Chart Breakdown

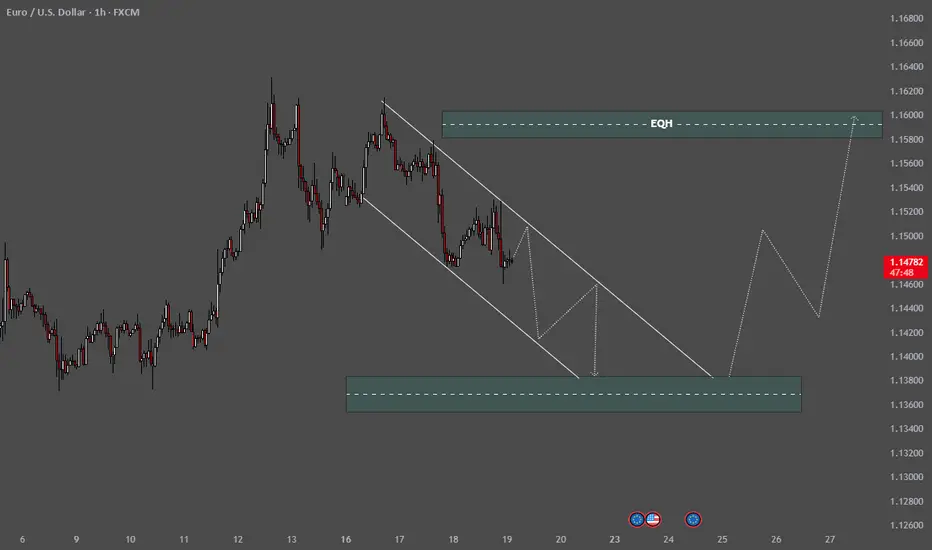

🔻 Price Action & Structure:

The market is currently trending downward within a descending channel, marked by two parallel white trendlines.

The current price is around 1.14797, with visible lower highs and lower lows, indicating a short-term bearish trend.

🔄 Projected Move:

A bullish breakout from the descending channel is anticipated.

The white projected path shows:

A dip toward the demand zone (highlighted in teal-green) around 1.13400–1.13800.

A reversal from that zone, forming higher highs and higher lows.

A move toward the upper liquidity zone, labeled EQH (Equal Highs) around 1.16000, suggesting a target for buy-side liquidity.

🧠

EQH = Equal High Liquidity

:

The EQH zone marks an area where previous highs are equal or nearly equal — a common target for price manipulation or stop-hunting.

It’s expected that the market will sweep this area for liquidity before possibly reversing or continuing.

💡 Interpretation:

The setup reflects a liquidity-based strategy using smart money concepts.

Bearish short-term → bullish medium-term outlook.

Potential trade idea: Wait for price to tap the lower demand zone, then look for entry confirmation (e.g., bullish engulfing or Ch0CH) to ride toward EQH.

🔻 Price Action & Structure:

The market is currently trending downward within a descending channel, marked by two parallel white trendlines.

The current price is around 1.14797, with visible lower highs and lower lows, indicating a short-term bearish trend.

🔄 Projected Move:

A bullish breakout from the descending channel is anticipated.

The white projected path shows:

A dip toward the demand zone (highlighted in teal-green) around 1.13400–1.13800.

A reversal from that zone, forming higher highs and higher lows.

A move toward the upper liquidity zone, labeled EQH (Equal Highs) around 1.16000, suggesting a target for buy-side liquidity.

🧠

EQH = Equal High Liquidity

:

The EQH zone marks an area where previous highs are equal or nearly equal — a common target for price manipulation or stop-hunting.

It’s expected that the market will sweep this area for liquidity before possibly reversing or continuing.

💡 Interpretation:

The setup reflects a liquidity-based strategy using smart money concepts.

Bearish short-term → bullish medium-term outlook.

Potential trade idea: Wait for price to tap the lower demand zone, then look for entry confirmation (e.g., bullish engulfing or Ch0CH) to ride toward EQH.

Trade active

💰 King Maker FX — Master the Gold Market with Precision.

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 King Maker FX — Master the Gold Market with Precision.

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.