Over the years, I have posted a lot of educational content here on TradingView. Everything from Elliot waves to Wyckoff, psychology to Gann.

I have been lucky as a trader, 25 years doing this you pick up a thing or two. But above everything else, what you realise is that trading is a mindset game and not a technical one.

Many new traders try their luck. They are either experts in another field or simply successful in something else, or they come to the trading arena seeking wealth.

Both tend to get humbled quickly.

It is common for many new traders to put so much emphasis on the strategy, they overlook the psychology. You see, a strategy might work for someone, but you can't get it to work for you. This could simply be the time on the charts you lack, the timeframe or the instrument you are trading. The account balance or the fact you are not used to seeing 3-4 losses in a row.

When it comes to trading, less really is more!

Here's a simple one for you.

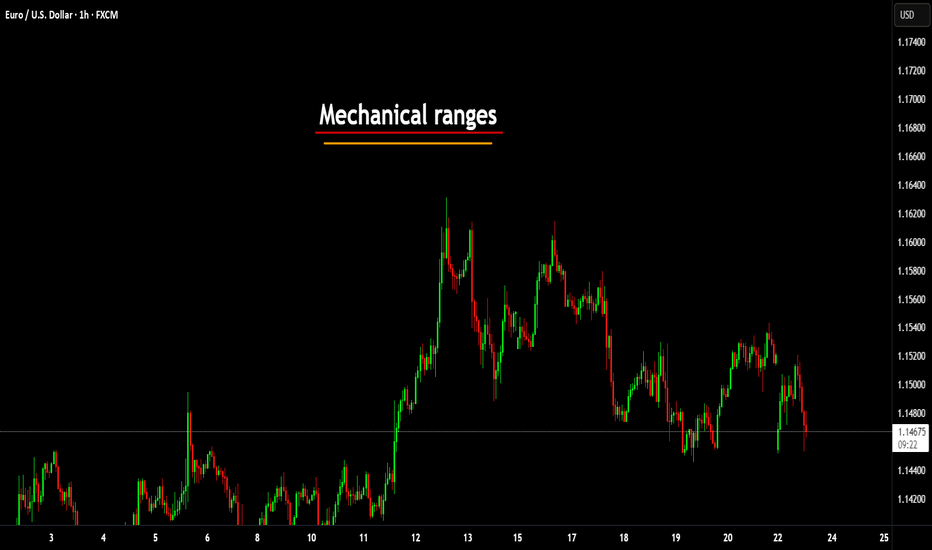

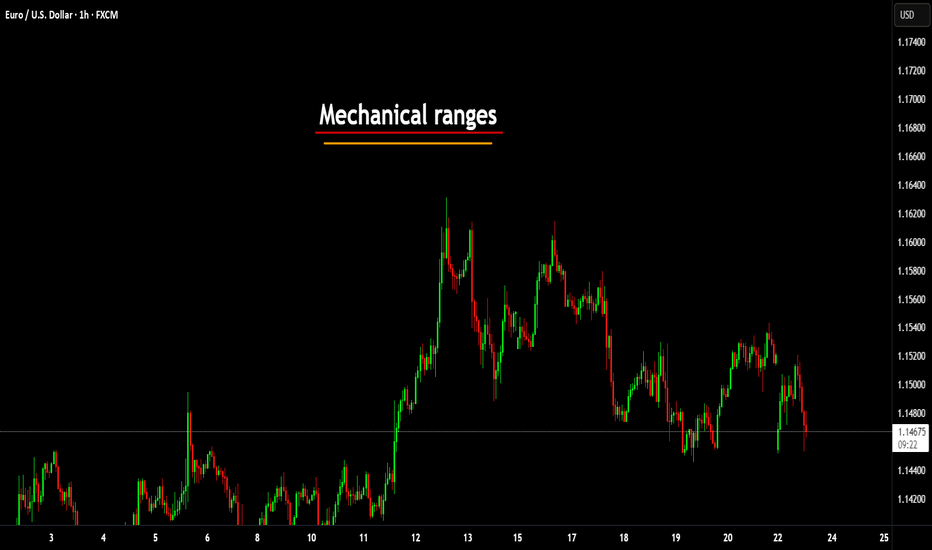

Take the mechanical range post I posted.

