Core Analysis Method: Smart Money Concepts

😇7 Dimension Analysis

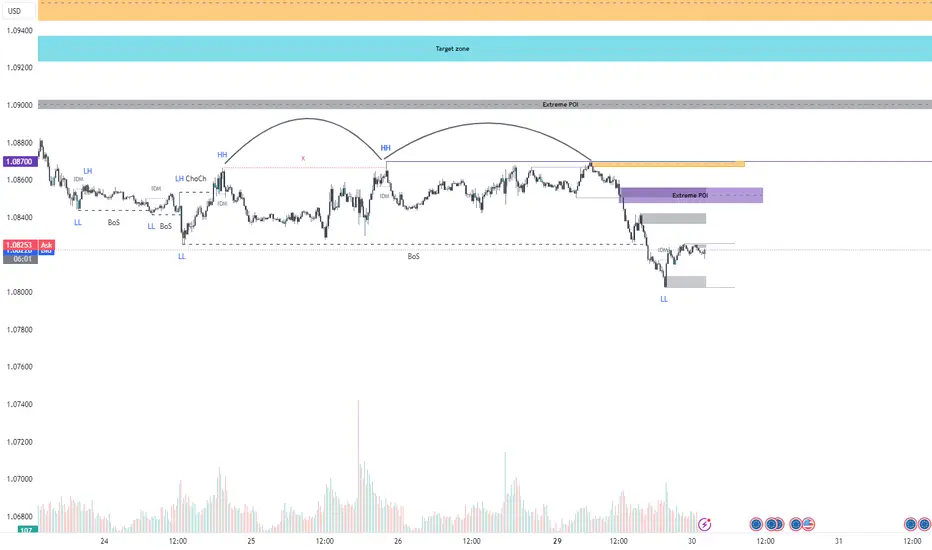

Time Frame: 15M

1: Swing Structure: The market has formed a bearish BOS after taking inducement. Now, the focus is on the corrective swing move as a pullback. The internal structure also supports a bullish corrective move toward the external POI, OB & BB with proper FVG and LIQ resting area in the discounted zone. We are using one regular entry module for this.

2: Pattern

🟢 CHART PATTERNS:

Reversal: Triple top is already formed at the top of the swing.

🟢 CANDLE PATTERNS:

We will check at the POI zone.

3: Volume:

🟢 Fixed range indicates full bearish control at the POI.

🟢 Volume during correction is almost dry.

4: Momentum RSI:

🟢 In strong bearish zone with proper bearish range shift and classic.

🟢 Grandfather-Father-Son entries based on H4 TF are intact and formed.

5: Volatility Bollinger Bands:

🟢 About to break after contraction, possible squeeze breakout in the lower band. Walking on the band is also expected here.

6: Strength: Based on ADX, bears fully control the market at this level.

7: Sentiment: Strong bearish.

✔️ Entry Time Frame: 15 min

✅ Entry TF Structure: BOS Bear

☑️ Trend line breakout: Awaited

💡 Decision: Sell limit

🚀 Entry: 1.08475

✋ Stop loss: 1.08580

🎯 Take profit: 1.07601

😊 Risk to reward Ratio: 7RR

🕛 Expected Duration: 2 days

SUMMARY: Analysis supports a sell position based on Smart Money Concepts methodology, with strong bearish signals from structure, volume, momentum, volatility, strength, and sentiment.

😇7 Dimension Analysis

Time Frame: 15M

1: Swing Structure: The market has formed a bearish BOS after taking inducement. Now, the focus is on the corrective swing move as a pullback. The internal structure also supports a bullish corrective move toward the external POI, OB & BB with proper FVG and LIQ resting area in the discounted zone. We are using one regular entry module for this.

2: Pattern

🟢 CHART PATTERNS:

Reversal: Triple top is already formed at the top of the swing.

🟢 CANDLE PATTERNS:

We will check at the POI zone.

3: Volume:

🟢 Fixed range indicates full bearish control at the POI.

🟢 Volume during correction is almost dry.

4: Momentum RSI:

🟢 In strong bearish zone with proper bearish range shift and classic.

🟢 Grandfather-Father-Son entries based on H4 TF are intact and formed.

5: Volatility Bollinger Bands:

🟢 About to break after contraction, possible squeeze breakout in the lower band. Walking on the band is also expected here.

6: Strength: Based on ADX, bears fully control the market at this level.

7: Sentiment: Strong bearish.

✔️ Entry Time Frame: 15 min

✅ Entry TF Structure: BOS Bear

☑️ Trend line breakout: Awaited

💡 Decision: Sell limit

🚀 Entry: 1.08475

✋ Stop loss: 1.08580

🎯 Take profit: 1.07601

😊 Risk to reward Ratio: 7RR

🕛 Expected Duration: 2 days

SUMMARY: Analysis supports a sell position based on Smart Money Concepts methodology, with strong bearish signals from structure, volume, momentum, volatility, strength, and sentiment.

Trade closed manually

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.