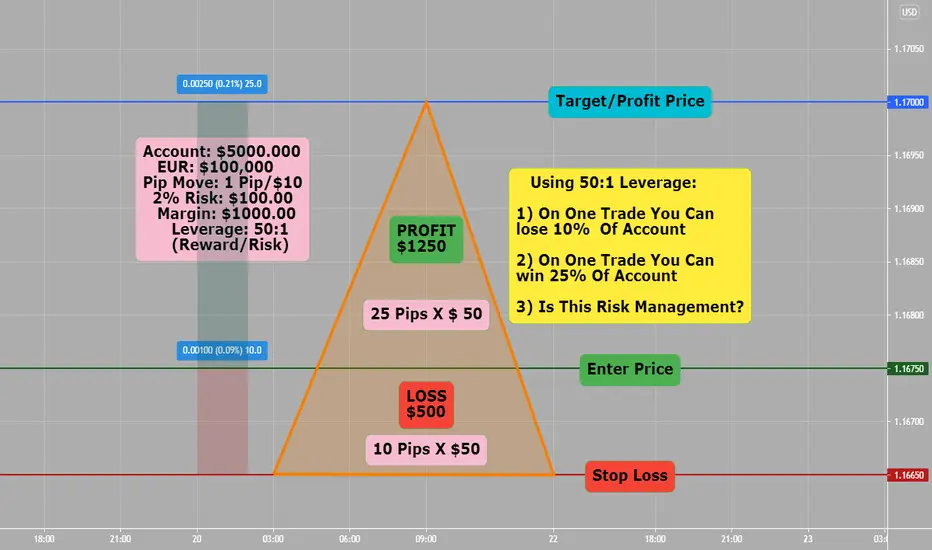

Should you use 50:1 leverage or maximum Reward Risk on any one trade? Is that using proper risk management?

Per chart example:

1) You could either lose on chart one trade 10% of your account or

2) You could win on chart one trade 25% of your account

Using Leverage is a double edged sword, which can be used or abused in the context of risk management, lot size, margin and leverage.

Bad risk management is number #1 reason why traders blow accounts.

Use 2% of account on one single trade, adjust lot size accordingly, stop losses and targets- this is a marathon not a sprint.

Per chart example:

1) You could either lose on chart one trade 10% of your account or

2) You could win on chart one trade 25% of your account

Using Leverage is a double edged sword, which can be used or abused in the context of risk management, lot size, margin and leverage.

Bad risk management is number #1 reason why traders blow accounts.

Use 2% of account on one single trade, adjust lot size accordingly, stop losses and targets- this is a marathon not a sprint.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.