📊 1. COT Report – Euro & Yen

EUR (Euro FX – CME):

Non-Commercials:

Long: +5,968 | Short: -4,293 → Net Long increasing

Commercials:

Long: +11,480 | Short: +24,451 → Net Short

→ Speculators are clearly bullish on the euro.

JPY (Japanese Yen – CME):

Non-Commercials:

Long: -5,319 | Short: +1,235 → Net Long decreasing

Commercials:

Long: +31,893 | Short: +25,462 → Hedging, but still net short

→ The yen continues to be sold, especially by institutional players.

📌 EUR/JPY COT Summary:

Speculators are buying EUR and selling JPY → strong bullish bias on EUR/JPY.

🧠 2. Retail Sentiment

80% of retail traders are short EUR/JPY, with an average entry at 161.50

Current price is around 167.20 → retail is heavily underwater

✅ Strong contrarian bullish signal

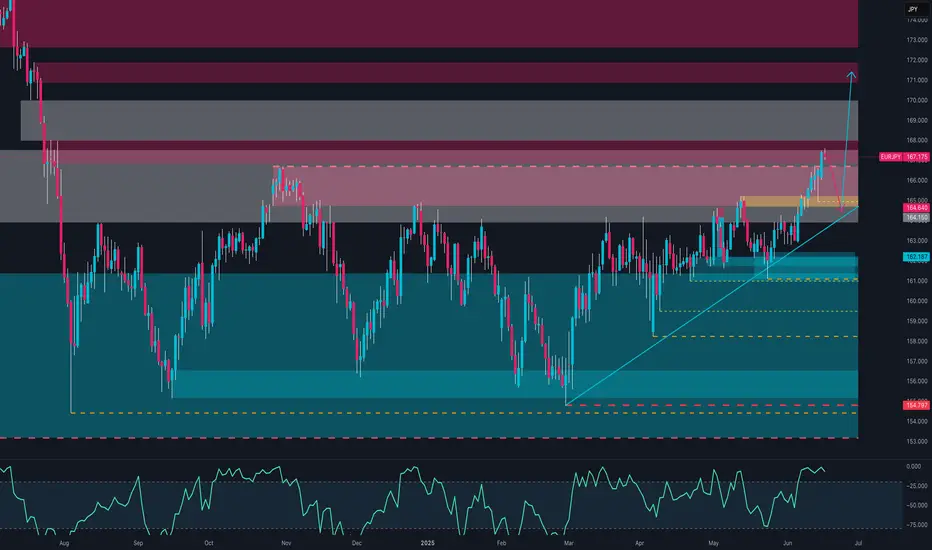

📉 3. Technical Analysis

Price broke out of a long-term range, printing new yearly highs

RSI is overbought but with no active bearish divergence

Price sits inside a major supply zone between 166.50 and 168.00, where previous rejections occurred

A potential pullback to the 164.60–164.15 area aligns with ascending trendline support

🟡 Likely Scenario:

A healthy technical pullback to 164.50–165.00 to cool off RSI,

followed by a continuation higher if supported by momentum and COT positioning

📅 4. Seasonality

June is historically a bullish month for EUR/JPY:

5-year avg: +1.167%

2-year avg: +2.41%

→ Seasonality supports more upside into early July

🌍 5. Macro Context

BoJ remains dovish, no sign of imminent tightening

ECB is steady but relatively less dovish → rate differential still favors the euro

No signs yet of verbal intervention from Japan.

EUR (Euro FX – CME):

Non-Commercials:

Long: +5,968 | Short: -4,293 → Net Long increasing

Commercials:

Long: +11,480 | Short: +24,451 → Net Short

→ Speculators are clearly bullish on the euro.

JPY (Japanese Yen – CME):

Non-Commercials:

Long: -5,319 | Short: +1,235 → Net Long decreasing

Commercials:

Long: +31,893 | Short: +25,462 → Hedging, but still net short

→ The yen continues to be sold, especially by institutional players.

📌 EUR/JPY COT Summary:

Speculators are buying EUR and selling JPY → strong bullish bias on EUR/JPY.

🧠 2. Retail Sentiment

80% of retail traders are short EUR/JPY, with an average entry at 161.50

Current price is around 167.20 → retail is heavily underwater

✅ Strong contrarian bullish signal

📉 3. Technical Analysis

Price broke out of a long-term range, printing new yearly highs

RSI is overbought but with no active bearish divergence

Price sits inside a major supply zone between 166.50 and 168.00, where previous rejections occurred

A potential pullback to the 164.60–164.15 area aligns with ascending trendline support

🟡 Likely Scenario:

A healthy technical pullback to 164.50–165.00 to cool off RSI,

followed by a continuation higher if supported by momentum and COT positioning

📅 4. Seasonality

June is historically a bullish month for EUR/JPY:

5-year avg: +1.167%

2-year avg: +2.41%

→ Seasonality supports more upside into early July

🌍 5. Macro Context

BoJ remains dovish, no sign of imminent tightening

ECB is steady but relatively less dovish → rate differential still favors the euro

No signs yet of verbal intervention from Japan.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.