Breaker blocks or simply called breakers are failed order blocks which are being retested same way with the break and retest entry pattern.

However I simply don’t trade this pattern whenever it presents itself on the charts.

There are certain conditions that has to be met before I seek to enter.

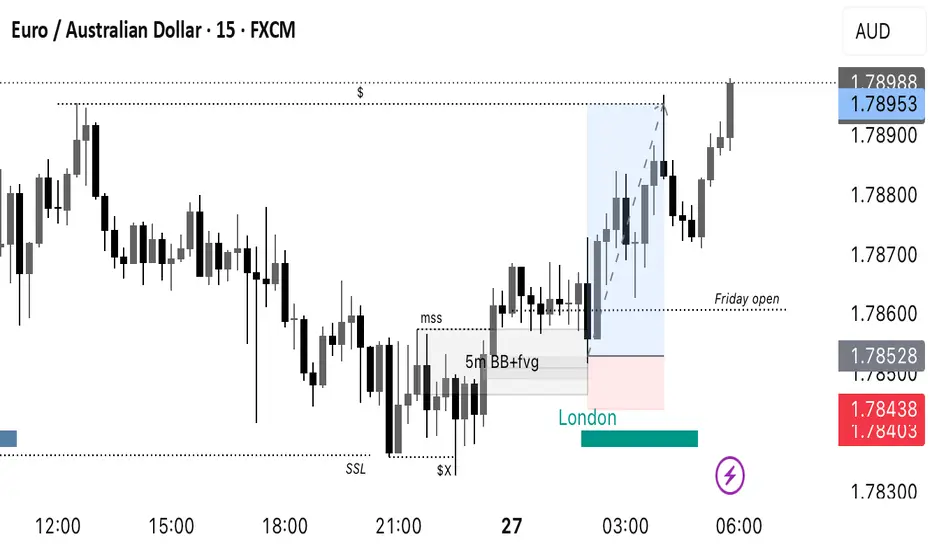

1. Firstly, prior to the order block(turned break block) being failed I need to see a grab of liquidity(either buy side or sell side liquidity depending on our directional bias which is the draw on liquidity).

2. After the grab of liquidity I expect to see a clean failure of the order block. Price has to push through the order block with momentum.

3. I expect to find a fair-value-gap as a result of that clean break within that failed order block (turned breaker block).

4. With these 3 factors in place I would not consider to enter if this setup does not occur at key levels. Which could be at the liquidation of an old higher timeframe swing low or high, higher timeframe fair-value-gap or inverted fair-value-gap, or a higher timeframe order block. This is to help understand market structure and direction.

5. Lastly, the above 4 factors needs to align with the I.C.T kill zones. I preferably prefer the London morning session 2am to 5am New York time.

Having these factors in complete alignment, my target is usually at the 50% mark of the Fibonacci or a key internal level (internal liquidity for example swing high/low, fair-value-gap etc) close to the 50% mark.

The chart picture above is an example of the breaker block entry model on EurAud during the London morning session.

However I simply don’t trade this pattern whenever it presents itself on the charts.

There are certain conditions that has to be met before I seek to enter.

1. Firstly, prior to the order block(turned break block) being failed I need to see a grab of liquidity(either buy side or sell side liquidity depending on our directional bias which is the draw on liquidity).

2. After the grab of liquidity I expect to see a clean failure of the order block. Price has to push through the order block with momentum.

3. I expect to find a fair-value-gap as a result of that clean break within that failed order block (turned breaker block).

4. With these 3 factors in place I would not consider to enter if this setup does not occur at key levels. Which could be at the liquidation of an old higher timeframe swing low or high, higher timeframe fair-value-gap or inverted fair-value-gap, or a higher timeframe order block. This is to help understand market structure and direction.

5. Lastly, the above 4 factors needs to align with the I.C.T kill zones. I preferably prefer the London morning session 2am to 5am New York time.

Having these factors in complete alignment, my target is usually at the 50% mark of the Fibonacci or a key internal level (internal liquidity for example swing high/low, fair-value-gap etc) close to the 50% mark.

The chart picture above is an example of the breaker block entry model on EurAud during the London morning session.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.