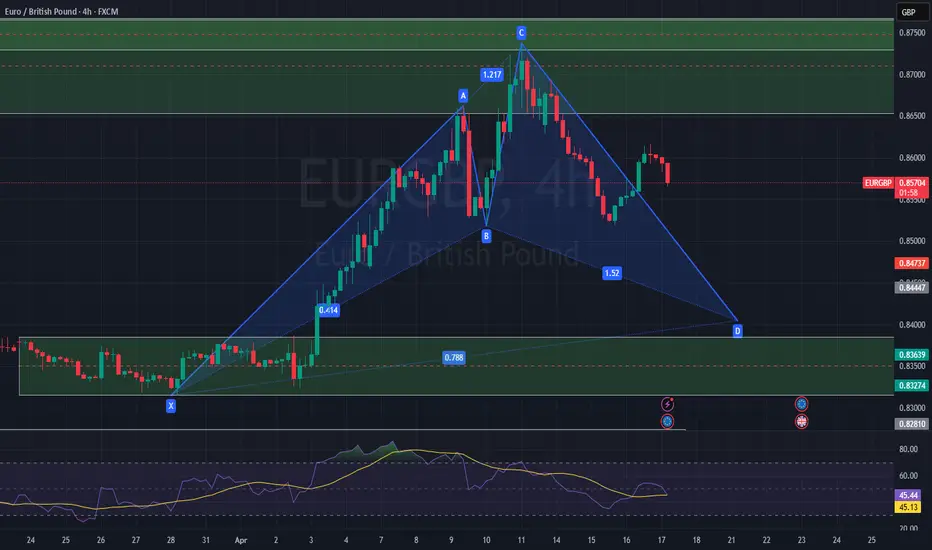

EURGBP – Bullish Cypher Harmonic Pattern 🟢🌀

✅ Pattern Overview:

Pattern Type: Bullish Cypher Harmonic

Status: Pattern completed or completing at D-point (PRZ)

Timeframe: Typically on 1H / 4H / Daily

Bias: Bullish Reversal expected from PRZ

🧩 Cypher Pattern Structure:

XA: Initial strong bullish leg

AB: Retraces to 38.2%–61.8% of XA

BC: Extends beyond X (typically 1.272–1.414)

CD: Retraces to 78.6% of XC

→ D-point = Potential Buy Zone

📍 Key PRZ Zone: Near 78.6% Fibonacci retracement of XC leg

📈 Trade Plan – LONG Setup

Entry:

Buy at or near the D-point (PRZ) – ideally with confirmation (e.g., bullish divergence, support zone, or price action signal like engulfing candle)

Wait for 1H/4H bullish candle close above local low

Stop-Loss:

Just below the X-point or local swing low

Allow some breathing room for harmonic volatility

Take Profit Levels:

TP1: 38.2% of CD

TP2: 61.8% of CD

TP3: Revisit of B-point zone (optional)

R:R Ratio: Minimum 1:2, ideally more

⚠️ Things to Monitor:

Euro and Pound fundamentals (news/data releases)

Price must respect PRZ zone and show momentum before entry

Confluence with trendline support, order block, or RSI divergence is ideal

✅ Pattern Overview:

Pattern Type: Bullish Cypher Harmonic

Status: Pattern completed or completing at D-point (PRZ)

Timeframe: Typically on 1H / 4H / Daily

Bias: Bullish Reversal expected from PRZ

🧩 Cypher Pattern Structure:

XA: Initial strong bullish leg

AB: Retraces to 38.2%–61.8% of XA

BC: Extends beyond X (typically 1.272–1.414)

CD: Retraces to 78.6% of XC

→ D-point = Potential Buy Zone

📍 Key PRZ Zone: Near 78.6% Fibonacci retracement of XC leg

📈 Trade Plan – LONG Setup

Entry:

Buy at or near the D-point (PRZ) – ideally with confirmation (e.g., bullish divergence, support zone, or price action signal like engulfing candle)

Wait for 1H/4H bullish candle close above local low

Stop-Loss:

Just below the X-point or local swing low

Allow some breathing room for harmonic volatility

Take Profit Levels:

TP1: 38.2% of CD

TP2: 61.8% of CD

TP3: Revisit of B-point zone (optional)

R:R Ratio: Minimum 1:2, ideally more

⚠️ Things to Monitor:

Euro and Pound fundamentals (news/data releases)

Price must respect PRZ zone and show momentum before entry

Confluence with trendline support, order block, or RSI divergence is ideal

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.