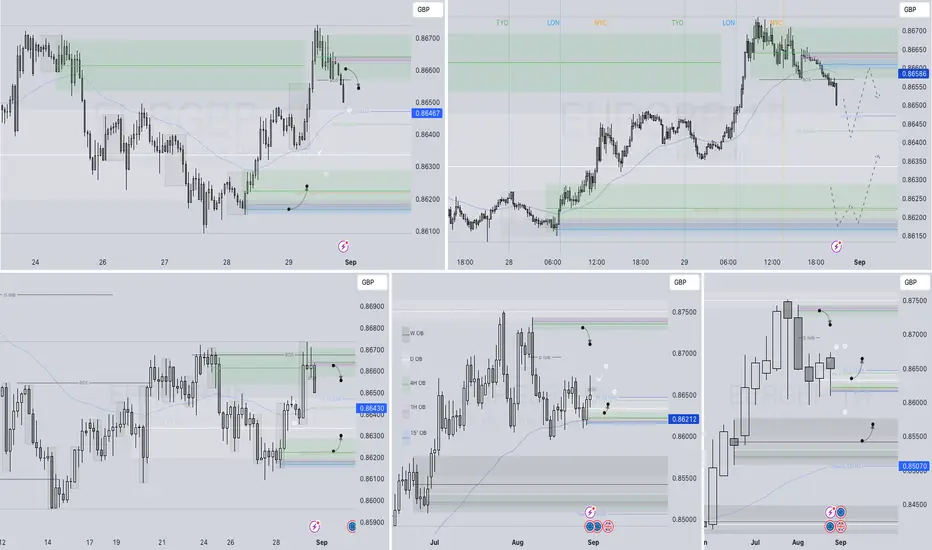

📈 EURGBP – Q3 W36 Y25 Weekly Forecast

🧠 Higher Time Frame Context (Weekly/Daily)

Price has closed above the Higher Time Frame (HTF) 50EMA, signaling strength and suggesting a bullish bias going into Monday of Week 36.

The strong weekly candle close in W35 indicates bullish pressure from the lows, reinforcing the idea of a higher-probability long setup.

I expect a rejection from the Daily 50EMA, aligning with HTF continuation expectations.

🔔 Bias: Long — in alignment with the HTF momentum and structure.

🔄 Recent Price Action & Short-Term Trade Plan

On Friday of W35, I closed my short position toward the end of my trading period.

Despite the HTF bullish bias, price is currently rejecting a 4H order block that created a higher low on the 4H timeframe.

This suggests that intra-day pullbacks (shorts) may still play out early in the week, particularly toward key long POIs (Points of Interest).

⚠️ Caution & Adjustments

I remain tentative about holding shorts, as the trading range is tight and higher time frame pressure is building to the upside.

My focus will shift to watching price react to long POIs, where I will:

Wait for a break of structure (BOS) on the lower timeframes (15M 5M 1M)

Enter on the pullback for a long, aiming for a higher high on the 4H chart by mid-week.

🧭 Execution Summary

Aspect Outlook / Plan

Higher Time Frame Bias ✅ Bullish – Strong weekly close above 50EMA

Current Price Action 🔄 Intra-day short-term rejection from 4H OB

Shorts ⚠️ Possible early-week pullbacks — small range, manage risk tightly

Long Plan 🟢 Await long POI tap + LTF BOS for long continuation

Target 🎯 Potential higher high on 4H by mid-W36

🧠 Final Thoughts

“Let price come to you. Let structure confirm it.”

Patience is key early in the week — I’ll be waiting for confirmation before positioning long, while allowing short-term shorts to play out cautiously.

FRGNT https://tradingview.sweetlogin.com/x/W27XXZo3/

🧠 Higher Time Frame Context (Weekly/Daily)

Price has closed above the Higher Time Frame (HTF) 50EMA, signaling strength and suggesting a bullish bias going into Monday of Week 36.

The strong weekly candle close in W35 indicates bullish pressure from the lows, reinforcing the idea of a higher-probability long setup.

I expect a rejection from the Daily 50EMA, aligning with HTF continuation expectations.

🔔 Bias: Long — in alignment with the HTF momentum and structure.

🔄 Recent Price Action & Short-Term Trade Plan

On Friday of W35, I closed my short position toward the end of my trading period.

Despite the HTF bullish bias, price is currently rejecting a 4H order block that created a higher low on the 4H timeframe.

This suggests that intra-day pullbacks (shorts) may still play out early in the week, particularly toward key long POIs (Points of Interest).

⚠️ Caution & Adjustments

I remain tentative about holding shorts, as the trading range is tight and higher time frame pressure is building to the upside.

My focus will shift to watching price react to long POIs, where I will:

Wait for a break of structure (BOS) on the lower timeframes (15M 5M 1M)

Enter on the pullback for a long, aiming for a higher high on the 4H chart by mid-week.

🧭 Execution Summary

Aspect Outlook / Plan

Higher Time Frame Bias ✅ Bullish – Strong weekly close above 50EMA

Current Price Action 🔄 Intra-day short-term rejection from 4H OB

Shorts ⚠️ Possible early-week pullbacks — small range, manage risk tightly

Long Plan 🟢 Await long POI tap + LTF BOS for long continuation

Target 🎯 Potential higher high on 4H by mid-W36

🧠 Final Thoughts

“Let price come to you. Let structure confirm it.”

Patience is key early in the week — I’ll be waiting for confirmation before positioning long, while allowing short-term shorts to play out cautiously.

FRGNT https://tradingview.sweetlogin.com/x/W27XXZo3/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.