Knowing the current situation regarding the war between Ukraine and Russia, my idea is either this war intensifies, or this pair might find a slow grind up towards 1.1250.

== Here are a few comments this morning from the ECB ==

➡️ "We are not seeing signs of stagflation currently"

➡️ "The war in Ukraine will have consequences for EU growth"

➡️ "European & US economies are at different stages of cycle"

➡️ "Geography makes Europe more exposed to the war than the US"

== TECHNICAL ANALYSIS ==

Starting with the 4 hour chart above, price-action is chopping around in a bullish channel with the overall trend remaining bearish. The blue arrow illustration on the chart is just a hypothetical idea of what I expect is likely to happen in the day ahead for this pair.

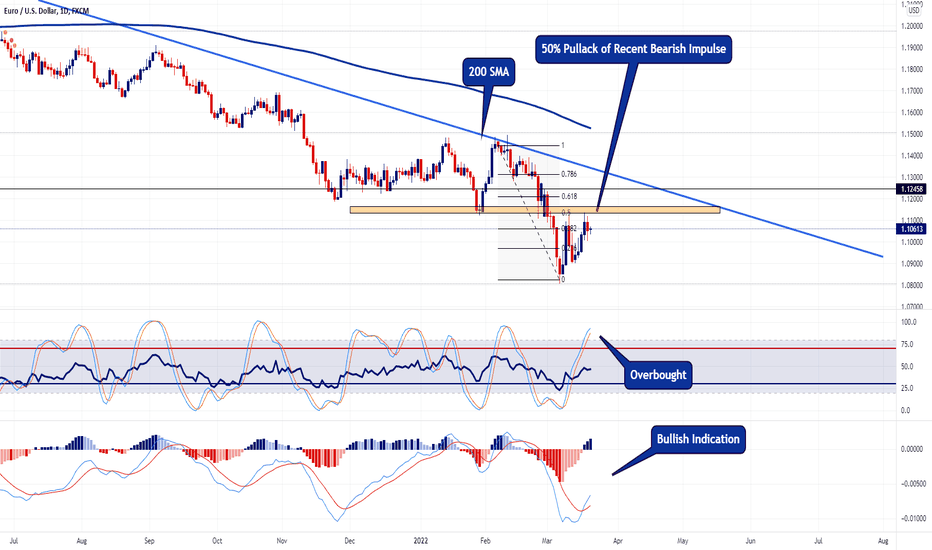

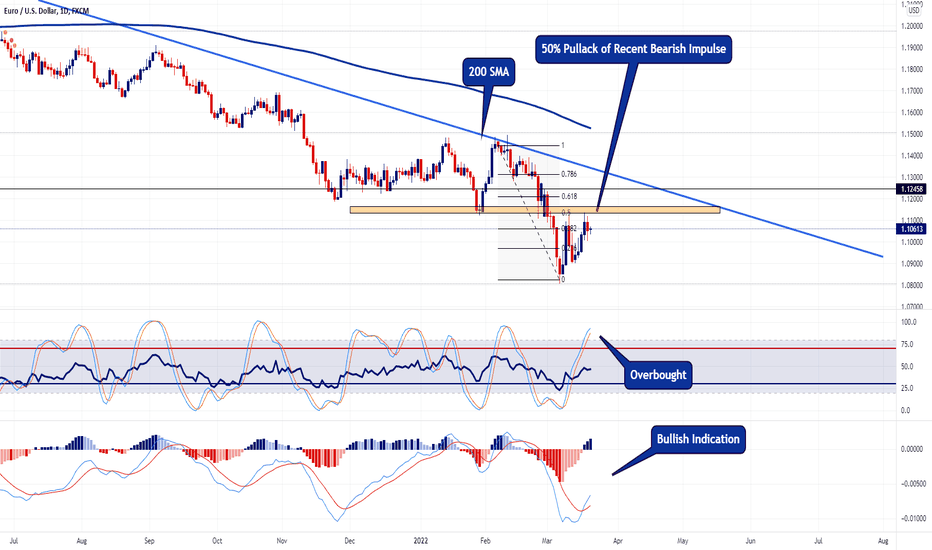

Let's now take look at the daily timeframe.

== DAILY CHART ==

On the daily chart , we have some conflicting indications between our oscillates which may be causing some confusion amongst traders. Lots of rhetoric from the ECB about inflation and interest rates which also adds to the uncertainty regarding this pair. As illustrated on the chart, price action is finding difficulties breaking above the 50% retrace level of the most recent bearish impulse to the upside. This leaves me to believe that in this type of market condition, perhaps stochastics is the leading clue provider suggesting further downside. Should price-action decide to break and hold above the 50% retracement zone, the 1.11 handle should then be monitored for the next area of resistance.

