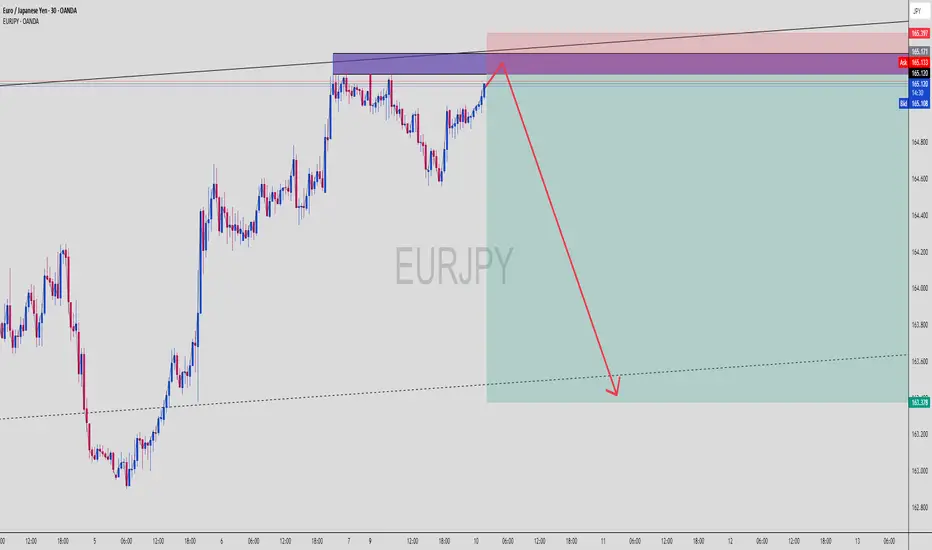

EURJPY (30-Min) | Supply Zone Hit + Bearish Reversal Setup

This EURJPY move is brewing into a classic SMC bearish play — engineered liquidity run, supply zone reaction, and a projected melt to imbalance below. Let’s dissect the ninja logic 🧠📉

🔍 Breakdown of the Setup:

🟥 Supply / Order Block Zone

Price enters a strong bearish OB zone between 165.100–165.397

Previous rejection wicks in this zone = smart money sell interest

Price now testing that area again — potential for liquidity sweep + reversal

🟪 Multi-Zone Confluence

Multiple overlapping zones stacked: OB, mitigation block, and liquidity sweep area

Perfect spot for Smart Money to unload positions before sending price lower

📏 Risk-Reward Optimization

Entry near 165.100–165.397 zone

Stop Loss placed slightly above the last rejection wick (above 165.397)

Take Profit projected around 163.378 based on measured impulse leg and imbalance fill

🧠 Liquidity Narrative

The rally into supply is likely a buy-side liquidity hunt

Smart Money often drives price into key zones before triggering reversals

Price may wick above 165.171 to fake bulls before a strong sell-off

🧠 Chart Ninja Entry Plan:

🔻 Entry Zone 165.100 – 165.397 (Supply OB)

🛡 SL Above 165.450 (above wick / last structure high)

🎯 TP Target 163.378 (imbalanced fill target)

⚖️ RRR Approx. 1:4+ depending on entry precision

🥷 Chart Ninja Note:

“The trap is always set where the crowd feels the safest —

and that’s exactly where the ninja strikes.” 🥷📉

This setup could be a clean ride down if price reacts as expected. Confirmation entry = bearish engulfing on M15 or M30.

🔁 Bonus Observation:

You can see lower timeframes building internal liquidity, meaning we might get a sharp, volatile drop once that top wick finishes sweeping.

📍Mark this zone and set an alert — entry can trigger fast!

🔥 What’s your confirmation style — engulfing candle or breaker structure?

This EURJPY move is brewing into a classic SMC bearish play — engineered liquidity run, supply zone reaction, and a projected melt to imbalance below. Let’s dissect the ninja logic 🧠📉

🔍 Breakdown of the Setup:

🟥 Supply / Order Block Zone

Price enters a strong bearish OB zone between 165.100–165.397

Previous rejection wicks in this zone = smart money sell interest

Price now testing that area again — potential for liquidity sweep + reversal

🟪 Multi-Zone Confluence

Multiple overlapping zones stacked: OB, mitigation block, and liquidity sweep area

Perfect spot for Smart Money to unload positions before sending price lower

📏 Risk-Reward Optimization

Entry near 165.100–165.397 zone

Stop Loss placed slightly above the last rejection wick (above 165.397)

Take Profit projected around 163.378 based on measured impulse leg and imbalance fill

🧠 Liquidity Narrative

The rally into supply is likely a buy-side liquidity hunt

Smart Money often drives price into key zones before triggering reversals

Price may wick above 165.171 to fake bulls before a strong sell-off

🧠 Chart Ninja Entry Plan:

🔻 Entry Zone 165.100 – 165.397 (Supply OB)

🛡 SL Above 165.450 (above wick / last structure high)

🎯 TP Target 163.378 (imbalanced fill target)

⚖️ RRR Approx. 1:4+ depending on entry precision

🥷 Chart Ninja Note:

“The trap is always set where the crowd feels the safest —

and that’s exactly where the ninja strikes.” 🥷📉

This setup could be a clean ride down if price reacts as expected. Confirmation entry = bearish engulfing on M15 or M30.

🔁 Bonus Observation:

You can see lower timeframes building internal liquidity, meaning we might get a sharp, volatile drop once that top wick finishes sweeping.

📍Mark this zone and set an alert — entry can trigger fast!

🔥 What’s your confirmation style — engulfing candle or breaker structure?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.