Here’s a powerful and professional description you can use when publishing this chart on TradingView:

---

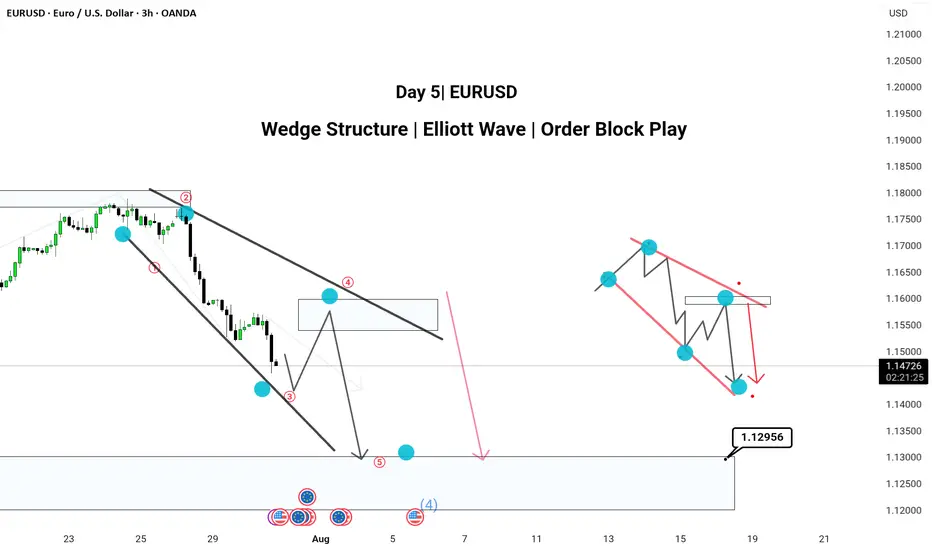

🔻 Day 4 | EUR/USD Analysis 🔻

Chart Type: 3H Timeframe

---

📌 Chart Breakdown:

EUR/USD is respecting a textbook XABCD wedge pattern with clean Elliott Wave structure forming inside.

We’ve marked 5 key waves (1–5) completing within a falling wedge, aligning with a 50–60% retracement (Golden Zone) between point A and D.

🧠 Most traders miss the Golden Zone, but it’s often the clearest sign of upcoming trend continuation. Here, that continuation is bearish.

---

✅ 3H Confluence Factors:

Wedge forming within a larger downtrend

Multiple Break of Structures (BOS) confirming bearish momentum

Price targeting 1.12956 zone (mapped order block)

Elliott Wave fractals confirmed within structure

Hidden supply zone respected at Wave 4

---

📉 Expecting:

Retracement to supply → drop toward demand zone near 1.12956

---

📎 Strategy Insight:

SMC + Elliott Wave + Multi-timeframe path tool mapping gives us high confluence to expect continuation into the demand area.

💬 Comment below your views —

Do you also trade Wedges with Elliott Wave confirmation?

#EURUSD #WedgePattern #ElliottWave #SmartMoneyConcepts #OrderBlock #TechnicalAnalysis #TradingView #ForexIndia

---

---

🔻 Day 4 | EUR/USD Analysis 🔻

Chart Type: 3H Timeframe

---

📌 Chart Breakdown:

EUR/USD is respecting a textbook XABCD wedge pattern with clean Elliott Wave structure forming inside.

We’ve marked 5 key waves (1–5) completing within a falling wedge, aligning with a 50–60% retracement (Golden Zone) between point A and D.

🧠 Most traders miss the Golden Zone, but it’s often the clearest sign of upcoming trend continuation. Here, that continuation is bearish.

---

✅ 3H Confluence Factors:

Wedge forming within a larger downtrend

Multiple Break of Structures (BOS) confirming bearish momentum

Price targeting 1.12956 zone (mapped order block)

Elliott Wave fractals confirmed within structure

Hidden supply zone respected at Wave 4

---

📉 Expecting:

Retracement to supply → drop toward demand zone near 1.12956

---

📎 Strategy Insight:

SMC + Elliott Wave + Multi-timeframe path tool mapping gives us high confluence to expect continuation into the demand area.

💬 Comment below your views —

Do you also trade Wedges with Elliott Wave confirmation?

#EURUSD #WedgePattern #ElliottWave #SmartMoneyConcepts #OrderBlock #TechnicalAnalysis #TradingView #ForexIndia

---

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.