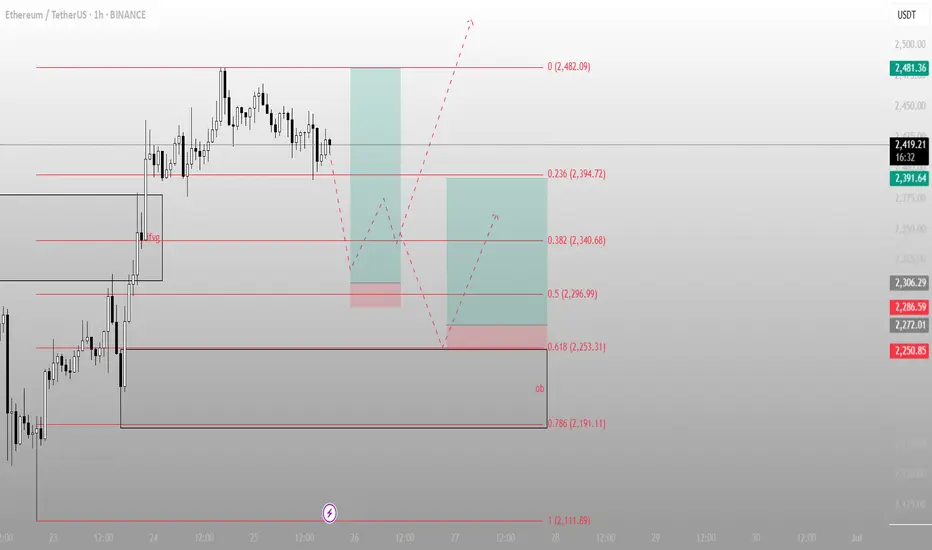

ETH is holding just above a key fib cluster, showing signs of controlled distribution, not weakness. Smart Money doesn’t chase — they build positions while the crowd second-guesses.

The Structure:

Current Price: ~2,419

Local High (Premium): 2,482.09

Fib Retracements:

0.236 → 2,394.72 (mild correction)

0.382 → 2,340.68 (initial re-entry zone)

0.5 → 2,296.99 (ideal discount)

0.618 → 2,253.31 (deep entry, high confluence)

0.786 → 2,191.11 (structure last line)

Key Zones:

FVG already filled during the move up — imbalance mitigated

Order block (OB) at 2,191.11: high-probability reaction zone

Strategy Outlook:

Scenario A (Shallow pullback):

ETH tests 2,394 → 2,340, then continues the push to 2,482

→ Aggressive buyers step in early

Scenario B (Deeper sweep):

A drop to 2,296 → 2,253 opens the door for reaccumulation

→ Classic Smart Money trap before the next rally

Invalidation:

A break below 2,191 (and OB failure) kills this bullish narrative

Execution Logic:

Accumulation Zones:

Light: 2,340–2,296

Strong: 2,253–2,191 (discount reload)

Target:

2,482

Extension optional if momentum builds above recent highs

The Structure:

Current Price: ~2,419

Local High (Premium): 2,482.09

Fib Retracements:

0.236 → 2,394.72 (mild correction)

0.382 → 2,340.68 (initial re-entry zone)

0.5 → 2,296.99 (ideal discount)

0.618 → 2,253.31 (deep entry, high confluence)

0.786 → 2,191.11 (structure last line)

Key Zones:

FVG already filled during the move up — imbalance mitigated

Order block (OB) at 2,191.11: high-probability reaction zone

Strategy Outlook:

Scenario A (Shallow pullback):

ETH tests 2,394 → 2,340, then continues the push to 2,482

→ Aggressive buyers step in early

Scenario B (Deeper sweep):

A drop to 2,296 → 2,253 opens the door for reaccumulation

→ Classic Smart Money trap before the next rally

Invalidation:

A break below 2,191 (and OB failure) kills this bullish narrative

Execution Logic:

Accumulation Zones:

Light: 2,340–2,296

Strong: 2,253–2,191 (discount reload)

Target:

2,482

Extension optional if momentum builds above recent highs

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.