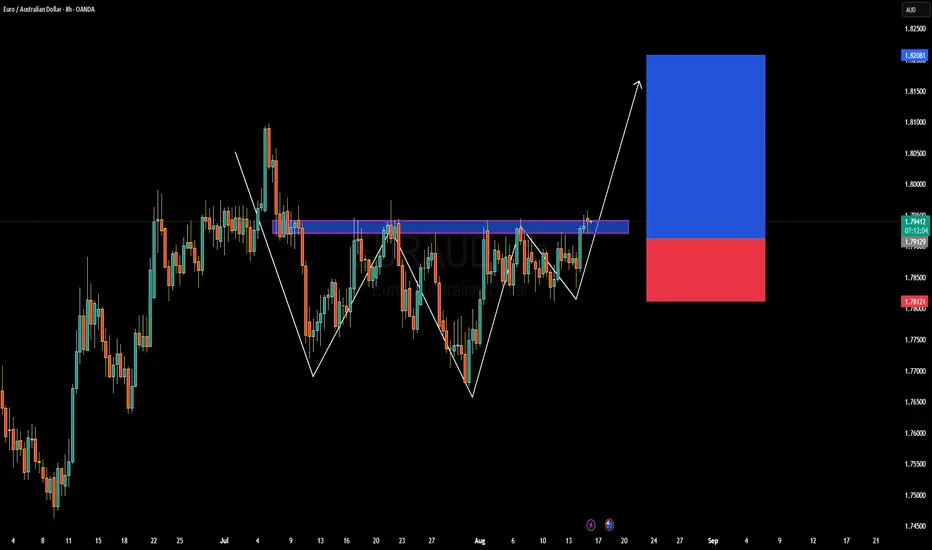

EUR/AUD is edging above a persistent resistance zone around 1.7950–1.7970 on the 8-hour chart. The pair has formed a classic two-leg corrective structure, and the recent higher low suggests bullish continuation. A clean break and hold above this resistance could pave the way for a retest of the 1.8200 zone, offering a favorable risk-to-reward setup for trend-following traders.

On the fundamentals front, the backdrop is mixed yet slightly favoring the euro. Both the ECB and RBA remain on easing paths, but the ECB has been more active with its cuts, while market-implied positioning already prices in an RBA cut in August. This divergence, paired with soft growth in Australia and cautious optimism around Eurozone stability, supports a sustained euro bid. Omega forecasts also show projected upside for EUR/AUD into September

However, caution is warranted. ActionForex highlights that intraday bias remains neutral; a sustained break above 1.7972 is needed to validate the bullish scenario, with a move toward the 1.8196 projection thereafter. Additionally, broader sentiment suggests EUR may be overstretched, and the AUD could rebound rapidly once RBA easing is priced in

Technically, this setup offers a clean structure—especially if the breakout is confirmed with volume and a solid candle close above 1.7970. A stop beneath the breakout zone around 1.7910 would provide tight risk control. Long-term targets could range from 1.8100 to 1.8200, depending on momentum sustainability.

On the fundamentals front, the backdrop is mixed yet slightly favoring the euro. Both the ECB and RBA remain on easing paths, but the ECB has been more active with its cuts, while market-implied positioning already prices in an RBA cut in August. This divergence, paired with soft growth in Australia and cautious optimism around Eurozone stability, supports a sustained euro bid. Omega forecasts also show projected upside for EUR/AUD into September

However, caution is warranted. ActionForex highlights that intraday bias remains neutral; a sustained break above 1.7972 is needed to validate the bullish scenario, with a move toward the 1.8196 projection thereafter. Additionally, broader sentiment suggests EUR may be overstretched, and the AUD could rebound rapidly once RBA easing is priced in

Technically, this setup offers a clean structure—especially if the breakout is confirmed with volume and a solid candle close above 1.7970. A stop beneath the breakout zone around 1.7910 would provide tight risk control. Long-term targets could range from 1.8100 to 1.8200, depending on momentum sustainability.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.