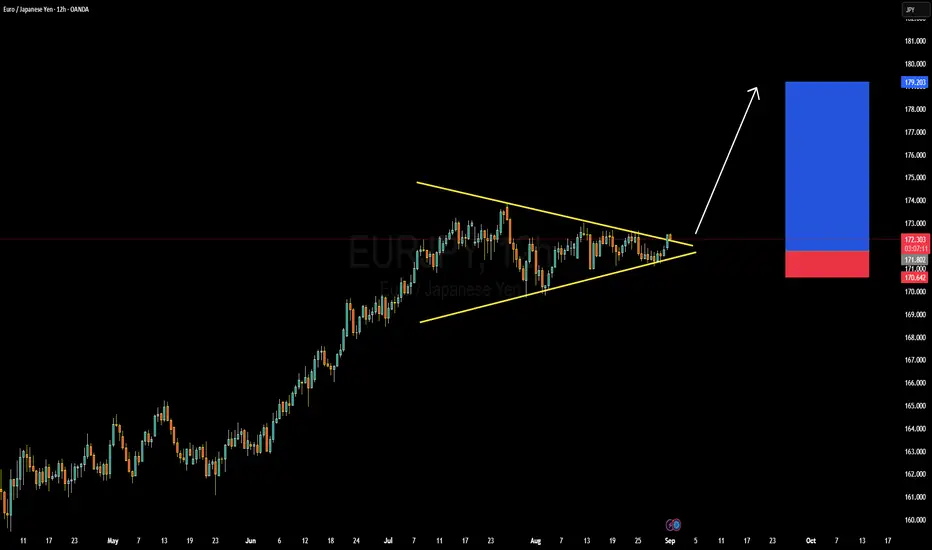

EURJPY is currently trading around 172.30, consolidating within a clear symmetrical triangle formation after a strong bullish rally from June. This pattern generally indicates accumulation before the next impulsive move, and given the dominant uptrend, the probability leans toward a bullish breakout. The immediate resistance lies near 173.00, and a decisive close above this zone can trigger continuation toward the 179.20 level, aligning with the projected target area shown on the chart. On the downside, 171.00 and 170.60 remain the key supports that protect the bullish structure.

From a fundamental perspective, the euro is finding support as investors focus on upcoming ECB policy signals, especially with inflation across the eurozone still above the bank’s comfort zone. Meanwhile, the yen remains under pressure as the Bank of Japan continues to maintain its ultra-loose monetary stance despite slight interventions to limit yen weakness. The widening interest rate differential keeps favoring EURJPY upside momentum, while safe-haven flows into JPY have been limited with global risk sentiment still steady.

The technical compression within this triangle combined with strong fundamentals creates a setup for potential volatility expansion in the coming sessions. A bullish breakout could attract momentum buyers and carry traders, targeting the 179–180 zone. However, if price slips back below 171.00, it would indicate short-term weakness and invite corrective moves before any continuation.

This pair remains one of the most attractive for trend-following strategies, with the carry trade advantage supporting euro strength against the yen. Traders should monitor the breakout direction closely, as the next leg will likely set the tone for September’s trading.

From a fundamental perspective, the euro is finding support as investors focus on upcoming ECB policy signals, especially with inflation across the eurozone still above the bank’s comfort zone. Meanwhile, the yen remains under pressure as the Bank of Japan continues to maintain its ultra-loose monetary stance despite slight interventions to limit yen weakness. The widening interest rate differential keeps favoring EURJPY upside momentum, while safe-haven flows into JPY have been limited with global risk sentiment still steady.

The technical compression within this triangle combined with strong fundamentals creates a setup for potential volatility expansion in the coming sessions. A bullish breakout could attract momentum buyers and carry traders, targeting the 179–180 zone. However, if price slips back below 171.00, it would indicate short-term weakness and invite corrective moves before any continuation.

This pair remains one of the most attractive for trend-following strategies, with the carry trade advantage supporting euro strength against the yen. Traders should monitor the breakout direction closely, as the next leg will likely set the tone for September’s trading.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.