Starting to trade manually, a Forex trader is faced with the question "What strategy should I use? Choosing the right strategy is not an easy thing, I'm quite often asked to suggest "some profitable system". There is no single and simple answer to this question, so how to choose a Forex trading strategy that is right for you?

First of all, we have to decide when we are going to trade. After all, not everyone has 24 hours a day free time: some study, some work, etc. Of course, there are mobile terminals for smartphones that allow you to trade when you are away from home, but again, not every job allows you to use your gadget whenever you want.

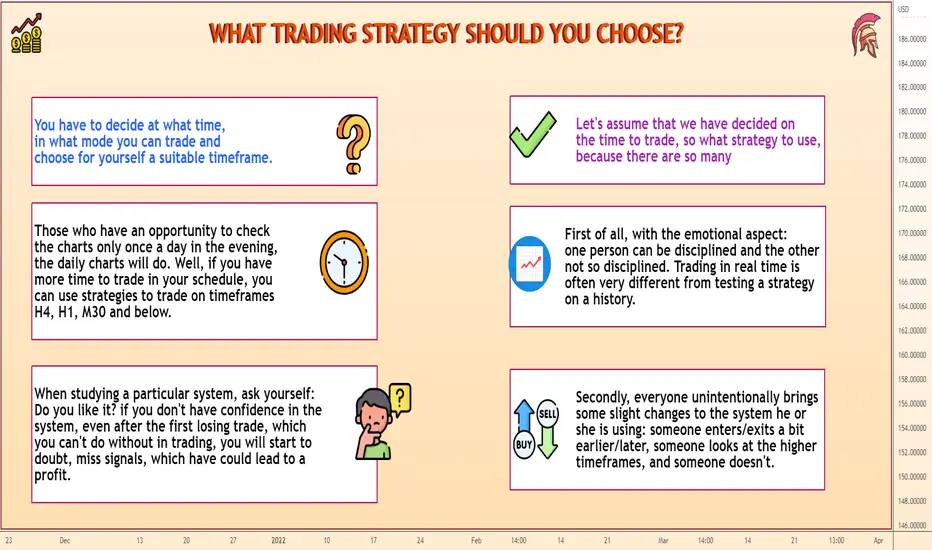

So, you have to decide at what time, in what mode you can trade and choose for yourself a suitable timeframe. Those who have an opportunity to check the charts only once a day in the evening, the daily charts will do. Well, if you have more time to trade in your schedule, you can use strategies to trade on timeframes H4, H1, M30 and below. You can even switch to ultra-fast trading using a tick chart, although it requires strong nerves and good reactions. There are also universal strategies that can be used on any timeframe.

Let's assume that we have decided on the time to trade, so what strategy to use, because there are so many?

First of all, it is worth noting that two different traders trading on the same system can have completely opposite results. What does this have to do with? First of all, with the emotional aspect: one person can be disciplined and the other not so disciplined. Trading in real time is often very different from testing a strategy on a history. Secondly, everyone unintentionally brings some slight changes to the system he or she is using: someone enters/exits a bit earlier/later, someone looks at the higher timeframes, and someone doesn't. Many add their own filters, trade only at certain times, etc. etc. The list goes on for a long time, but the point is that success with the strategy greatly depends on the qualities and experience of the trader.

When choosing a strategy, just like when choosing a car or a life partner, you should be guided by your own preferences. When studying a particular system, ask yourself: do you like it? Will you feel comfortable and confident trading with this strategy? Because if you don't have confidence in the system, even after the first losing trade, which you can't do without in trading, you will start to doubt, miss signals, which have could lead to a profit, distort the rules of the trading strategy, etc. You have to feel confident in the system, it must fit your psychology: to hold one position for several days or to open/close many small orders during the same time.

The strategy must also be consistent with your beliefs; the same martingale has many opponents, but also many adherents. Some believe that trading on minute charts is impossible, while others will prove the opposite.

It is also possible when you take from the system only some elements that you like (some indicator or method of analysis) and thus, leaving the best, over time, you build your own strategy.

First of all, we have to decide when we are going to trade. After all, not everyone has 24 hours a day free time: some study, some work, etc. Of course, there are mobile terminals for smartphones that allow you to trade when you are away from home, but again, not every job allows you to use your gadget whenever you want.

So, you have to decide at what time, in what mode you can trade and choose for yourself a suitable timeframe. Those who have an opportunity to check the charts only once a day in the evening, the daily charts will do. Well, if you have more time to trade in your schedule, you can use strategies to trade on timeframes H4, H1, M30 and below. You can even switch to ultra-fast trading using a tick chart, although it requires strong nerves and good reactions. There are also universal strategies that can be used on any timeframe.

Let's assume that we have decided on the time to trade, so what strategy to use, because there are so many?

First of all, it is worth noting that two different traders trading on the same system can have completely opposite results. What does this have to do with? First of all, with the emotional aspect: one person can be disciplined and the other not so disciplined. Trading in real time is often very different from testing a strategy on a history. Secondly, everyone unintentionally brings some slight changes to the system he or she is using: someone enters/exits a bit earlier/later, someone looks at the higher timeframes, and someone doesn't. Many add their own filters, trade only at certain times, etc. etc. The list goes on for a long time, but the point is that success with the strategy greatly depends on the qualities and experience of the trader.

When choosing a strategy, just like when choosing a car or a life partner, you should be guided by your own preferences. When studying a particular system, ask yourself: do you like it? Will you feel comfortable and confident trading with this strategy? Because if you don't have confidence in the system, even after the first losing trade, which you can't do without in trading, you will start to doubt, miss signals, which have could lead to a profit, distort the rules of the trading strategy, etc. You have to feel confident in the system, it must fit your psychology: to hold one position for several days or to open/close many small orders during the same time.

The strategy must also be consistent with your beliefs; the same martingale has many opponents, but also many adherents. Some believe that trading on minute charts is impossible, while others will prove the opposite.

It is also possible when you take from the system only some elements that you like (some indicator or method of analysis) and thus, leaving the best, over time, you build your own strategy.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

90% accuracy in telegram

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

🔻FREE Telegram channel🔻

t.me/DeGRAMChannel

Crypto signals in telegram

@DeGRAMCrypto

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.