Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(ETHUSDT 1D Chart)

The price began to rise after breaking above the important 2419.83-2706.15 area.

This can be interpreted as the beginning of a step-up trend, with an upward breakout of the HA-High ~ DOM(60) range.

The HA-High ~ DOM(60) range corresponds to the 2581.59-2681.60 range.

This suggests that the price is currently testing whether a second step-up trend will continue or whether it will simply end as the first step-up trend.

The HA-High ~ DOM(60) range is currently 3708.87-3762.33.

Therefore, if the price rises above 3708.87-3762.33 and maintains this level through the upcoming volatility period, a second step-up trend is expected.

The conditions for this are as follows:

- The K value of the StochRSI indicator must rise from the oversold zone and show an upward trend with K > D. - The OBV indicator must rise above the High Line and maintain an upward trend.

- The TC (Trend Check) indicator must continue its upward trend. (If possible, it's best to stay above 0.)

The next volatility period for ETH is expected to last from around August 6th to 10th.

However, it's worth keeping an eye on the movements during the BTC volatility period.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

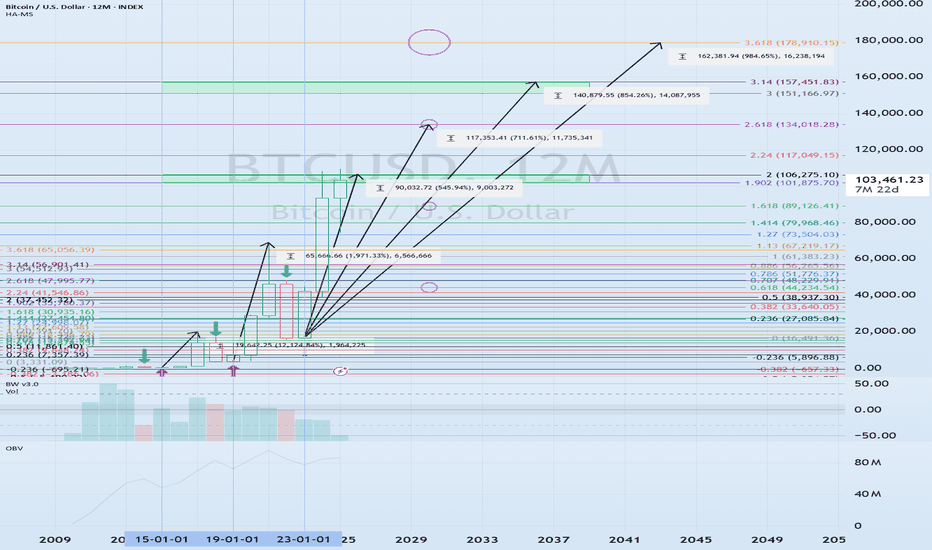

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.