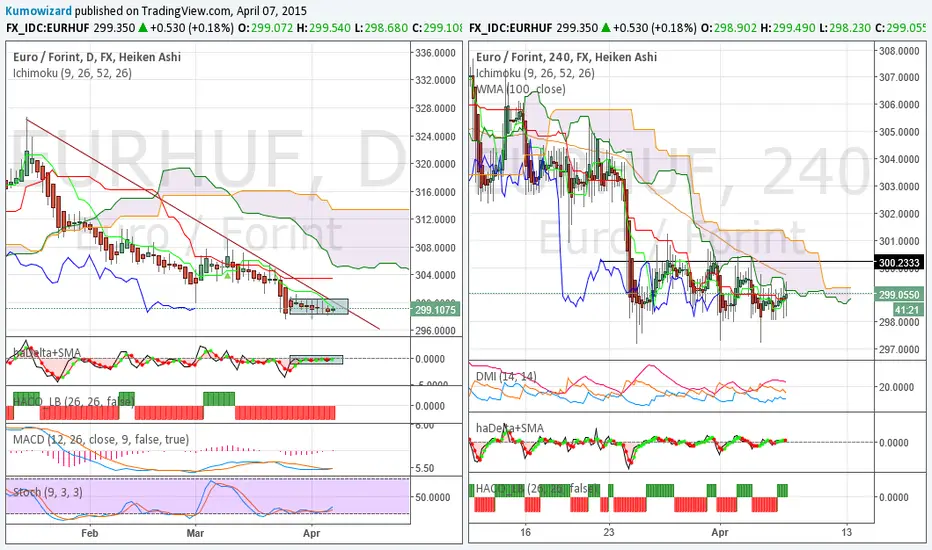

Daily:

- For the last 8-9 trading days EURHUF has been moving in an extremely tight range

- Heikin Ashi candles are almost all dojis, with both upper and lower wicks. haDelta/SMA3 is stuck ard zero line

- Ichimoku setup is bearish, but the flat Kijun Sen may attract Price back towards 304-305, in case it breaks above Tenkan Sen and the trendline (300,20 - 300,75).

- Please note that Slow Stoch and MACD are both turning up. This is often a reliable signal in EURHUF.

4H:

- Kumo is getting thinner ahead.

- Ichimoku setup is neutral and Heikin Ashi signals are mixed. No trend. Price is close to 100WMA.

- Price will move sharply soon. From recent setup we can not decide clearly which way. For a counter bullish move towards 304-305 it should break above 300,20, or the other way for bearish continuation it should finally close below 298.

Given the daily setup, especially the MACD-Slow Stoch dual signal I assume we'll rather see some bullish Price action ahead. I enterred small long today, looking to add more if 4H lvls break.

p.s.: NBH representatives made clear last week they are ready to cut base rate further "as long as necessary". For me this looks like NBH feels a bit uncomfortable with the relatively strong HUF. They have the tools to weaken it if they wish. Hungary still has quite some external debt, so do not consider HUF as CZK. Anyway, the market has to take that call as well. If the market still wants to push it lower, it will do so. But at least this time we can place a relatively tight stop for the long positions below 298.

- For the last 8-9 trading days EURHUF has been moving in an extremely tight range

- Heikin Ashi candles are almost all dojis, with both upper and lower wicks. haDelta/SMA3 is stuck ard zero line

- Ichimoku setup is bearish, but the flat Kijun Sen may attract Price back towards 304-305, in case it breaks above Tenkan Sen and the trendline (300,20 - 300,75).

- Please note that Slow Stoch and MACD are both turning up. This is often a reliable signal in EURHUF.

4H:

- Kumo is getting thinner ahead.

- Ichimoku setup is neutral and Heikin Ashi signals are mixed. No trend. Price is close to 100WMA.

- Price will move sharply soon. From recent setup we can not decide clearly which way. For a counter bullish move towards 304-305 it should break above 300,20, or the other way for bearish continuation it should finally close below 298.

Given the daily setup, especially the MACD-Slow Stoch dual signal I assume we'll rather see some bullish Price action ahead. I enterred small long today, looking to add more if 4H lvls break.

p.s.: NBH representatives made clear last week they are ready to cut base rate further "as long as necessary". For me this looks like NBH feels a bit uncomfortable with the relatively strong HUF. They have the tools to weaken it if they wish. Hungary still has quite some external debt, so do not consider HUF as CZK. Anyway, the market has to take that call as well. If the market still wants to push it lower, it will do so. But at least this time we can place a relatively tight stop for the long positions below 298.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.