EUR

FUNDAMENTAL BIAS: NEUTRAL

1. Monetary Policy

Accelerating policy normalization in deed, but just don’t call it that. The March ECB meeting saw the ECB surprise markets by speeding up their normalization pace with the APP set to increase to EUR 40bln in April and then lowered to EUR 30bln in May and EUR 20bln in June, with an aim of ending APP in Q3. This was quite a shift, and alongside 2024 HICP expected at 1.9% it meant a hike for 2022 is still on the table. However, even though the statement was hawkish, the ECB tried very hard to come across as dovish as possible, no doubt trying to get a soft landing. The bank broke the link between APP and rates by saying hikes could take place ‘some time’ after purchases end (previously said ‘shortly’ after they end). President Lagarde also stressed that the Ukraine/Russia war introduced a material risk to activity and inflation (and it’s too early to know what the full impact of this will be). As a result, she stresses more than once that their actions with the APP should not be seen as accelerating but rather as normalizing (pretty sure going from open-ended QE to done in the next quarter is accelerating but maybe owls play by the different rules). To further add dovishness Lagarde also said that the war in Ukraine means risks are now again titled to the downside, compared to ‘broadly balanced’. After the meeting STIR markets and bund yields jumped to price in close to 2 hikes by year-end again, but the dovish push back from Lagarde saw the EUR come under pressure, failing to benefit from higher implied rates.

2. Economic & Health Developments

Recent activity data suggests the hit from lockdowns weren’t as bad as feared, the Omicron restrictions weighed on growth. Differentials still favour the US and UK above the EZ. The big focus though is on the incoming inflation data after the ECB’s recent hawkish pivot at their Feb meeting. On the fiscal front, attention is on ongoing discussions to potentially allow purchases of ‘green bonds’ NOT to count against budget deficits. If approved, this can drastically change the fiscal landscape and would be a positive for the EUR and EU equities. Geopolitics Even though the EUR, through Western sanctions, have dodged potential weakness from the CBR selling the EUR to prop up the RUB, the single currency was not immune for long. It held up okay initially, but as proximity risk to the war and economic risk from supply constraints and sanctions grew, the risk premium ballooned, sending EUR risk reversals sharply lower and implied volatility higher. With very big moves lower already, chasing the lows aren’t very attractive, but picking bottoms is equally dangerous without clear catalysts.

3. CFTC Analysis

Friday’s CFTC data did not show what we expected. Despite the big falls in the EUR and a very big reduction in Asset Manager net-longs, leverage funds reduced net-shorts on the EUR. Unless they reduced shorts in anticipation of a bounced from stretched lows the update does not make much sense right now. Regardless of positioning though, the best way to trade the EUR from these levels is with a clear catalyst.

