CHF: Bullish momentum unlikely to last

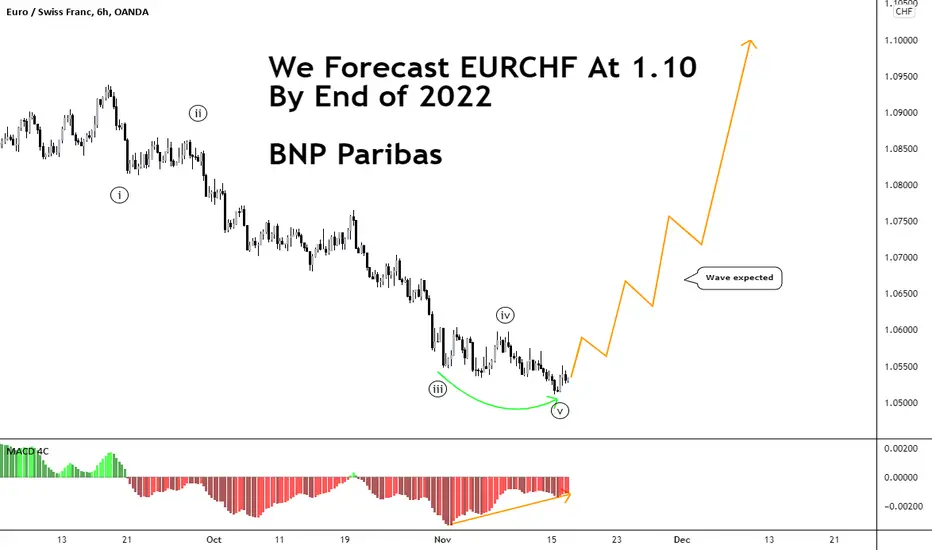

The CHF strengthened significantly in October with EURCHF sustaining a break below 1.06. The decline in the cross means EURCHF now appears very cheap relative to our short-term fair value model STEER™ and macro fair value model MarFA™. This is suggestive of an FX flow, rather than fundamentals driving a stronger CHF. We view risks around EURCHF as skewed to the upside. EURCHF is close to levels last seen in May 2020. At the time, the SNB intervened in FX markets to stabilise the cross. Total sight deposits in Switzerland rose CHF4bn over the past three weeks. The pace of the rise suggests the SNB may again be intervening in FX markets. The credible threat of further SNB intervention will keep EURCHF from breaking significantly lower, in our view. Additionally, the SNB is currently priced to tighten around 20bp more than the ECB over the coming two years. This seems overdone to us, given inflation in Switzerland is remains below target and the fact that there is limited historical precedent for this. We forecast EURCHF at 1.10 by the end of next year.

MACROECONOMIC FUNDAMENTALS AND MONETARY POLICY

October inflation in Switzerland accelerated to 1.2% y/y. Manufacturing PMI’s remained in expansionary territory in October at 65.4. FX intervention remains as the SNB’s primary policy tool. While the market has priced the SNB to tighten, its high tiering threshold for domestic banks and low inflation rate means the central bank is likely to tighten by less than other central banks, which makes the CHF an attractive funding currency.

FAIR VALUE

BNP Paribas CLEER™ suggests EURCHF is trading in line with its CLEER of 1.06. However, BNP Paribas FEER views the CHF as structurally rich and suggests EURCHF equilibrium fair value is at 1.41 and USDCHF at 1.01.

BALANCE OF PAYMENTS

Switzerland’s broad basic balance of payments (BBBoP) improved to -2.9% in Q2 2021 (4q sum, % of GDP through to end-Q2 2021) because of FDI outflows slowing and the current account surplus widening.

The CHF strengthened significantly in October with EURCHF sustaining a break below 1.06. The decline in the cross means EURCHF now appears very cheap relative to our short-term fair value model STEER™ and macro fair value model MarFA™. This is suggestive of an FX flow, rather than fundamentals driving a stronger CHF. We view risks around EURCHF as skewed to the upside. EURCHF is close to levels last seen in May 2020. At the time, the SNB intervened in FX markets to stabilise the cross. Total sight deposits in Switzerland rose CHF4bn over the past three weeks. The pace of the rise suggests the SNB may again be intervening in FX markets. The credible threat of further SNB intervention will keep EURCHF from breaking significantly lower, in our view. Additionally, the SNB is currently priced to tighten around 20bp more than the ECB over the coming two years. This seems overdone to us, given inflation in Switzerland is remains below target and the fact that there is limited historical precedent for this. We forecast EURCHF at 1.10 by the end of next year.

MACROECONOMIC FUNDAMENTALS AND MONETARY POLICY

October inflation in Switzerland accelerated to 1.2% y/y. Manufacturing PMI’s remained in expansionary territory in October at 65.4. FX intervention remains as the SNB’s primary policy tool. While the market has priced the SNB to tighten, its high tiering threshold for domestic banks and low inflation rate means the central bank is likely to tighten by less than other central banks, which makes the CHF an attractive funding currency.

FAIR VALUE

BNP Paribas CLEER™ suggests EURCHF is trading in line with its CLEER of 1.06. However, BNP Paribas FEER views the CHF as structurally rich and suggests EURCHF equilibrium fair value is at 1.41 and USDCHF at 1.01.

BALANCE OF PAYMENTS

Switzerland’s broad basic balance of payments (BBBoP) improved to -2.9% in Q2 2021 (4q sum, % of GDP through to end-Q2 2021) because of FDI outflows slowing and the current account surplus widening.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.