Today, I want to examine the EURCHF(

EURCHF) Short position opportunity from both a Fundamental and Technical perspective.

EURCHF) Short position opportunity from both a Fundamental and Technical perspective.

First, let’s examine the EURCHF pair from a fundamental perspective:

The ECB’s dovish policy stance and weakening Eurozone data contrast sharply with the Swiss Franc’s safe-haven appeal and economic stability. With geopolitical tensions in the background, EURCHF may continue to slide lower, supporting short positions.

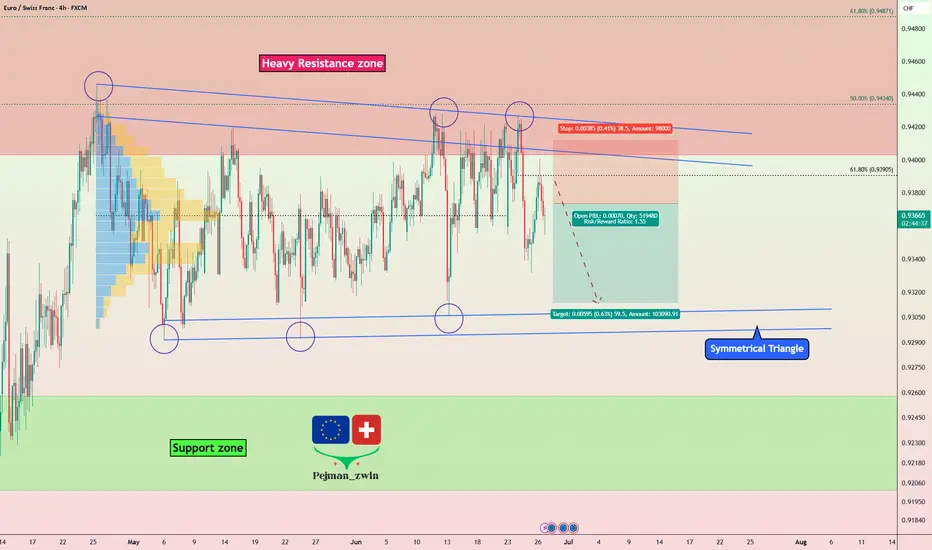

In terms of technical analysis, EURCHF is moving near a Heavy Resistance zone(0.967 CHF-0.940 CHF).

In terms of Classical Technical Analysis, EURCHF is moving inside a Symmetrical Triangle Pattern. The point to note about this example is that every time EURCHF approaches the upper lines of the symmetrical triangle, it starts to decline with a lot of momentum. And considering the previous movement of EURCHF, which was bearish, it is better to look for short positions from inside the symmetrical triangle.

Based on the above explanation, I expect EURCHF to move back towards the lower lines of the symmetrical triangle pattern.

Note: Stop Loss(SL): 0.94120 CHF

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Swiss Franc Analyze (EURCHF), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

First, let’s examine the EURCHF pair from a fundamental perspective:

The ECB’s dovish policy stance and weakening Eurozone data contrast sharply with the Swiss Franc’s safe-haven appeal and economic stability. With geopolitical tensions in the background, EURCHF may continue to slide lower, supporting short positions.

In terms of technical analysis, EURCHF is moving near a Heavy Resistance zone(0.967 CHF-0.940 CHF).

In terms of Classical Technical Analysis, EURCHF is moving inside a Symmetrical Triangle Pattern. The point to note about this example is that every time EURCHF approaches the upper lines of the symmetrical triangle, it starts to decline with a lot of momentum. And considering the previous movement of EURCHF, which was bearish, it is better to look for short positions from inside the symmetrical triangle.

Based on the above explanation, I expect EURCHF to move back towards the lower lines of the symmetrical triangle pattern.

Note: Stop Loss(SL): 0.94120 CHF

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Swiss Franc Analyze (EURCHF), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade active

Trade was activated🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🎁Welcome than a 50% bonus(Low Spread)👉vtm.pro/Y3AV7r

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.