4. The Week Ahead

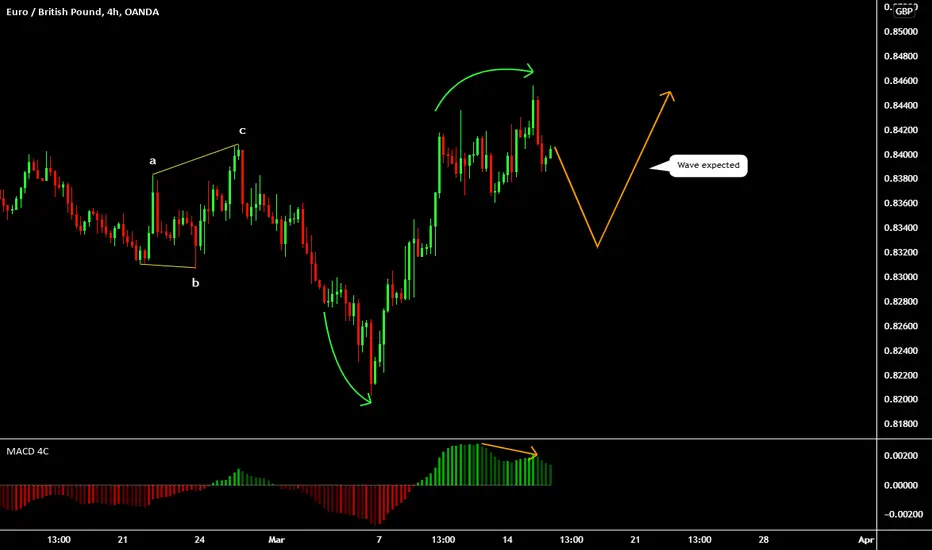

For the week ahead it’ll be very quiet on the data front, with all the focus for the EUR still on the geopolitical situation, where any escalation in tensions is expected to weigh on the EUR while de-escalations are expected to provide support. Apart from that, given the liquidity of the EURUSD and EURGBP currency pairs, as well as the EUR’s close to 60% weighting in the DXY , the upcoming FOMC and BoE policy decisions could end up being the biggest drivers for the EUR apart from geopolitics. The hurdle is quite high for the Fed to really surprise markets on the hawkish side (certainly possible for them to do so though), which means unless markets price in even more hikes for the Fed and unless the geopolitical situation deteriorates very drastically, the strong USD upside might run out of short-term steam which would be supportive for the EUR. When it comes to the BoE though, the recent amount of downside priced in for the GBP in such a short space of time and the recent dovish tones from the bank, means the bar is very low for a less dovish reaction from the GBP. Why is this important for the EUR? Given the liquidity of the EURGBP pair any major momentum in EURGBP can affect the EUR and GBP pairs in general so worth keeping on the radar.

GBP

FUNDAMENTAL BIAS: NEUTRAL

1. Monetary Policy

Hawkish surprise with a hint of dovish undertones sums up the Feb BoE decision. The bank announced the start of passive QT and hiked rates by 25bsp as expected, but the vote split was unanimous (9-0) but with a big hawkish surprise being 4 MPC members voting for a 50bsp hike. Inflation forecasts saw a big upward revision to a 7.25% peak by April ( prev . 6.0%) & 5.21% in 1-year ( prev . 3.40%). This initial hawkish statement saw immediate strength for GBP but during the press conference the BoE tried their best to get a dovish landing. Gov Bailey started his opening remarks by noting that the MPC’s decision to hike was not because the economy was strong but only because higher rates were necessary to return inflation to target, and even though he opened the door for further hikes he added that markets should not assume rates are on a long march higher. He also acknowledged the stagflation fears recently voiced by some market participants by saying that policy faces a trade-off between weakening growth and higher inflation . Despite the dovish nuances, STIR markets still price an implied cash rate of 1.0% by May which would mean a 25bsp in both March and May (1.0% is the level the BoE previously said they would being outright Gilt selling). Overall, the statement was hawkish, but

the clear dovish undertones from the BoE was a bit surprising and also a bit worrisome for the future outlook.

2. Economic & Health Developments

With inflation the main reason for the BoE’s recent rate hikes, there is a concern that the UK economy faces stagflation risk, as price pressures stay sticky while growth decelerates. That also means that current market expectations for rates looks way too aggressive and means downside risks for GBP should growth data push lower, inflation stay sticky, or the BoE continue to push their recent dovish tone.

3. Political Developments

Domestic political uncertainty usually leads to higher risk premiumsfor GBP, so the fate of PM Johnson remains a focus. Fallout from the heavily redacted Sue Gray report was limited but with growing distrust from within his party the question remains whether a vote of no-confidence will happen (if so, that could see short-term downside), and then focus will be on whether the PM can survive an actual vote of no-confidence, where a win should be GBP positive and negative for GBP if he loses. The Northern Ireland protocol is still in focus with the UK threatening to trigger Article 16 and the EU threatening to terminate the Brexit deal if they do. For now, markets have rightly ignored this as posturing, but any actual escalation can see sharp downside for GBP.

4. CFTC Analysis

Friday’s most recent CFTC data showed GBP positioning deteriorated across market participants with big netshort increases for large specs and asset managers, while leveraged funds were more reserved in their reduction of their Sterling net-long (biggest amongst the majors). Who needs to capitulate among these? Given how stretched the recent downside has been, leveraged funds might be better positioned going into the BoE.

