EU10Y= 2.602%

EUR INTEREST RATE after governing council decision 25basis point on deposit facility 2% main refinancing operation 2.15% and marginal lending facility 2.40%

NZ10Y=4.56%

NZD INTEREST RATE =3.25%The current Official Cash Rate (OCR) in New Zealand is 3.25%. The Reserve Bank of New Zealand (RBNZ) last updated this rate on May 28, 2025, with the next update scheduled for July 9, 2025..

The OCR is the main tool used by the RBNZ to manage inflation and maintain price stability. A higher OCR generally leads to higher interest rates across the economy, which can help to cool down inflation. Conversely, a lower OCR can stimulate economic activity by lowering interest rates.

What is the OCR? official cash rate is used to achieve and maintain price stability.

New Zealand's central bank is called Reserve Bank of New Zealand (RBNZ)

BOND YIELD DIFFERENTIAL =1.96%

INTEREST RATE DIFFERENTIAL=1.25%

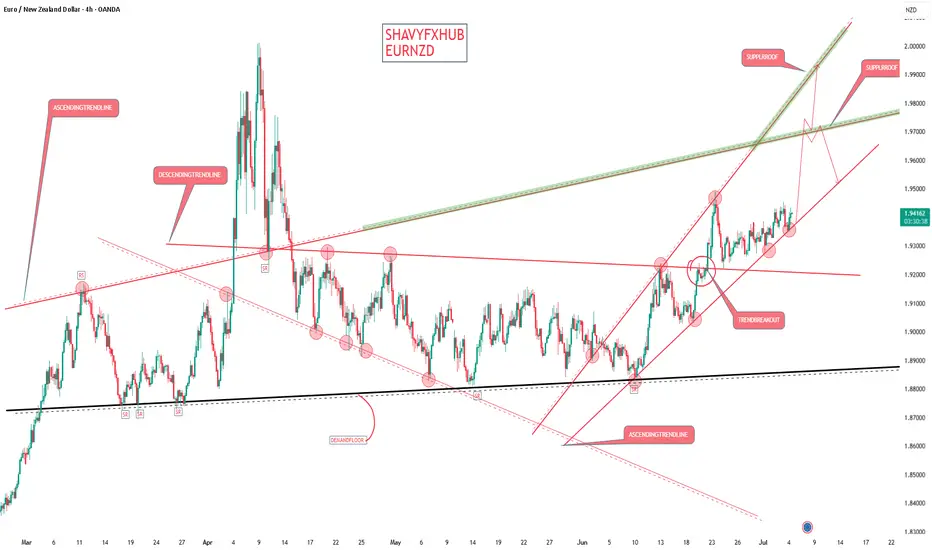

CARRY TRADE ADVANTAGE= FAVOUR EURNZD sell , but the internal demand structure break of supply roof shows that buying will continue despite yield and interest rate differential in favor of NZD

The technicality of sell will be on the confluence on ascending trendline supply roof .

UPCOMING FUNDAMENTAL DATA REPORT.

New Zealand

Reserve Bank of New Zealand (RBNZ) Monetary Policy Review

Date: July 9, 2025

Consensus: RBNZ is widely expected to hold the Official Cash Rate at 3.25%. Most major banks and economists forecast no change, though a minority expect a 25 basis point cut. Markets anticipate only one more cut this year, likely in Q3.

Q2 2025 Inflation Data

Date: July 21, 2025

Significance: This release will be closely watched for signs of persistent or easing price pressures, which could influence future RBNZ policy decisions.

Labor Market Data

Next Release: Early August 2025 (Q2 data)

Recent Trend: Unemployment rate stable at 5.1% in Q1, with employment growth of 0.1%.

Eurozone

ECB Policy Announcements

Next Meeting: July 18, 2025

Focus: Markets are watching for signals on the pace of further rate cuts, with the ECB expected to continue a gradual easing cycle as inflation moderates.

Eurozone Inflation (CPI)

Next Flash Estimate: July 17, 2025

Recent Data: June inflation at 2.0% year-on-year, in line with expectations.

Eurozone GDP and Employment

Next Release: July 30, 2025 (Q2 preliminary)

Recent Data: Q1 GDP growth at 0.6% quarter-on-quarter; employment up 0.2%.

Other Events to Watch

Commodity Prices: Dairy auction results and global commodity trends can impact NZD.

Chinese Economic Data: As a major trading partner, Chinese data releases (trade, GDP) can influence NZD and thus EURNZD.

Summary Table: Major Upcoming Data

Date Event/Release Region Expected Impact on EURNZD

July 9, 2025 RBNZ Policy Decision New Zealand High (rate hold/cut)

July 17, 2025 Eurozone Flash CPI Eurozone Moderate (inflation, ECB outlook)

July 18, 2025 ECB Policy Meeting Eurozone High (rate guidance)

July 21, 2025 NZ Q2 Inflation New Zealand High (future RBNZ moves)

July 30, 2025 Eurozone Q2 GDP/Employment Eurozone Moderate

Early Aug NZ Q2 Labor Market New Zealand Moderate

Market Outlook

EURNZD is sensitive to central bank policy divergence, inflation trends, and labor market data from both regions.

