📊 Pair: EURNZD

🕒 Timeframe: Likely H1 or H4

📅 Date: May 18, 2025

🔍 Technical Analysis

🔁 Key Zones

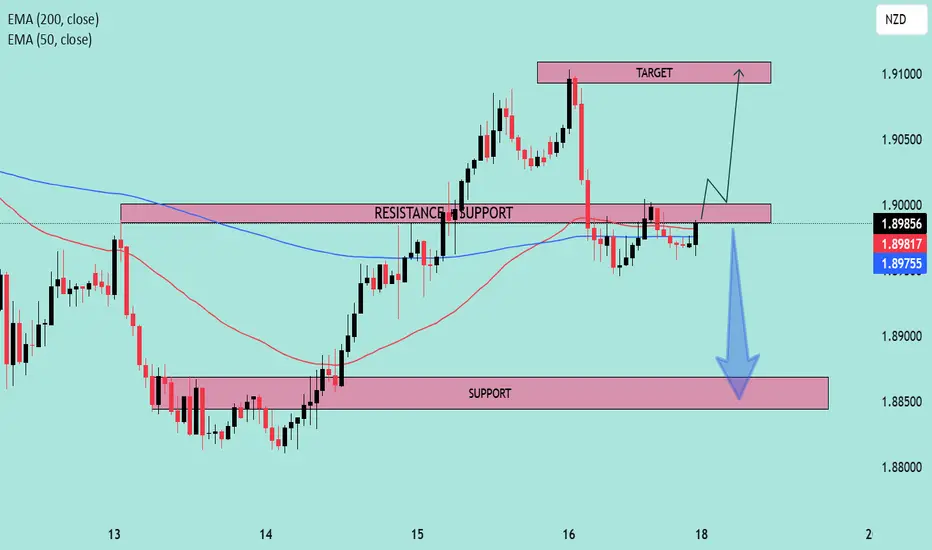

🔴 Resistance-Turned-Support (RTS):

1.8975 – 1.8990

This area was previously a resistance level that price broke above, and is now acting as a critical support zone (flip zone). Price is currently retesting this area.

🎯 Target Zone (Resistance):

1.9085 – 1.9110

This is the next projected bullish target if price successfully rebounds from current support.

🛑 Major Support Zone:

1.8840 – 1.8860

Strong buying interest was seen here previously, acting as a safety net in case of bearish rejection from the current level.

🔄 EMA Confluence

📘 EMA 200 (Blue): 1.8975

📕 EMA 50 (Red): 1.8981

Price is hovering around the EMAs, indicating a moment of decision. A decisive move above these EMAs could trigger bullish momentum. 📈

🔮 Scenario Outlook

🟢 Bullish Scenario (Preferred Setup)

✅ Confirmation above 1.8990

➡️ Retest and continuation could push price toward the 1.9100 target zone.

🔼 Momentum supported by prior breakout and higher lows.

📌 Entry Idea: Above 1.8995

🎯 Target: 1.9100

🛡️ Stop: Below 1.8950

🔴 Bearish Scenario

❌ If price fails to hold the 1.8970–1.8990 zone, a breakdown could follow.

⬇️ Likely move toward 1.8850 support zone.

🚨 Watch for bearish engulfing or rejection candles near resistance.

🧠 Summary

Price is at a key decision point.

✅ Bullish bias is slightly stronger due to market structure (higher highs & higher lows).

⚠️ But a clean break below support would shift focus to the downside.

📈 Strategy: Wait for confirmation ⚖️

Bullish: Break + retest of 1.8990

Bearish: Breakdown below 1.8950 and close under EMAs

🕒 Timeframe: Likely H1 or H4

📅 Date: May 18, 2025

🔍 Technical Analysis

🔁 Key Zones

🔴 Resistance-Turned-Support (RTS):

1.8975 – 1.8990

This area was previously a resistance level that price broke above, and is now acting as a critical support zone (flip zone). Price is currently retesting this area.

🎯 Target Zone (Resistance):

1.9085 – 1.9110

This is the next projected bullish target if price successfully rebounds from current support.

🛑 Major Support Zone:

1.8840 – 1.8860

Strong buying interest was seen here previously, acting as a safety net in case of bearish rejection from the current level.

🔄 EMA Confluence

📘 EMA 200 (Blue): 1.8975

📕 EMA 50 (Red): 1.8981

Price is hovering around the EMAs, indicating a moment of decision. A decisive move above these EMAs could trigger bullish momentum. 📈

🔮 Scenario Outlook

🟢 Bullish Scenario (Preferred Setup)

✅ Confirmation above 1.8990

➡️ Retest and continuation could push price toward the 1.9100 target zone.

🔼 Momentum supported by prior breakout and higher lows.

📌 Entry Idea: Above 1.8995

🎯 Target: 1.9100

🛡️ Stop: Below 1.8950

🔴 Bearish Scenario

❌ If price fails to hold the 1.8970–1.8990 zone, a breakdown could follow.

⬇️ Likely move toward 1.8850 support zone.

🚨 Watch for bearish engulfing or rejection candles near resistance.

🧠 Summary

Price is at a key decision point.

✅ Bullish bias is slightly stronger due to market structure (higher highs & higher lows).

⚠️ But a clean break below support would shift focus to the downside.

📈 Strategy: Wait for confirmation ⚖️

Bullish: Break + retest of 1.8990

Bearish: Breakdown below 1.8950 and close under EMAs

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalyse

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalyse

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalyse

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalyse

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.