5. The Week Ahead

For the week ahead the data focus will fall on the incoming labour report, with more focus on the wage component as opposed to the headline jobs print. The bank is concerned about second-round effects, so much so that Governor Bailey has in previous weeks said that workers should not demand exuberant increases. We also saw from the Bank’s Agents report suggesting there are signs of significant wage increases this year. Thus, goes without saying that wages will be important. Even though higher wages could see short-term GBP upside, what it means med-term is arguably more negative as it adds to further stagflation fears. For the BoE meeting, markets are fully pricing in a 25bsp hike which means all the focus will fall on the tone and language. The bank’s commitment to lower inflation will be in focus, especially as it relates to growth. Recall that at the Feb policy press conference and the MPC hearing, the bank was already concerned about what higher inflation and higher rates would mean for the growth outlook. That has now arguably been exacerbated by the Ukraine/Russia war. The one risk to the meeting is from the hawkish side, where the GBP’s drop is something, they would have noticed. As lower currency valuation feeds into higher inflation , they could sound less dovish, but at this stage that would seem like an unproductive way of easing inflationary pressures (but not something to completely reject as an option). Our baseline is for a continued dovish tone, but unless they come across even more dovish than before, the recent stretched downside in the GBP could offer some short-term relief higher.

FUNDAMENTAL BIAS: NEUTRAL

1. Monetary Policy

Accelerating policy normalization in deed, but just don’t call it that. The March ECB meeting saw the ECB surprise markets by speeding up their normalization pace with the APP set to increase to EUR 40bln in April and then lowered to EUR 30bln in May and EUR 20bln in June, with an aim of ending APP in Q3. This was quite a shift, and alongside 2024 HICP expected at 1.9% it meant a hike for 2022 is still on the table. However, even though the statement was hawkish, the ECB tried very hard to come across as dovish as possible, no doubt trying to get a soft landing. The bank broke the link between APP and rates by saying hikes could take place ‘some time’ after purchases end (previously said ‘shortly’ after they end). President Lagarde also stressed that the Ukraine/Russia war introduced a material risk to activity and inflation (and it’s too early to know what the full impact of this will be). As a result, she stresses more than once that their actions with the APP should not be seen as accelerating but rather as normalizing (pretty sure going from open-ended QE to done in the next quarter is accelerating but maybe owls play by the different rules). To further add dovishness Lagarde also said that the war in Ukraine means risks are now again titled to the downside, compared to ‘broadly balanced’. After the meeting STIR markets and bund yields jumped to price in close to 2 hikes by year-end again, but the dovish push back from Lagarde saw the EUR come under pressure, failing to benefit from higher implied rates.

2. Economic & Health Developments

Recent activity data suggests the hit from lockdowns weren’t as bad as feared, the Omicron restrictions weighed on growth. Differentials still favour the US and UK above the EZ. The big focus though is on the incoming inflation data after the ECB’s recent hawkish pivot at their Feb meeting. On the fiscal front, attention is on ongoing discussions to potentially allow purchases of ‘green bonds’ NOT to count against budget deficits. If approved, this can drastically change the fiscal landscape and would be a positive for the EUR and EU equities. Geopolitics Even though the EUR, through Western sanctions, have dodged potential weakness from the CBR selling the EUR to prop up the RUB, the single currency was not immune for long. It held up okay initially, but as proximity risk to the war and economic risk from supply constraints and sanctions grew, the risk premium ballooned, sending EUR risk reversals sharply lower and implied volatility higher. With very big moves lower already, chasing the lows aren’t very attractive, but picking bottoms is equally dangerous without clear catalysts.

3. CFTC Analysis

Friday’s CFTC data did not show what we expected. Despite the big falls in the EUR and a very big reduction in Asset Manager net-longs, leverage funds reduced net-shorts on the EUR. Unless they reduced shorts in anticipation of a bounced from stretched lows the update does not make much sense right now. Regardless of positioning though, the best way to trade the EUR from these levels is with a clear catalyst.

4. The Week Ahead

For the week ahead it’ll be very quiet on the data front, with all the focus for the EUR still on the geopolitical situation, where any escalation in tensions is expected to weigh on the EUR while de-escalations are expected to provide support. Apart from that, given the liquidity of the EURUSD and EURGBP currency pairs, as well as the EUR’s close to 60% weighting in the DXY , the upcoming FOMC and BoE policy decisions could end up being the biggest drivers for the EUR apart from geopolitics. The hurdle is quite high for the Fed to really surprise markets on the hawkish side (certainly possible for them to do so though), which means unless markets price in even more hikes for the Fed and unless the geopolitical situation deteriorates very drastically, the strong USD upside might run out of short-term steam which would be supportive for the EUR. When it comes to the BoE though, the recent amount of downside priced in for the GBP in such a short space of time and the recent dovish tones from the bank, means the bar is very low for a less dovish reaction from the GBP. Why is this important for the EUR? Given the liquidity of the EURGBP pair any major momentum in EURGBP can affect the EUR and GBP pairs in general so worth keeping on the radar.

