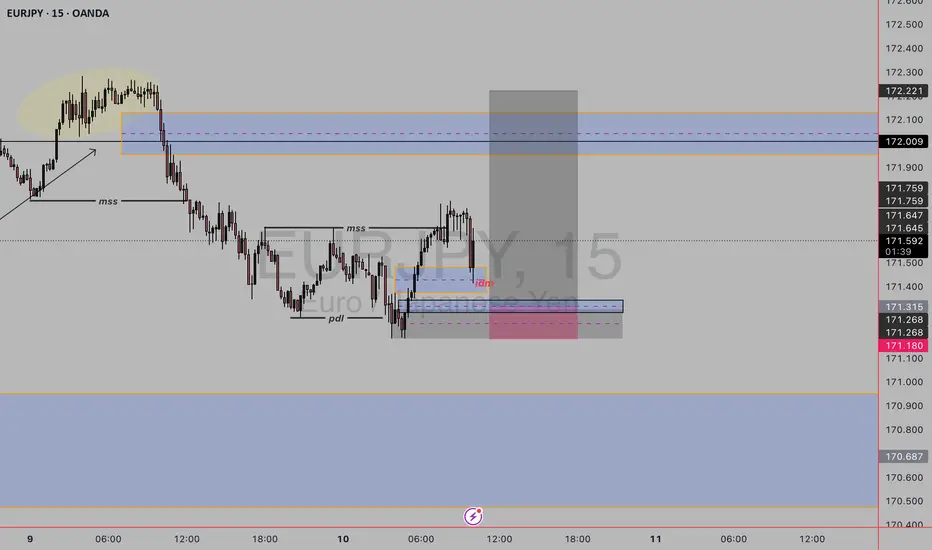

Setup Breakdown:

1. Previous Downtrend and Market Structure Shift (MSS):

Price was in a clear downtrend, as seen on the left side.

A Market Structure Shift (MSS) is marked — this suggests the beginning of a potential bullish reversal.

After MSS, price makes a higher high and pulls back, indicating bullish interest.

2. Liquidity Grab Below Previous Day’s Low (PDL):

Price swept below the Previous Day's Low (PDL) and into a demand zone (blue and purple shaded box).

This is a classic liquidity hunt — smart money clears out stop losses below the PDL before reversing.

3. Refined Demand Zone (Entry):

Entry is planned at the refined demand zone, where price previously showed buying interest.

The entry (pink box) is within this zone, suggesting you’re anticipating a reaction there.

4. FVG (Fair Value Gap) Fill and Targeting Supply:

The target zone is marked in the grey box at the top, just below 172.221, likely a previous supply area or unmitigated order block.

The grey shaded area is a high reward zone, showing you expect a strong bullish move from demand into that supply.

5. Risk-to-Reward:

Stop loss just below the demand zone, likely under the liquidity sweep.

Take profit is around 2–3x the stop distance, targeting the premium/supply area.

✅ Why This is a Strong Buy Setup:

MSS confirmed (shift from bearish to bullish structure).

PDL sweep = liquidity grab → fuels bullish move.

Entry in refined demand aligned with price action logic.

Clear imbalanced area above → price may seek to fill inefficiencies.

High Risk-Reward with low drawdown potential if demand holds

1. Previous Downtrend and Market Structure Shift (MSS):

Price was in a clear downtrend, as seen on the left side.

A Market Structure Shift (MSS) is marked — this suggests the beginning of a potential bullish reversal.

After MSS, price makes a higher high and pulls back, indicating bullish interest.

2. Liquidity Grab Below Previous Day’s Low (PDL):

Price swept below the Previous Day's Low (PDL) and into a demand zone (blue and purple shaded box).

This is a classic liquidity hunt — smart money clears out stop losses below the PDL before reversing.

3. Refined Demand Zone (Entry):

Entry is planned at the refined demand zone, where price previously showed buying interest.

The entry (pink box) is within this zone, suggesting you’re anticipating a reaction there.

4. FVG (Fair Value Gap) Fill and Targeting Supply:

The target zone is marked in the grey box at the top, just below 172.221, likely a previous supply area or unmitigated order block.

The grey shaded area is a high reward zone, showing you expect a strong bullish move from demand into that supply.

5. Risk-to-Reward:

Stop loss just below the demand zone, likely under the liquidity sweep.

Take profit is around 2–3x the stop distance, targeting the premium/supply area.

✅ Why This is a Strong Buy Setup:

MSS confirmed (shift from bearish to bullish structure).

PDL sweep = liquidity grab → fuels bullish move.

Entry in refined demand aligned with price action logic.

Clear imbalanced area above → price may seek to fill inefficiencies.

High Risk-Reward with low drawdown potential if demand holds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.