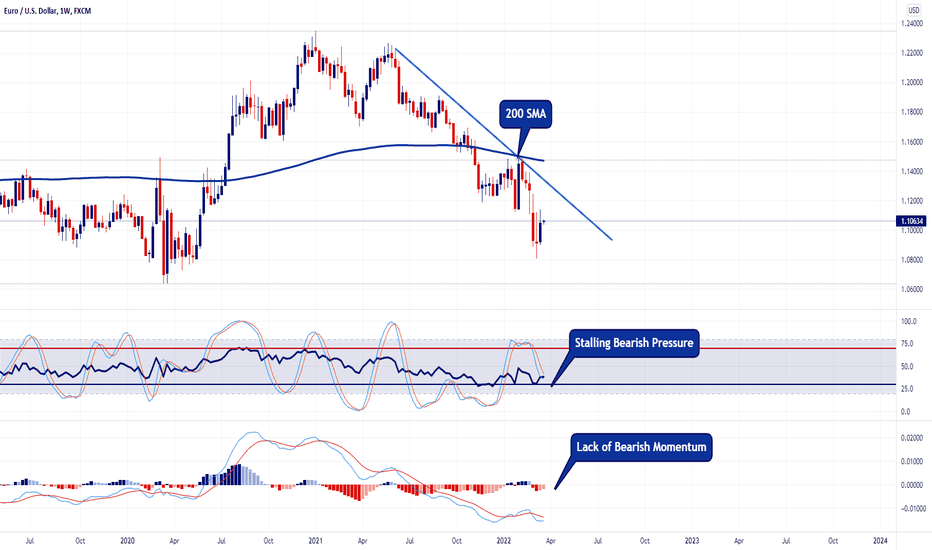

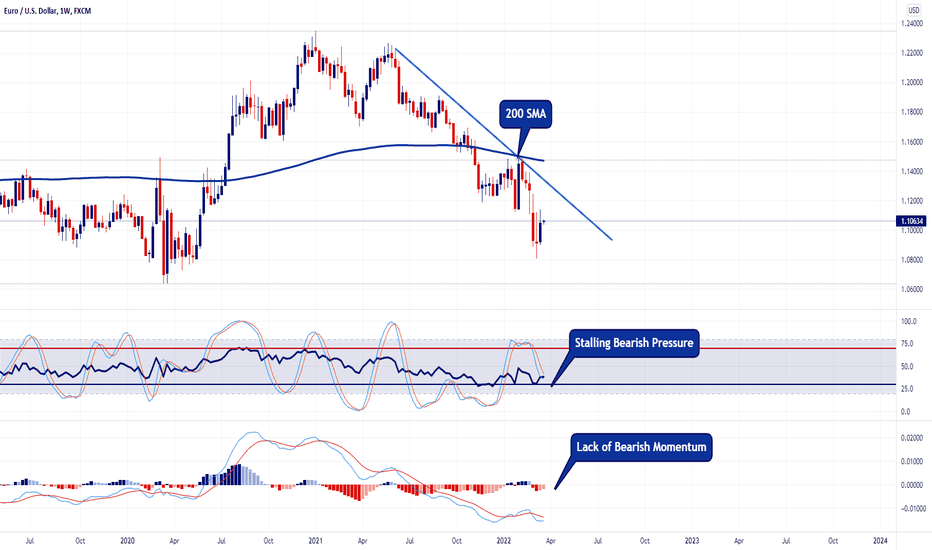

Lastly, let's view the weekly timeframe.

== WEEKLY VIEW ==

Oscillators are showing signs of a potential reversal on the horizon. Should we get a pullback, monitor the descending resistance for lack of bullish momentum as the overall trend will still remain bearish .

== Here are a few comments this morning from the ECB ==

➡️ "We are not seeing signs of stagflation currently"

➡️ "The war in Ukraine will have consequences for EU growth"

➡️ "European & US economies are at different stages of cycle"

➡️ "Geography makes Europe more exposed to the war than the US"

== TECHNICAL ANALYSIS ==

Starting with the 4 hour chart above, price-action is chopping around in a bullish channel with the overall trend remaining bearish. The blue arrow illustration on the chart is just a hypothetical idea of what I expect is likely to happen in the day ahead for this pair.

Let's now take look at the daily timeframe.

== DAILY CHART ==

On the daily chart , we have some conflicting indications between our oscillates which may be causing some confusion amongst traders. Lots of rhetoric from the ECB about inflation and interest rates which also adds to the uncertainty regarding this pair. As illustrated on the chart, price action is finding difficulties breaking above the 50% retrace level of the most recent bearish impulse to the upside. This leaves me to believe that in this type of market condition, perhaps stochastics is the leading clue provider suggesting further downside. Should price-action decide to break and hold above the 50% retracement zone, the 1.11 handle should then be monitored for the next area of resistance.

Lastly, let's view the weekly timeframe.

== WEEKLY VIEW ==

Oscillators are showing signs of a potential reversal on the horizon. Should we get a pullback, monitor the descending resistance for lack of bullish momentum as the overall trend will still remain bearish .

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.