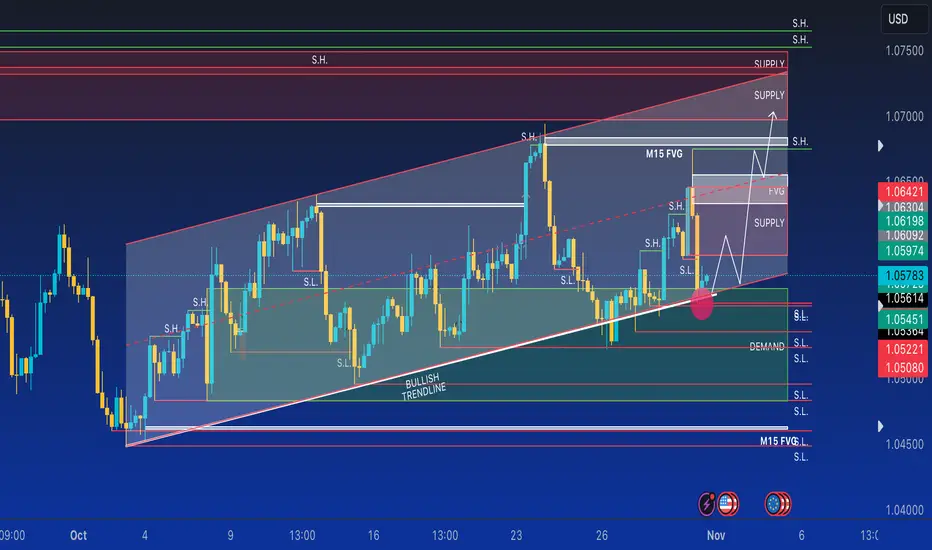

Last Tuesday, EUR/USD experienced a decline, currently consolidating around 1.0570 after dropping from weekly highs just above 1.0550. The US dollar remains strong in anticipation of the FOMC decision and crucial US employment data. On the daily chart of EUR/USD, the price reversed its direction near the 55-day Simple Moving Average (SMA) but remains above the 20-day SMA on closing.

Looking at the 4-hour chart, EUR/USD found support along a short-term uptrend line and is currently trading around the 20-period SMA. Technical indicators offer an unclear picture. A bounce above 1.0600 would strengthen the euro's prospects, targeting the next resistance level at 1.0630, while consolidation below 1.0560 would signal potential weakness.

EUR/USD initially reached weekly highs but then reversed course on Tuesday due to a stronger US dollar in anticipation of US employment and FOMC meeting data. Inflation and growth data in Europe came in below expectations.

Data from the Eurozone showed a slowdown in inflation in October, with the annual rate dropping to 2.9% from 4.8%, below the market consensus of 3%. Even core inflation dropped to 4.2%, in line with forecasts. Growth data also showed an unexpected contraction of 0.1%, making it likely that the European Central Bank (ECB) will maintain its current position in December.

Now, attention shifts to US data and the FOMC meeting. US data on Tuesday presented mixed results, including a decrease in consumer confidence, a 1.1% increase in labor costs in the third quarter, and a drop to 44 in the Chicago PMI index.

On Wednesday, the ADP employment report and the ISM Manufacturing PMI will be released before the FOMC statement. The Federal Reserve is expected to keep interest rates unchanged, which could result in a relatively minor event. However, with a focus on Chairman Powell and his team, increased volatility is anticipated. In fact, I expect a neutral day tomorrow in anticipation of the Fed, despite my long-term trend, as seen on the chart. Let me know what you think. Regards, Nicola, CEO of Forex48 Trading Academy.

Looking at the 4-hour chart, EUR/USD found support along a short-term uptrend line and is currently trading around the 20-period SMA. Technical indicators offer an unclear picture. A bounce above 1.0600 would strengthen the euro's prospects, targeting the next resistance level at 1.0630, while consolidation below 1.0560 would signal potential weakness.

EUR/USD initially reached weekly highs but then reversed course on Tuesday due to a stronger US dollar in anticipation of US employment and FOMC meeting data. Inflation and growth data in Europe came in below expectations.

Data from the Eurozone showed a slowdown in inflation in October, with the annual rate dropping to 2.9% from 4.8%, below the market consensus of 3%. Even core inflation dropped to 4.2%, in line with forecasts. Growth data also showed an unexpected contraction of 0.1%, making it likely that the European Central Bank (ECB) will maintain its current position in December.

Now, attention shifts to US data and the FOMC meeting. US data on Tuesday presented mixed results, including a decrease in consumer confidence, a 1.1% increase in labor costs in the third quarter, and a drop to 44 in the Chicago PMI index.

On Wednesday, the ADP employment report and the ISM Manufacturing PMI will be released before the FOMC statement. The Federal Reserve is expected to keep interest rates unchanged, which could result in a relatively minor event. However, with a focus on Chairman Powell and his team, increased volatility is anticipated. In fact, I expect a neutral day tomorrow in anticipation of the Fed, despite my long-term trend, as seen on the chart. Let me know what you think. Regards, Nicola, CEO of Forex48 Trading Academy.

Note

The EUR/USD initially climbed to 1.0552 following the FOMC statement but then lost its upward momentum. The US Dollar experienced a modest decline with only a limited market response.As expected, the Federal Reserve (Fed) has chosen to maintain the federal funds rate's target range at 5.25% to 5.50%, in line with market predictions. The Fed refrained from presenting any new macroeconomic projections during this meeting, and the statement closely resembled that of the September meeting. The market's primary focus now shifts to the forthcoming press conference with Chair Jerome Powell.

This marks the Fed's second consecutive meeting with an unchanged stance.

Earlier on Wednesday, the ADP employment report indicated an increase in private payrolls by 113,000 for October, surpassing September's 89,000 but falling short of the estimated 150,000. The ISM Manufacturing PMI took an unexpected dip to 46.7 in October from 49 in September. On a more positive note, JOLTS Jobs Opening data exceeded expectations, rising to 9.55 million in September compared to the anticipated 9.25 million. More employment data is scheduled for release on Thursday with Jobless Claims and on Friday with Nonfarm Payrolls.

In terms of the EUR/USD, it's currently hovering around the critical support level of 1.0520. A breach below this level might trigger further losses, with the next target at 1.0500. To improve the intraday outlook, the Euro needs to surpass the 20-hour Simple Moving Average (SMA). The pair is approaching its daily close for the past two weeks. Nevertheless, as long as it remains above 1.0520, the extent of losses appears limited.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.