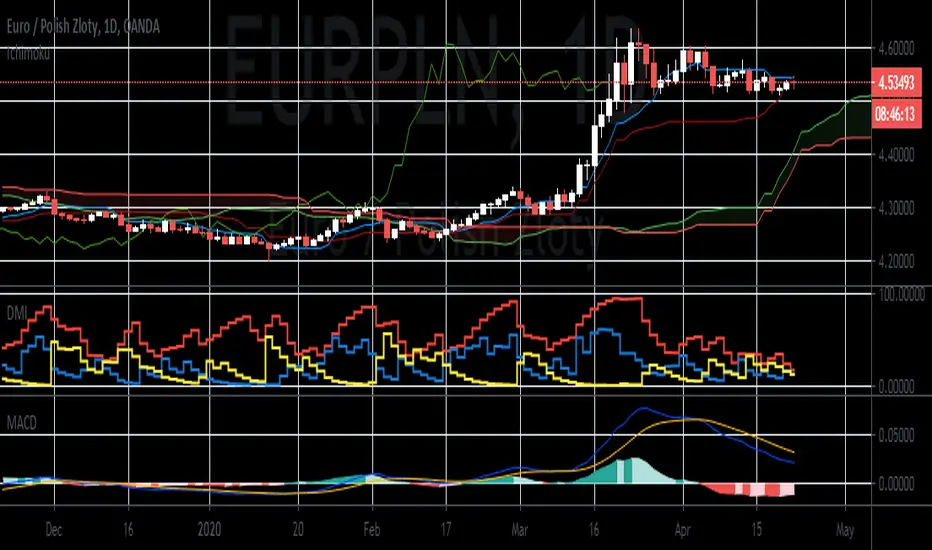

EUR/PLN bulls are struggling to regain their momentum back in the sessions resulting in the pair to trade sideways in recent days. After the pair touched its resistance level in the past sessions, bears were able to tone down the momentum of bulls. Still, looking at the chart, it’s evident that bullish investors continue to hold on to their gains as the pair remains widely bullish. Since the second half of March, bulls have propelled the 50-day moving average farther above the 200-day moving average, signaling a promising bullish run for the pair in the near-term trading. Moreover, according to recent reports, for the first time in record, the National Bank of Poland has started to purchase government bonds. The quantitative easing worried the investors of the Polish zloty, leaving the currency volatile in the forex market. Reports say that a bond-buying operation worth PLN 30.6 billion has trigger questions and concerns for the Polish economy’s status.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.