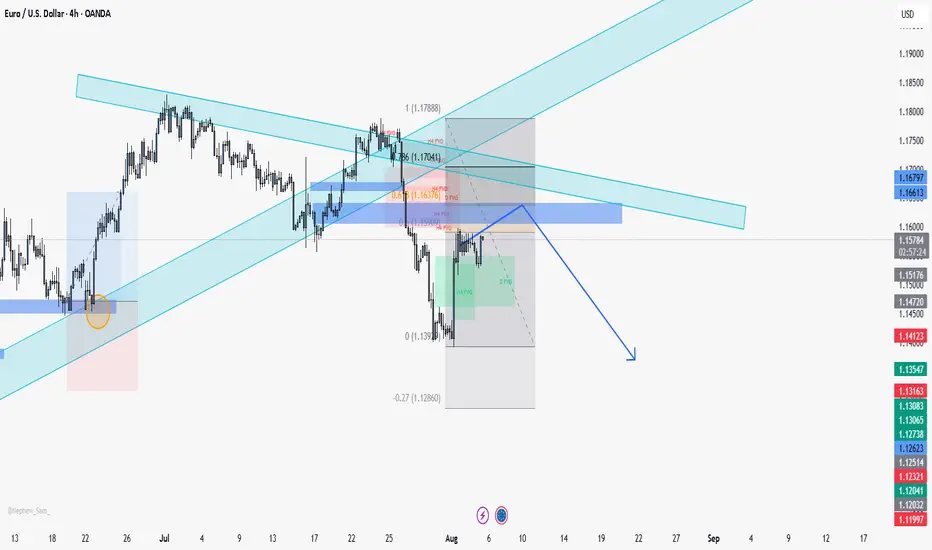

EUR/USD 4H Short Setup

Bearish Break of Structure 🔻 | Daily & 4H Aligned ✅ | FVG + Supply Zone 📦

📊 Market Bias:

✅ Weekly: Still bullish but slowing down

✅ Daily: Now bearish – break of structure confirmed

✅ 4H: Bearish – lower highs and lower lows in play

EUR/USD has officially shifted structure on the daily and 4H, breaking previous lows and confirming bearish intent. We're now watching for price to retrace into a high-confluence short zone before continuation to the downside.

📉 Price Action Overview:

Price recently broke a key daily higher low, marking a daily break of structure (BOS)

On the 4H, price also made a BOS and is now forming a potential lower high

Price is retracing toward a 4H FVG and daily supply zone – ideal for shorting a trend continuation

🔁 Fibonacci Retracement Levels (of the recent 4H drop):

0.5 = 1.1787

0.618 = 1.1809

0.786 = 1.1839

This zone is our short entry region, sitting inside a bearish FVG and prior daily supply.

📦 Fair Value Gap (FVG):

Clean 4H FVG formed on the impulsive drop

Price is now retracing toward that imbalance, likely to rebalance before continuing lower

This FVG also overlaps with the Fib retracement and previous support-turned-resistance

📐 Structure & Confluence:

✅ Daily BOS confirms macro shift

✅ 4H forming lower highs/lows

✅ FVG + Supply Zone + Fib retracement = strong short confluence zone

🎯 Short Targets:

TP1: 1.1700 – near-term low and clean liquidity

TP2: 1.1660 – next structural support

TP3: 1.1620 – deeper demand zone

❌ Invalidation Level:

A clean break and 4H close above 1.1840 invalidates the setup and suggests buyers may reclaim control

📌 Summary:

EUR/USD is offering a textbook bearish continuation setup. With confirmed daily and 4H structure shifts, a pullback into the 1.1787–1.1839 zone offers a high-probability short entry. Confluence between Fib, FVG, and supply makes this a strong area for a lower high to form. Bearish targets extend into the 1.1700–1.1620 zone — as long as 1.1840 holds.

Bearish Break of Structure 🔻 | Daily & 4H Aligned ✅ | FVG + Supply Zone 📦

📊 Market Bias:

✅ Weekly: Still bullish but slowing down

✅ Daily: Now bearish – break of structure confirmed

✅ 4H: Bearish – lower highs and lower lows in play

EUR/USD has officially shifted structure on the daily and 4H, breaking previous lows and confirming bearish intent. We're now watching for price to retrace into a high-confluence short zone before continuation to the downside.

📉 Price Action Overview:

Price recently broke a key daily higher low, marking a daily break of structure (BOS)

On the 4H, price also made a BOS and is now forming a potential lower high

Price is retracing toward a 4H FVG and daily supply zone – ideal for shorting a trend continuation

🔁 Fibonacci Retracement Levels (of the recent 4H drop):

0.5 = 1.1787

0.618 = 1.1809

0.786 = 1.1839

This zone is our short entry region, sitting inside a bearish FVG and prior daily supply.

📦 Fair Value Gap (FVG):

Clean 4H FVG formed on the impulsive drop

Price is now retracing toward that imbalance, likely to rebalance before continuing lower

This FVG also overlaps with the Fib retracement and previous support-turned-resistance

📐 Structure & Confluence:

✅ Daily BOS confirms macro shift

✅ 4H forming lower highs/lows

✅ FVG + Supply Zone + Fib retracement = strong short confluence zone

🎯 Short Targets:

TP1: 1.1700 – near-term low and clean liquidity

TP2: 1.1660 – next structural support

TP3: 1.1620 – deeper demand zone

❌ Invalidation Level:

A clean break and 4H close above 1.1840 invalidates the setup and suggests buyers may reclaim control

📌 Summary:

EUR/USD is offering a textbook bearish continuation setup. With confirmed daily and 4H structure shifts, a pullback into the 1.1787–1.1839 zone offers a high-probability short entry. Confluence between Fib, FVG, and supply makes this a strong area for a lower high to form. Bearish targets extend into the 1.1700–1.1620 zone — as long as 1.1840 holds.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.