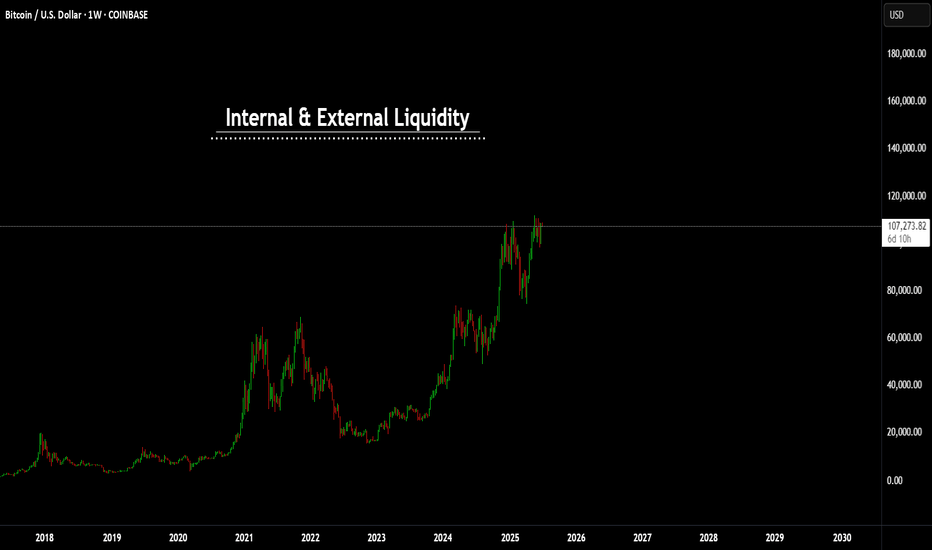

Now look at this;

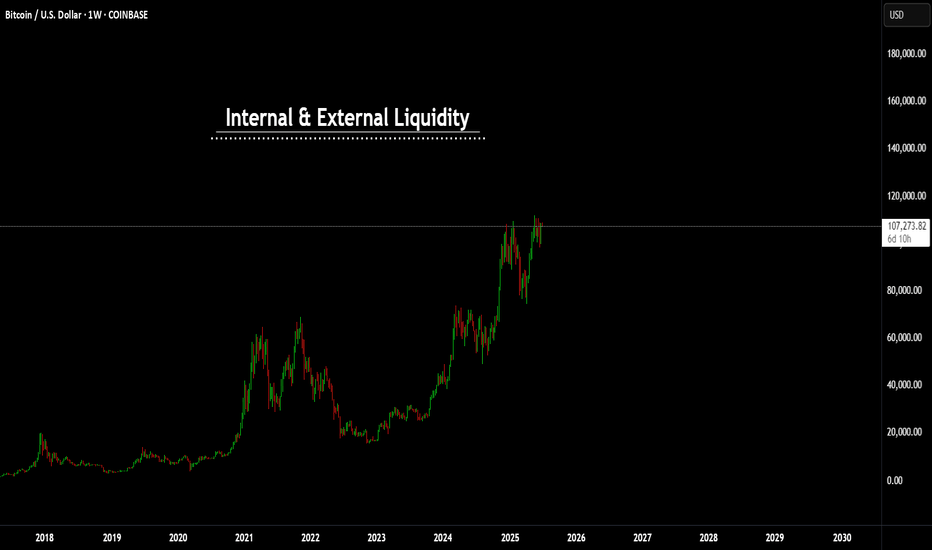

On the larger timeframes we can see clearly the ranges and the supply/demand.

