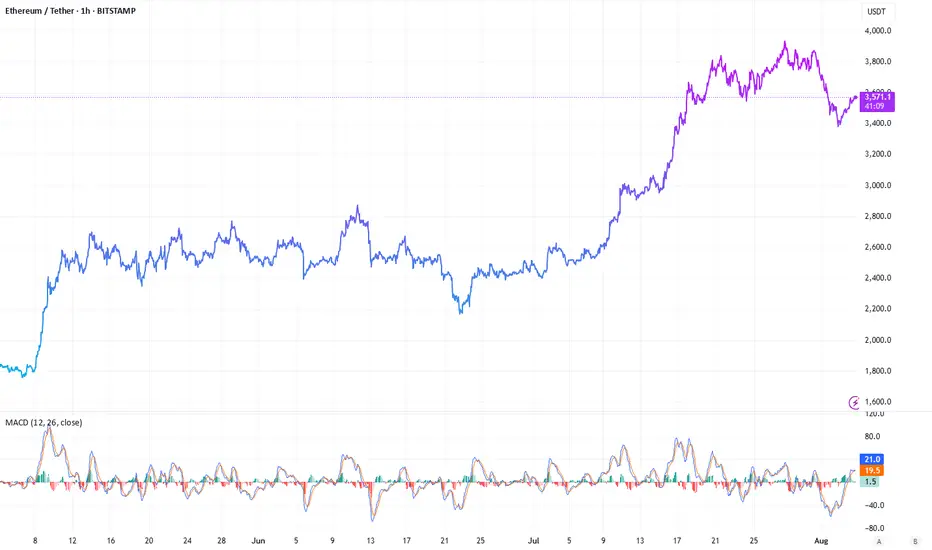

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum ETHUSD, the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

ETHUSD, the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young , Airbus AIR, JPMorgan

AIR, JPMorgan  JPM, Microsoft

JPM, Microsoft  MSFT, and Amazon $NASDAQ:AMZN. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

MSFT, and Amazon $NASDAQ:AMZN. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Lets take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.Cryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a pretty interesting case for those, who are eyeing the backbone of Web3.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum, the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young, Airbus, JPMorgan, Microsoft, and Amazon. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young , Airbus

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Lets take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.Cryptocurrency ecosystem is actively maturing and investors are increasingly drawn to infrastructure providers that underpin the decentralized economy. Consensys is a leading blockchain software company, stands out with its flagship MetaMask wallet and a suite of Ethereum-focused solutions. With a robust business model and global adoption, Consensys offers a pretty interesting case for those, who are eyeing the backbone of Web3.

MetaMask: The Leading Crypto Wallet

Consensys’s flagship product, MetaMask, is one of the most widely used cryptocurrency wallets globally, competing closely with Trust Wallet for market dominance. Unlike centralized exchange storage, MetaMask is a decentralized, self-custodial wallet—essentially software that allows users to manage digital assets independently. With an estimated 30 million monthly active users, MetaMask facilitates billions in transactions, verifiable on the Ethereum blockchain.

MetaMask generates revenue through a 0.875% fee on token swaps, contributing to a reported $60 million in net profit for 2024. Its user base is spread across various markets, including Nigeria, Indonesia, the United States, South Korea, and Germany. In regions like Nigeria, where banking systems charge high fees, MetaMask transforms cash flow by enabling low-cost transactions. In developed markets like the U.S. and Germany, it serves as a gateway for asset storage and decentralized app (dApp) interactions.

A key growth catalyst for MetaMask is the potential launch of its own governance token. Unlike competitors Trust Wallet and Gnosis, MetaMask lacks a native token, which could streamline transactions and boost revenue by reducing reliance on third-party staking providers. Market speculation suggests a token launch could enhance MetaMask’s valuation and make it by this a hot topic for discussions.

Infura: Ethereum’s Infrastructure Backbone

Beyond MetaMask, Consensys’s Infura provides critical infrastructure for Ethereum, the world’s second-largest blockchain. Infura’s API services enable developers to build and scale dApps without running their own nodes, supporting over 430,000 developers and processing transactions worth over $1 trillion annually. Infrastructure is integral to Ethereum’s ecosystem, powering everything from DeFi platforms to NFT marketplaces.

Infura’s revenue model, based on usage fees ($40–$50 per 200,000 API requests), capitalizes on Ethereum’s growth. As transaction volumes rise—up 83% since 2017—Infura’s role as a reliable backend for MetaMask and other dApps positions it as a critical part of Consensys’s business.

Sharplink: Smart Contracts for Enterprises

Consensys’s Sharplink division develops software for smart contracts, serving high-profile clients like Ernst & Young, Airbus, JPMorgan, Microsoft, and Amazon. Solutions enable secure and automated agreements on Ethereum, with applications ranging from supply chain management to digital identity. Central banks in countries like Norway and Israel are also exploring Sharplink’s technology for digital currency initiatives.

Staking and Asset Management

Consensys owns approximately $500 million in Ethereum and other cryptocurrencies, generating income from staking and other revenue-generating operations, thereby complementing the company's software offerings, ensuring financial stability, and providing access to the growth of the cryptocurrency market.

Why Consensys Stands Out

Take Kraken or Bybit, for example. Their reported trading volumes are quite difficult to verify, but at the same time, Consensys' decentralized products provide transparency. Every MetaMask transaction and Infura API call is recorded on Ethereum’s public ledger, allowing investors to validate activity. Such openness mitigates the exaggeration common in crypto, where claims of user bases or turnovers can be inflated.

Consensys’s diversified portfolio—spanning wallets, infrastructure, smart contracts, and staking, as we told before—reduces reliance on any single revenue source. Its global reach, from emerging markets like Nigeria to tech hubs like the U.S., further de-risks its business model. Major investors, including BlackRock, JPMorgan, and Microsoft, have already backed Consensys, signaling that way confidence in its long-term potential.

The Road Ahead

Founded by Ethereum co-founder Joseph Lubin, Consensys has raised $1 billion to date, with a reported valuation target of $7 billion for a potential IPO. While the timeline for going public remains uncertain, the company’s focus on Ethereum’s ecosystem positions it to benefit from Web3’s expansion. Challenges, such as regulatory scrutiny and competition from wallets like Trust Wallet or blockchains like Solana, exist, but Consensys’s entrenched role in Ethereum gives it a competitive edge.

CEO Mind-Money.eu

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

CEO Mind-Money.eu

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

🌐 mind-money.eu

Personal website of Julia Khandoshko:

🌐 iuliia-khandoshko.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.