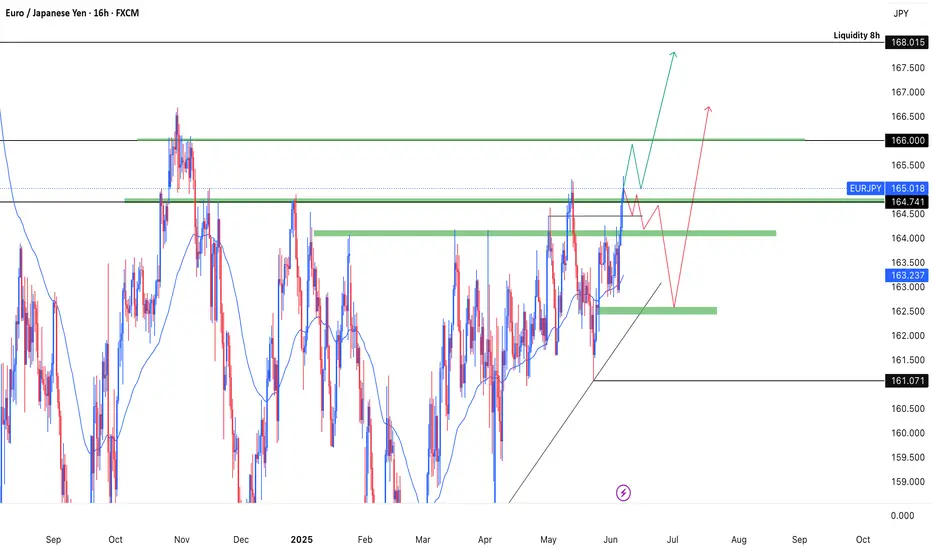

EUR/JPY Technical Analysis – Buy vs. Sell Scenarios

Current Market Context (June 8, 2025)

Price: 165.018 (Closing)

Daily Change: +0.12% (Mild bullish momentum)

Key Levels:

Resistance: 165.277 (Daily High), 166.000 (Psychological), 167.000 (Upper Range)

Support: 164.741 (Daily Low), 164.000 (Critical), 162.000 (Strong Demand Zone)

Scenario 1: BUY (Long Trade)

Trigger:

Price holds above 164.741 (Daily Low) and bounces with rising volume.

Break above 165.277 (Daily High) confirms bullish continuation.

Targets:

166.000 (Psychological Resistance)

167.000 (Upper Range)

Stop-Loss: Below 164.000 (Invalidation Level)

Rationale:

Bullish momentum from the daily close (+0.12%).

Higher lows suggest buyer interest near 164.000–164.741.

Scenario 2: SELL (Short Trade)

Trigger:

Price breaks below 164.741 (Daily Low) with increased selling volume.

Rejection from 165.277 (Daily High) signals weakness.

Targets:

164.000 (Support)

162.000 (Strong Demand Zone)

Stop-Loss: Above 165.300 (Above Daily High)

Current Market Context (June 8, 2025)

Price: 165.018 (Closing)

Daily Change: +0.12% (Mild bullish momentum)

Key Levels:

Resistance: 165.277 (Daily High), 166.000 (Psychological), 167.000 (Upper Range)

Support: 164.741 (Daily Low), 164.000 (Critical), 162.000 (Strong Demand Zone)

Scenario 1: BUY (Long Trade)

Trigger:

Price holds above 164.741 (Daily Low) and bounces with rising volume.

Break above 165.277 (Daily High) confirms bullish continuation.

Targets:

166.000 (Psychological Resistance)

167.000 (Upper Range)

Stop-Loss: Below 164.000 (Invalidation Level)

Rationale:

Bullish momentum from the daily close (+0.12%).

Higher lows suggest buyer interest near 164.000–164.741.

Scenario 2: SELL (Short Trade)

Trigger:

Price breaks below 164.741 (Daily Low) with increased selling volume.

Rejection from 165.277 (Daily High) signals weakness.

Targets:

164.000 (Support)

162.000 (Strong Demand Zone)

Stop-Loss: Above 165.300 (Above Daily High)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.