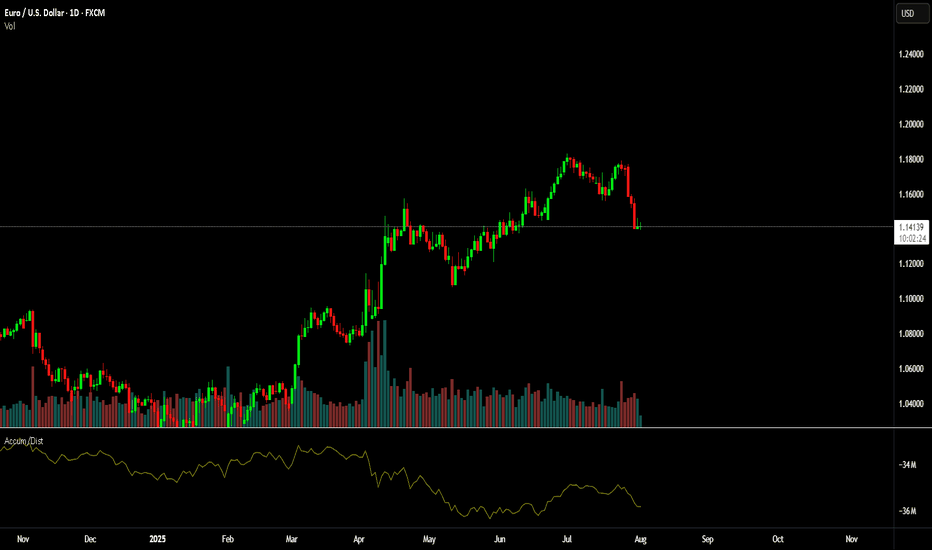

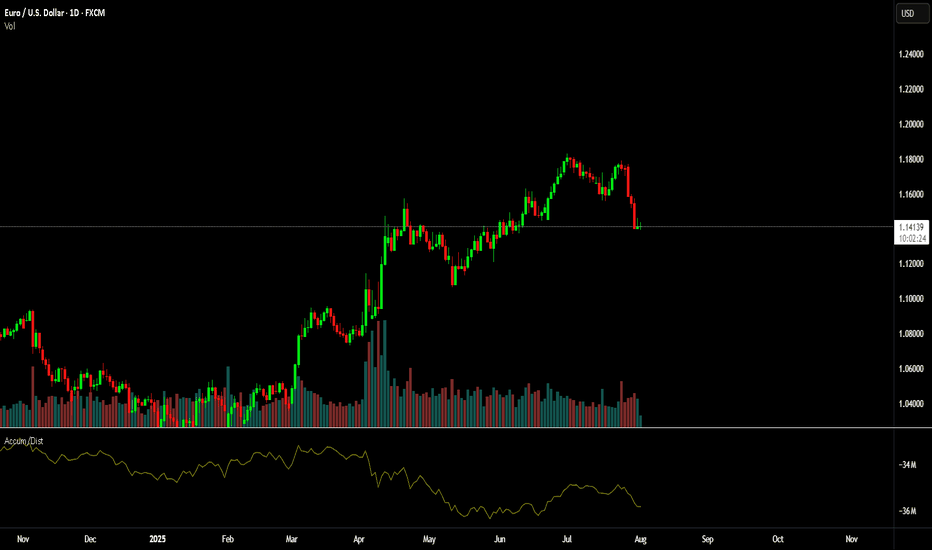

Then dropping down to the daily.

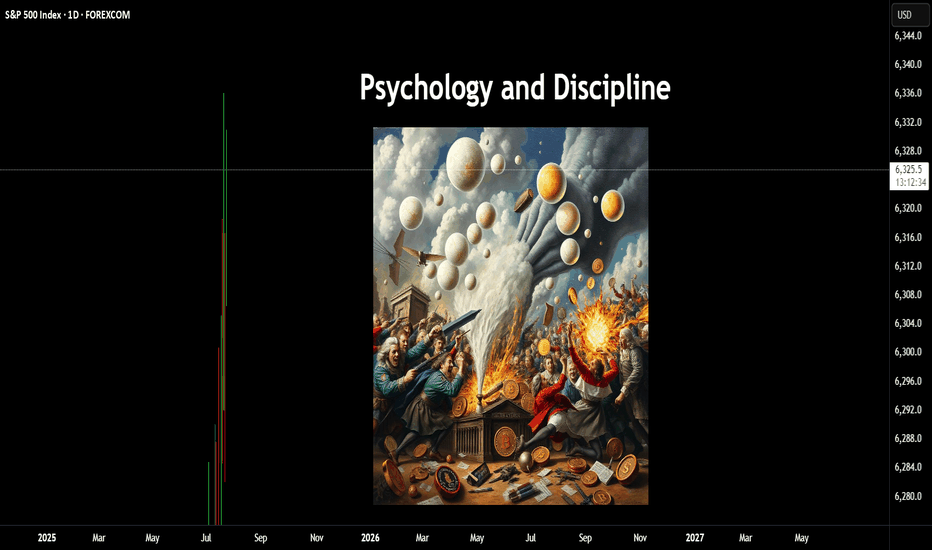

This is where, the technical aspect becomes less important and the psychology behind the move shows it's hand.