RBNZ’s July 9 decision and Q2 inflation will be pivotal for NZD direction, while ECB’s July meeting and Eurozone inflation will shape EUR moves.

Traders should also monitor commodity prices and Chinese economic releases for additional NZD volatility triggers.

In summary:

The next two weeks feature several high-impact events for EURNZD, led by the RBNZ policy review (July 9), Eurozone inflation and ECB meeting (July 17–18), and New Zealand’s Q2 inflation (July 21). These releases will set the tone for the cross, with policy signals and inflation data likely to drive volatility.

#eurnzd

EUR INTEREST RATE after governing council decision 25basis point on deposit facility 2% main refinancing operation 2.15% and marginal lending facility 2.40%

NZ10Y=4.56%

NZD INTEREST RATE =3.25%The current Official Cash Rate (OCR) in New Zealand is 3.25%. The Reserve Bank of New Zealand (RBNZ) last updated this rate on May 28, 2025, with the next update scheduled for July 9, 2025..

The OCR is the main tool used by the RBNZ to manage inflation and maintain price stability. A higher OCR generally leads to higher interest rates across the economy, which can help to cool down inflation. Conversely, a lower OCR can stimulate economic activity by lowering interest rates.

What is the OCR? official cash rate is used to achieve and maintain price stability.

New Zealand's central bank is called Reserve Bank of New Zealand (RBNZ)

BOND YIELD DIFFERENTIAL =1.96%

INTEREST RATE DIFFERENTIAL=1.25%

CARRY TRADE ADVANTAGE= FAVOUR EURNZD sell , but the internal demand structure break of supply roof shows that buying will continue despite yield and interest rate differential in favor of NZD

The technicality of sell will be on the confluence on ascending trendline supply roof .

UPCOMING FUNDAMENTAL DATA REPORT.

New Zealand

Reserve Bank of New Zealand (RBNZ) Monetary Policy Review

Date: July 9, 2025

Consensus: RBNZ is widely expected to hold the Official Cash Rate at 3.25%. Most major banks and economists forecast no change, though a minority expect a 25 basis point cut. Markets anticipate only one more cut this year, likely in Q3.

Q2 2025 Inflation Data

Date: July 21, 2025

Significance: This release will be closely watched for signs of persistent or easing price pressures, which could influence future RBNZ policy decisions.

Labor Market Data

Next Release: Early August 2025 (Q2 data)

Recent Trend: Unemployment rate stable at 5.1% in Q1, with employment growth of 0.1%.

Eurozone

ECB Policy Announcements

Next Meeting: July 18, 2025

Focus: Markets are watching for signals on the pace of further rate cuts, with the ECB expected to continue a gradual easing cycle as inflation moderates.

Eurozone Inflation (CPI)

Next Flash Estimate: July 17, 2025

Recent Data: June inflation at 2.0% year-on-year, in line with expectations.

Eurozone GDP and Employment

Next Release: July 30, 2025 (Q2 preliminary)

Recent Data: Q1 GDP growth at 0.6% quarter-on-quarter; employment up 0.2%.

Other Events to Watch

Commodity Prices: Dairy auction results and global commodity trends can impact NZD.

Chinese Economic Data: As a major trading partner, Chinese data releases (trade, GDP) can influence NZD and thus EURNZD.

Summary Table: Major Upcoming Data

Date Event/Release Region Expected Impact on EURNZD

July 9, 2025 RBNZ Policy Decision New Zealand High (rate hold/cut)

July 17, 2025 Eurozone Flash CPI Eurozone Moderate (inflation, ECB outlook)

July 18, 2025 ECB Policy Meeting Eurozone High (rate guidance)

July 21, 2025 NZ Q2 Inflation New Zealand High (future RBNZ moves)

July 30, 2025 Eurozone Q2 GDP/Employment Eurozone Moderate

Early Aug NZ Q2 Labor Market New Zealand Moderate

Market Outlook

EURNZD is sensitive to central bank policy divergence, inflation trends, and labor market data from both regions.

RBNZ’s July 9 decision and Q2 inflation will be pivotal for NZD direction, while ECB’s July meeting and Eurozone inflation will shape EUR moves.

Traders should also monitor commodity prices and Chinese economic releases for additional NZD volatility triggers.

In summary:

The next two weeks feature several high-impact events for EURNZD, led by the RBNZ policy review (July 9), Eurozone inflation and ECB meeting (July 17–18), and New Zealand’s Q2 inflation (July 21). These releases will set the tone for the cross, with policy signals and inflation data likely to drive volatility.

#eurnzd

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.