Trend Overview:

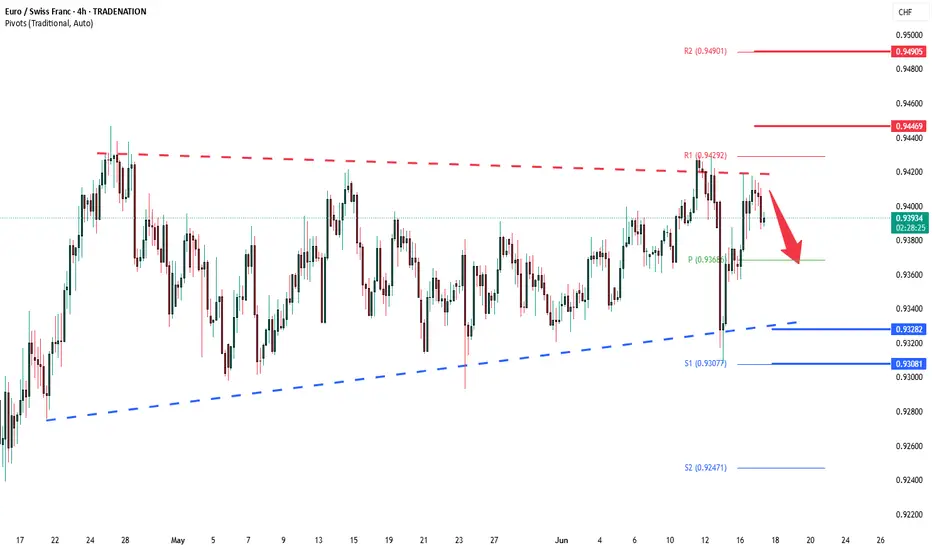

EUR/CHF continues to display a bearish trend, with current price action forming a corrective pullback against the broader downward momentum.

Key Resistance Level:

0.9430 – This is a significant previous intraday consolidation zone and currently acts as a pivotal resistance level.

Bearish Scenario (Primary Bias):

A short-term oversold rally into the 0.9430 level followed by a bearish rejection would reinforce the dominant downtrend.

Downside price targets include:

0.9370 – Initial support zone.

0.9330 – Mid-term support level.

0.9300 – Long-term structural support.

Bullish Scenario (Invalidation):

A confirmed breakout and daily close above 0.9430 would invalidate the current bearish bias.

This would open the path for a continuation toward:

0.9446 – Immediate resistance.

0.9490 – Key upper resistance and possible trend reversal confirmation level.

Conclusion:

EUR/CHF remains in a bearish structure, with the corrective pullback offering potential short entries if price is rejected at 0.9430. A failure to break this level would likely drive the pair lower toward 0.9300. However, a sustained move above 0.9430 would shift sentiment to bullish in the short term and open space for further upside toward 0.9490.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/CHF continues to display a bearish trend, with current price action forming a corrective pullback against the broader downward momentum.

Key Resistance Level:

0.9430 – This is a significant previous intraday consolidation zone and currently acts as a pivotal resistance level.

Bearish Scenario (Primary Bias):

A short-term oversold rally into the 0.9430 level followed by a bearish rejection would reinforce the dominant downtrend.

Downside price targets include:

0.9370 – Initial support zone.

0.9330 – Mid-term support level.

0.9300 – Long-term structural support.

Bullish Scenario (Invalidation):

A confirmed breakout and daily close above 0.9430 would invalidate the current bearish bias.

This would open the path for a continuation toward:

0.9446 – Immediate resistance.

0.9490 – Key upper resistance and possible trend reversal confirmation level.

Conclusion:

EUR/CHF remains in a bearish structure, with the corrective pullback offering potential short entries if price is rejected at 0.9430. A failure to break this level would likely drive the pair lower toward 0.9300. However, a sustained move above 0.9430 would shift sentiment to bullish in the short term and open space for further upside toward 0.9490.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.