I have added volume and the AD line just to show how obvious this can be.

What do you see? Well as the price goes up, the volume goes down, we know we took liquidity to the upside.

So, if nothing else you would anticipate a pullback phase.

Then you get the clarity. Price drops and then pushes back, yet fails to make a new high. Almost like the volume told you it was about to happen.

Where did it pull back to?

Adding a simple volume profile too, from the swing high to the swing low. You can see the majority of the sell off (PoC) happened at a specific price point. Price pulled back to exactly that region before dropping.

The drop caused a local change in character and immediately took out the swing low - the last swing low of the leg up. (the real change in the trend).

There is obviously more to cover than this, but that is for another post.

Once you learn the way markets capitalise on the fear, the greed, the herd mindset, sentiment of the retail crowd. You can use the sentiment analysis in your favour.

You don't need 6 screens, fancy indicators, there is no silver bullet or 100% win rate strategies. And no a bot won't make you a Billionaire overnight.

If it was that easy, we would have no doctors, lawyers or firefighters; they would all be professional Bot traders.

Simplify your approach, put emphasis on the proper mindset, psychology and risk management and you will do alright!

Stay safe in the markets!

Some other recent posts;

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

I have been lucky as a trader, 25 years doing this you pick up a thing or two. But above everything else, what you realise is that trading is a mindset game and not a technical one.

Many new traders try their luck. They are either experts in another field or simply successful in something else, or they come to the trading arena seeking wealth.

Both tend to get humbled quickly.

It is common for many new traders to put so much emphasis on the strategy, they overlook the psychology. You see, a strategy might work for someone, but you can't get it to work for you. This could simply be the time on the charts you lack, the timeframe or the instrument you are trading. The account balance or the fact you are not used to seeing 3-4 losses in a row.

When it comes to trading, less really is more!

Here's a simple one for you.

Take the mechanical range post I posted.

Now look at this;

On the larger timeframes we can see clearly the ranges and the supply/demand.

Then dropping down to the daily.

This is where, the technical aspect becomes less important and the psychology behind the move shows it's hand.

I have added volume and the AD line just to show how obvious this can be.

What do you see? Well as the price goes up, the volume goes down, we know we took liquidity to the upside.

So, if nothing else you would anticipate a pullback phase.

Then you get the clarity. Price drops and then pushes back, yet fails to make a new high. Almost like the volume told you it was about to happen.

Where did it pull back to?

Adding a simple volume profile too, from the swing high to the swing low. You can see the majority of the sell off (PoC) happened at a specific price point. Price pulled back to exactly that region before dropping.

The drop caused a local change in character and immediately took out the swing low - the last swing low of the leg up. (the real change in the trend).

There is obviously more to cover than this, but that is for another post.

Once you learn the way markets capitalise on the fear, the greed, the herd mindset, sentiment of the retail crowd. You can use the sentiment analysis in your favour.

You don't need 6 screens, fancy indicators, there is no silver bullet or 100% win rate strategies. And no a bot won't make you a Billionaire overnight.

If it was that easy, we would have no doctors, lawyers or firefighters; they would all be professional Bot traders.

Simplify your approach, put emphasis on the proper mindset, psychology and risk management and you will do alright!

Stay safe in the markets!

Some other recent posts;

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Discord Server for education and advanced techniques: discord.gg/5t3w47raHe

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Discord Server for education and advanced techniques: discord.gg/5t3w47raHe

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Masterclass Webinar: mayfairtradingevents.com

Prop firm partners (FTMO)

shorturl.at/hBEQ4

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.