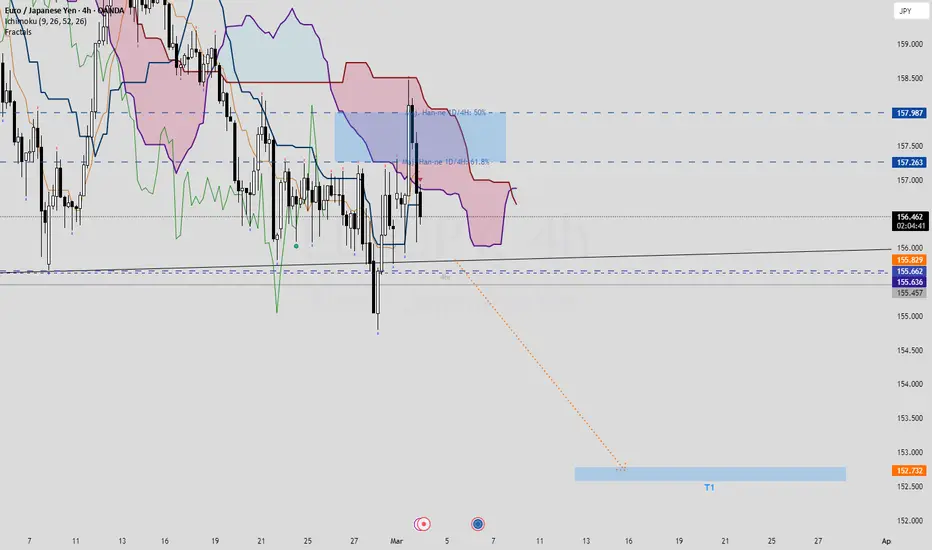

Ichimoku daily and 4hr showing bearish moves. Price tested Senkou Span B at 158.492 and was swiftly rejected. Personally think this may have been a liquidity grab / stop hunt before the 3 following widespread bearish candles.

There was a bear trap earlier on 28th Feb. in the Asian session which as you can see, wicked down to 154.807. After triggering the bears push price up and shook out any remaining weak hands.

Look for a potential bearish breakout over the next few sessions.

in term of potential targets, there is an N wave at 152.755. Ultimate target for the Sym.Tri 147.400.

There was a bear trap earlier on 28th Feb. in the Asian session which as you can see, wicked down to 154.807. After triggering the bears push price up and shook out any remaining weak hands.

Look for a potential bearish breakout over the next few sessions.

in term of potential targets, there is an N wave at 152.755. Ultimate target for the Sym.Tri 147.400.

Trade active

Momentum has now shifted bearish on the 4 hour but remains in a consolidation of distribution (check OBV). ECB rate decision coming up on 6th March but this is probably already priced in. Saying that, recent economic data showing increasing inflation so may surprise. if rates unchanged then that would probably mean strength in euro. If rates are reduced as seems to be market consensus then this will I believe, confirm short or potentially act as a trigger for the bearish breakout. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.