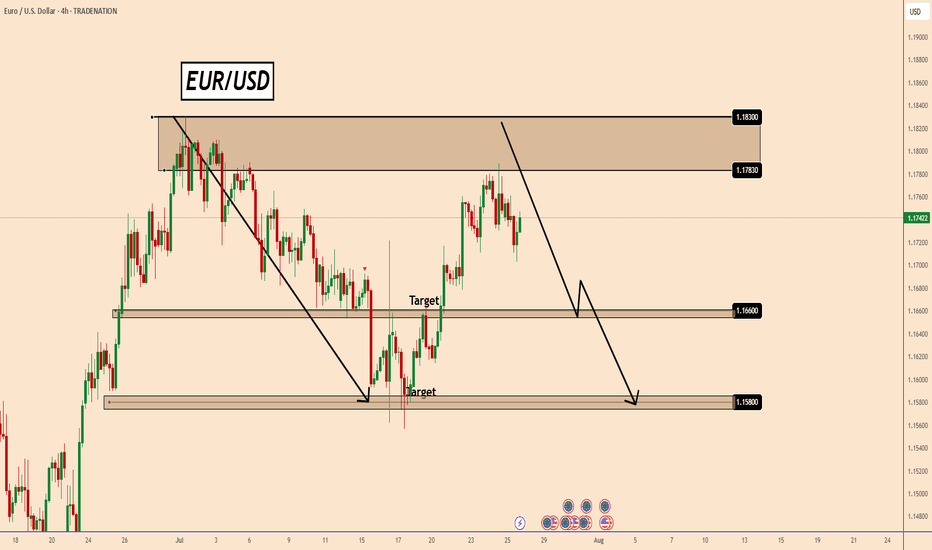

EURUSD: Double Top Pattern Ahead of FOMC Meeting

EURUSD has formed a possible double top, and price action is now trading below the neckline - an indication of increasing bearish probability.

All eyes are on today's FOMC and the interest rate decision. If the Fed signals a rate cut or hints at future easing, this could trigger a sell-off, further validating the bearish scenario.

Although the USD has been weak for an extended period, the market may be changing its positioning this time. Even if EURUSD moves higher during the event, the broader setup favors a decline.

⚠️ Trading around major news events is very risky. It's better to wait for clarity after the FOMC before taking any action.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD has formed a possible double top, and price action is now trading below the neckline - an indication of increasing bearish probability.

All eyes are on today's FOMC and the interest rate decision. If the Fed signals a rate cut or hints at future easing, this could trigger a sell-off, further validating the bearish scenario.

Although the USD has been weak for an extended period, the market may be changing its positioning this time. Even if EURUSD moves higher during the event, the broader setup favors a decline.

⚠️ Trading around major news events is very risky. It's better to wait for clarity after the FOMC before taking any action.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.