#ETHUSDT - UniverseMetta - Analysis

Potential reversal & correction setup in progress

📆 W1 – Weekly Timeframe

🔹 Price is testing a major monthly resistance zone, from which price has previously rejected toward the lower edge of a large triangle structure

🔹 According to the 3-wave structure, ETH has reached 161% of Wave 1 and closed above the 200% Fibo level

🔹 If the price fails to make a new high this week, a top fractal may form — a possible signal for a medium-term correction

📉 D1 – Daily Timeframe

🔹 A double top pattern is forming, along with a potential retest of the trendline

🔹 If confirmed, this could trigger a 3-wave correction structure downward

🔹 A downward fractal is already printed — adding confluence to the bearish scenario

🎯 Correction targets:

• $3,242

• $2,546

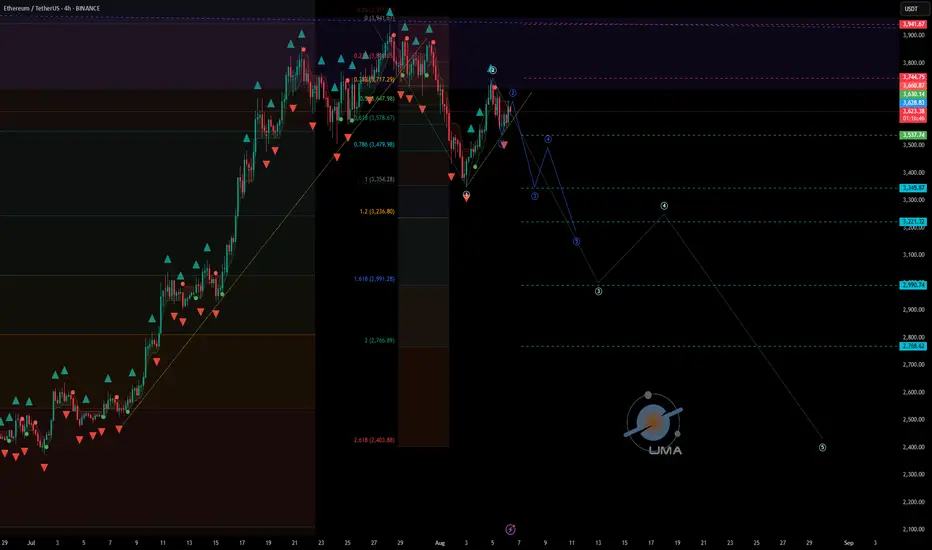

⏳ H4 – 4H Timeframe

🔹 Current price action suggests a correction from the recent impulse

🔹 A 3rd wave may initiate upon trendline breakout

🔹 Entry confirmation may come from breakout + retest, or via confirmed double top structure

🔹 Stop should be placed above the high of Wave 1 (H4)

🎯 Trade Setup:

Entry: 0.64930

TP: 0.65404 - 0.65700 - 0.66164 - 0.66676

Stop: 0.64482

‼️ Risk should not exceed 1–3% of your portfolio

This signal/idea is not financial advice

📌 Key Fundamental Triggers to Watch:

🔹 Federal Reserve expectations – a dovish shift could support ETH short-term, but failure to materialize may drive a pullback

🔹 ETH ETF news – updates on applications, approvals, and volume flows can significantly impact sentiment

🔹 Correlation with NASDAQ/S&P500 – weakness in equities could drag crypto lower

🔹 On-chain activity – declining gas usage or demand may indicate lower network utility and bearish pressure

🔹 Weekly overbought condition – many technical indicators (RSI, MACD) point to overextension

Potential reversal & correction setup in progress

📆 W1 – Weekly Timeframe

🔹 Price is testing a major monthly resistance zone, from which price has previously rejected toward the lower edge of a large triangle structure

🔹 According to the 3-wave structure, ETH has reached 161% of Wave 1 and closed above the 200% Fibo level

🔹 If the price fails to make a new high this week, a top fractal may form — a possible signal for a medium-term correction

📉 D1 – Daily Timeframe

🔹 A double top pattern is forming, along with a potential retest of the trendline

🔹 If confirmed, this could trigger a 3-wave correction structure downward

🔹 A downward fractal is already printed — adding confluence to the bearish scenario

🎯 Correction targets:

• $3,242

• $2,546

⏳ H4 – 4H Timeframe

🔹 Current price action suggests a correction from the recent impulse

🔹 A 3rd wave may initiate upon trendline breakout

🔹 Entry confirmation may come from breakout + retest, or via confirmed double top structure

🔹 Stop should be placed above the high of Wave 1 (H4)

🎯 Trade Setup:

Entry: 0.64930

TP: 0.65404 - 0.65700 - 0.66164 - 0.66676

Stop: 0.64482

‼️ Risk should not exceed 1–3% of your portfolio

This signal/idea is not financial advice

📌 Key Fundamental Triggers to Watch:

🔹 Federal Reserve expectations – a dovish shift could support ETH short-term, but failure to materialize may drive a pullback

🔹 ETH ETF news – updates on applications, approvals, and volume flows can significantly impact sentiment

🔹 Correlation with NASDAQ/S&P500 – weakness in equities could drag crypto lower

🔹 On-chain activity – declining gas usage or demand may indicate lower network utility and bearish pressure

🔹 Weekly overbought condition – many technical indicators (RSI, MACD) point to overextension

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.