Ticker: ETN (NYSE) | Sector: Industrial/Energy Infrastructure

📈 Trade Setup

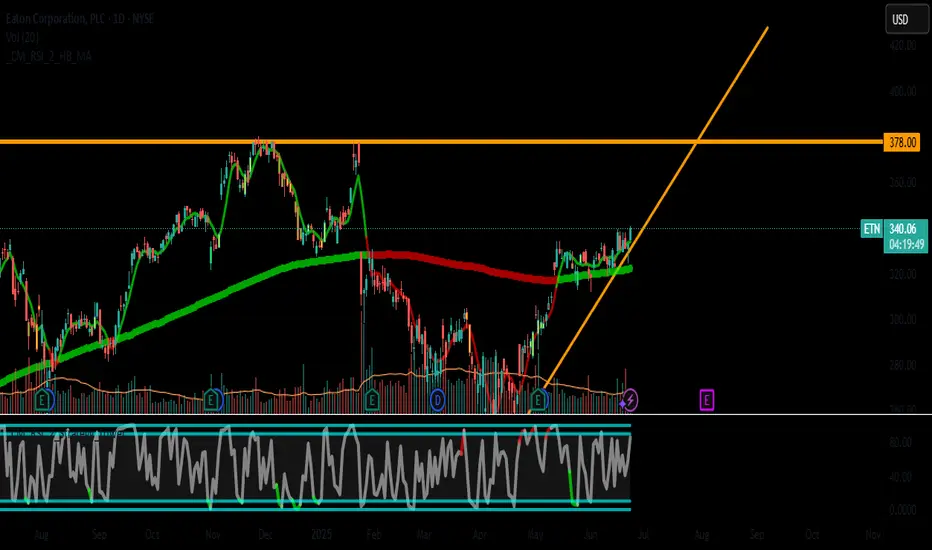

Entry: $340.5 (Current price near breakout level)

Stop Loss: $315 (-7.5% from entry)

Take Profit: $391.68 (+15% upside)

Risk/Reward Ratio: 1:2

🔍 Technical Analysis

Trend & Momentum:

Daily Chart: Strong uptrend (Higher highs & higher lows).

RSI (14): 62 (Bullish but not overbought).

MACD: Bullish crossover above signal line.

Key Levels:

Support: $315 (200-day SMA + previous resistance turned support).

Resistance: $350 (Psychological level), then $391.68 (ATH projection).

Volume: Rising on upward moves (bullish confirmation).

💡 Fundamental Catalyst

Sector Tailwinds:

Global energy infrastructure spending surge (grid modernization, data centers).

ETN’s exposure to electrification and renewable energy plays.

Valuation:

P/E: 33.5 (slightly rich but justified by growth).

Strong free cash flow (+12% YoY).

🎯 Why This Trade?

Breakout Play: ETN is testing a multi-week consolidation. A close above $345 confirms bullish momentum.

Sector Strength: Industrials outperforming S&P 500 YTD.

Low Relative Volatility: ATR of ~$8 suggests controlled risk.

⚡ Trade Management

Add-on: Consider adding at $355 if volume supports the breakout.

Adjust SL: Move to breakeven at $350 if price reaches $365.

Watchlist: Monitor XLI (Industrial ETF) for sector confirmation.

⚠️ Risks

Market Pullback: Broad selloff could drag industrials.

Earnings Volatility: Next report due in ~3 weeks.

📉 Chart Note:

"ETN is poised for a measured move to ATHs if $345 breaks. SL below $315 keeps risk defined."

✅ Verdict: High-conviction swing trade with clear technical structure.

#ETN #Breakout #IndustrialStocks #SwingTrading

(Disclaimer: Not financial advice. Do your own research. Past performance ≠ future results.)

📈 Trade Setup

Entry: $340.5 (Current price near breakout level)

Stop Loss: $315 (-7.5% from entry)

Take Profit: $391.68 (+15% upside)

Risk/Reward Ratio: 1:2

🔍 Technical Analysis

Trend & Momentum:

Daily Chart: Strong uptrend (Higher highs & higher lows).

RSI (14): 62 (Bullish but not overbought).

MACD: Bullish crossover above signal line.

Key Levels:

Support: $315 (200-day SMA + previous resistance turned support).

Resistance: $350 (Psychological level), then $391.68 (ATH projection).

Volume: Rising on upward moves (bullish confirmation).

💡 Fundamental Catalyst

Sector Tailwinds:

Global energy infrastructure spending surge (grid modernization, data centers).

ETN’s exposure to electrification and renewable energy plays.

Valuation:

P/E: 33.5 (slightly rich but justified by growth).

Strong free cash flow (+12% YoY).

🎯 Why This Trade?

Breakout Play: ETN is testing a multi-week consolidation. A close above $345 confirms bullish momentum.

Sector Strength: Industrials outperforming S&P 500 YTD.

Low Relative Volatility: ATR of ~$8 suggests controlled risk.

⚡ Trade Management

Add-on: Consider adding at $355 if volume supports the breakout.

Adjust SL: Move to breakeven at $350 if price reaches $365.

Watchlist: Monitor XLI (Industrial ETF) for sector confirmation.

⚠️ Risks

Market Pullback: Broad selloff could drag industrials.

Earnings Volatility: Next report due in ~3 weeks.

📉 Chart Note:

"ETN is poised for a measured move to ATHs if $345 breaks. SL below $315 keeps risk defined."

✅ Verdict: High-conviction swing trade with clear technical structure.

#ETN #Breakout #IndustrialStocks #SwingTrading

(Disclaimer: Not financial advice. Do your own research. Past performance ≠ future results.)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.