Technical Analysis

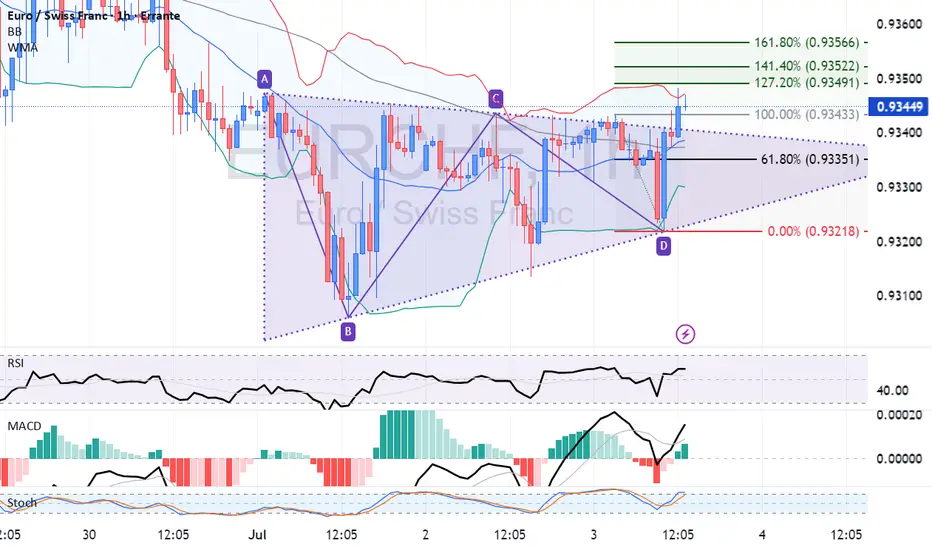

The EUR/CHF 1-hour chart highlights a clear breakout from a symmetrical triangle consolidation pattern, indicating bullish momentum. The price has decisively breached the upper trendline resistance near 0.9335 and surged above the last top resistance at approximately 0.9343, signaling a strong upward impulse.

Key levels and technical observations:

• Support Levels: The previous triangle resistance at 0.9335 now acts as support. Additional support is near 0.9320 (the recent swing low).

• Resistance Levels: Short-term resistance targets lie at the Fibonacci extension levels of 127.2% (0.9349), 141.4% (0.9352), and 161.8% (0.9356). A sustained move beyond these levels could open further upside potential.

Alternative Scenario:

If EUR/CHF fails to hold above the breakout zone and drops back below 0.9335, the pair could revisit the triangle apex and the 61.8% Fibonacci retracement near 0.9335. A breach below this would invalidate the bullish breakout and open the door for a retest of the recent low near 0.9320, risking a reversal to the downside.

The EUR/CHF 1-hour chart highlights a clear breakout from a symmetrical triangle consolidation pattern, indicating bullish momentum. The price has decisively breached the upper trendline resistance near 0.9335 and surged above the last top resistance at approximately 0.9343, signaling a strong upward impulse.

Key levels and technical observations:

• Support Levels: The previous triangle resistance at 0.9335 now acts as support. Additional support is near 0.9320 (the recent swing low).

• Resistance Levels: Short-term resistance targets lie at the Fibonacci extension levels of 127.2% (0.9349), 141.4% (0.9352), and 161.8% (0.9356). A sustained move beyond these levels could open further upside potential.

Alternative Scenario:

If EUR/CHF fails to hold above the breakout zone and drops back below 0.9335, the pair could revisit the triangle apex and the 61.8% Fibonacci retracement near 0.9335. A breach below this would invalidate the bullish breakout and open the door for a retest of the recent low near 0.9320, risking a reversal to the downside.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.