GBP

FUNDAMENTAL BIAS: NEUTRAL

1. Monetary Policy

Hawkish surprise with a hint of dovish undertones sums up the Feb BoE decision. The bank announced the start of passive QT and hiked rates by 25bsp as expected, but the vote split was unanimous (9-0) but with a big hawkish surprise being 4 MPC members voting for a 50bsp hike. Inflation forecasts saw a big upward revision to a 7.25% peak by April ( prev . 6.0%) & 5.21% in 1-year ( prev . 3.40%). This initial hawkish statement saw immediate strength for GBP but during the press conference the BoE tried their best to get a dovish landing. Gov Bailey started his opening remarks by noting that the MPC’s decision to hike was not because the economy was strong but only because higher rates were necessary to return inflation to target, and even though he opened the door for further hikes he added that markets should not assume rates are on a long march higher. He also acknowledged the stagflation fears recently voiced by some market participants by saying that policy faces a trade-off between weakening growth and higher inflation . Despite the dovish nuances, STIR markets still price an implied cash rate of 1.0% by May which would mean a 25bsp in both March and May (1.0% is the level the BoE previously said they would being outright Gilt selling). Overall, the statement was hawkish, but

the clear dovish undertones from the BoE was a bit surprising and also a bit worrisome for the future outlook.

2. Economic & Health Developments

With inflation the main reason for the BoE’s recent rate hikes, there is a concern that the UK economy faces stagflation risk, as price pressures stay sticky while growth decelerates. That also means that current market expectations for rates looks way too aggressive and means downside risks for GBP should growth data push lower, inflation stay sticky, or the BoE continue to push their recent dovish tone.

3. Political Developments

Domestic political uncertainty usually leads to higher risk premiumsfor GBP, so the fate of PM Johnson remains a focus. Fallout from the heavily redacted Sue Gray report was limited but with growing distrust from within his party the question remains whether a vote of no-confidence will happen (if so, that could see short-term downside), and then focus will be on whether the PM can survive an actual vote of no-confidence, where a win should be GBP positive and negative for GBP if he loses. The Northern Ireland protocol is still in focus with the UK threatening to trigger Article 16 and the EU threatening to terminate the Brexit deal if they do. For now, markets have rightly ignored this as posturing, but any actual escalation can see sharp downside for GBP.

4. CFTC Analysis

Friday’s most recent CFTC data showed GBP positioning deteriorated across market participants with big netshort increases for large specs and asset managers, while leveraged funds were more reserved in their reduction of their Sterling net-long (biggest amongst the majors). Who needs to capitulate among these? Given how stretched the recent downside has been, leveraged funds might be better positioned going into the BoE.

5. The Week Ahead

For the week ahead the data focus will fall on the incoming labour report, with more focus on the wage component as opposed to the headline jobs print. The bank is concerned about second-round effects, so much so that Governor Bailey has in previous weeks said that workers should not demand exuberant increases. We also saw from the Bank’s Agents report suggesting there are signs of significant wage increases this year. Thus, goes without saying that wages will be important. Even though higher wages could see short-term GBP upside, what it means med-term is arguably more negative as it adds to further stagflation fears. For the BoE meeting, markets are fully pricing in a 25bsp hike which means all the focus will fall on the tone and language. The bank’s commitment to lower inflation will be in focus, especially as it relates to growth. Recall that at the Feb policy press conference and the MPC hearing, the bank was already concerned about what higher inflation and higher rates would mean for the growth outlook. That has now arguably been exacerbated by the Ukraine/Russia war. The one risk to the meeting is from the hawkish side, where the GBP’s drop is something, they would have noticed. As lower currency valuation feeds into higher inflation , they could sound less dovish, but at this stage that would seem like an unproductive way of easing inflationary pressures (but not something to completely reject as an option). Our baseline is for a continued dovish tone, but unless they come across even more dovish than before, the recent stretched downside in the GBP could offer some short-term relief higher.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.