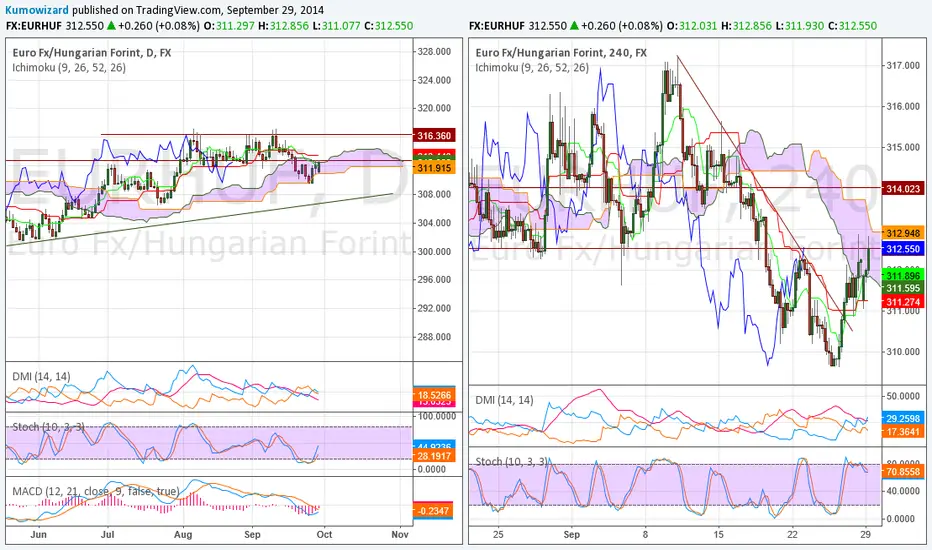

EURHUF looked to step out of it's prev range on the downside. It broke below 312,50, and had a chance to move as low as 307,50-308. However the Kumo bottom (Senkou B) proved to be a strong resistance during this corretion and stopped further strengthenning. Price is now back to first key level at 312,50, flirting to break back above it.

Daily: Price in the Kumo, neutral. Will become bullish again if moves and closes above 312,50.

Slow Stoch again proved to be the best indicator to give signal in time! Frankly speaking, since I use Ichimoku, I give less relevance to Slow Stoch in general (often misleading), but not in the case of EURHUF. On this exotic par Slow Stoch is still very reliable. MACD started to point up too.

All in all Looking at the daily chart it, the picture is neutral, with maybe some bullish bias.

4 Hrs: Ichimoku tells us it is neutral between 311,50-313, but DMI-ADX puts bullish pressure on the cross. We also had a weak bullish Tenkan/Kijun cross on Friday, so holding short is not a good idea any more.

Well, to be honest low rates really do matter. So as a strategy on EM ccys, I use HUF now rather as a funding ccy, which means I rather buy EURHUF on dips and then I try to sell EURTRY on spikes, making some synhtetic TRYHUF long position on legs. While EURHUF has no positive carry, EURTRY 6M implied is ard 8,60-8,80 % p.a.

Daily: Price in the Kumo, neutral. Will become bullish again if moves and closes above 312,50.

Slow Stoch again proved to be the best indicator to give signal in time! Frankly speaking, since I use Ichimoku, I give less relevance to Slow Stoch in general (often misleading), but not in the case of EURHUF. On this exotic par Slow Stoch is still very reliable. MACD started to point up too.

All in all Looking at the daily chart it, the picture is neutral, with maybe some bullish bias.

4 Hrs: Ichimoku tells us it is neutral between 311,50-313, but DMI-ADX puts bullish pressure on the cross. We also had a weak bullish Tenkan/Kijun cross on Friday, so holding short is not a good idea any more.

Well, to be honest low rates really do matter. So as a strategy on EM ccys, I use HUF now rather as a funding ccy, which means I rather buy EURHUF on dips and then I try to sell EURTRY on spikes, making some synhtetic TRYHUF long position on legs. While EURHUF has no positive carry, EURTRY 6M implied is ard 8,60-8,80 % p.a.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.